Does The Bigger Picture Have Bullish Characteristics?

This week’s stock market video takes a broader look at the market’s risk-reward profile.

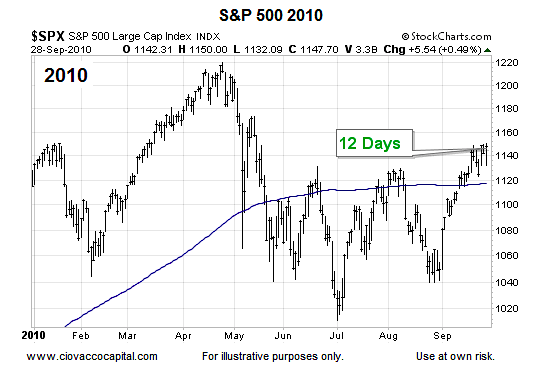

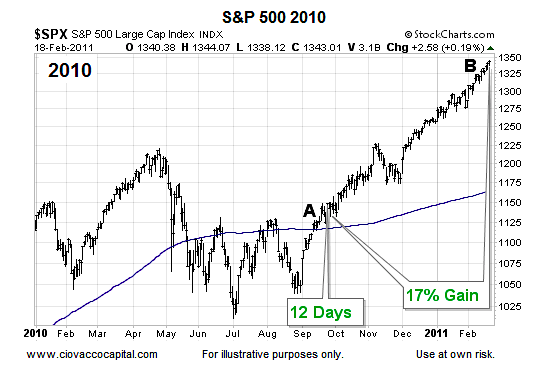

2010 – The Rally Continued

After the 2010 “flash crash” correction, the S&P 500 was unable to post twelve consecutive daily closes above the 200 day moving average until mid-September.

What happened after the twelfth consecutive close in 2010? Stocks tacked on an additional 17% between point A and point B.

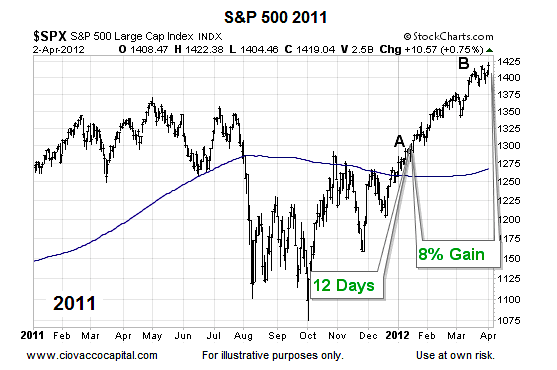

2011 – The Rally Continued

Calendar year 2011 saw numerous events that were similar to 2015; a consolidation period, a sharp plunge, a double bottom, and a stock market rally back above the 200 day moving average. The twelfth consecutive daily close above the 200 day did not occur until early 2012.

What happened after the twelfth consecutive close in 2012? Stocks tacked on an additional 8% between point A and point B.

How Can We Use This?

Does history tell us what is going to happen in late 2015/early 2016? No, history can only speak to probabilities. In each of the historical cases above, once the S&P 500 posted twelve consecutive daily closes above the 200 day moving average, the rally continued and tacked on significant gains.

What About 1987?

1987 has some similarities and could be included in this analysis. We decided to omit it for two reasons: (1) the S&P 500 stayed below its 200 day moving average for seven months, which is quite a bit different than 2015 (two months), and (2) the negative slope of the 200 day was significantly steeper (more bearish) in 1987.

Thanks for reading.

Twitter: @CiovaccoCapital

Read more from Chris on the CCM blog.

Author or his funds have a long position in related securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.