- The Earth is flat

- Cigarettes are healthy

- Leeches are the cure for everything

- The universe revolves around the Earth

- California is an island

- Red wine is healthy, unhealthy, healthy…

Facts are essential as they offer humans a sense of stability in a chaotic world. For instance, we find comfort in the “fact” that the life-sustaining sun will continue to shine for billions of years. If there were serious doubts about this fact, our lives would be very different today.

In this article, I debunk a “fact” that serves as the foundation for the pricing of all financial assets. It was not that long ago that people who thought the earth round were labeled delirious madmen. Today, questioning the “risk-free” status of U.S. Treasury securities (UST), as I do, will lead many financial professionals to decry our prudence as foolish irrationality.

That said, I would rather assess the situation objectively than get caught “swimming naked when the tide goes out” on U.S. Treasury securities… and sovereign debt risks resurface.

Mesofacts

In a must-read article entitled, My Leitner-esque Moment, Kevin Muir of The Macro Tourist blog broaches the topic of sovereign debt risk and, in what must be a moment of temporary insanity, questions the so-called “risk-free” status of UST.

Sovereign debt risk exists and said bonds default from time to time. Despite history and facts, associating the word “risk” with UST is for some reason blasphemous amongst financial professionals. The yields of UST are treated by all investors, even those nay-sayers like Muir and ourselves, to be the risk-free rate. This argument does not refer to the risk of changing yields but more importantly to that of credit risk.

All financial and investment models and theories assume that US Treasuries (UST) have no credit risk which, by definition, implies zero chance of default. What in this world has no risk? If you can name something, congratulations, I cannot.

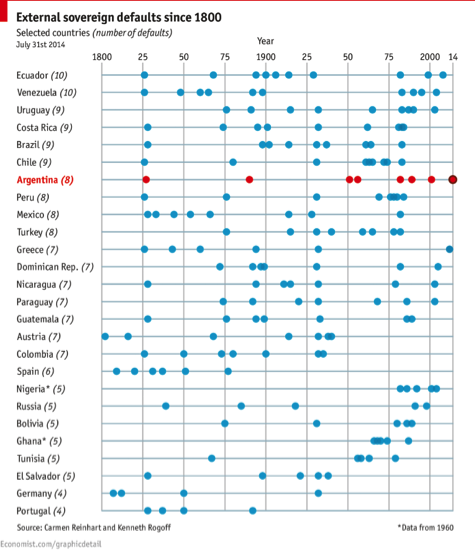

For background, consider that sovereign debt defaults have been commonplace among big and small countries. The graph below shows the frequency by country since 1800.

Go back further in time, and almost all nations can be added to that list. The United States stands alone as an economic and military powerhouse that has never defaulted. (It is important to note that many people, ourselves included, believe the U.S. defaulted when it went off the gold standard.)

Despite America’s perfect credit record thus far, it would be false to assume that UST are “risk-free”. This type of fact, assumed by the masses, is what Samuel Arbesman, the author of The Half-Life of Facts, calls a mesofact. A mesofact, unlike the known effect of gravity, is not a fact of the natural order destined to last for eons. Nor will it have a very short existence, like the fact that the sun is currently shining on my garden. Essentially, a mesofact is one that has temporary permanence.

I refuse to debate whether UST are risk-free as we patently know that cannot be true. Instead, I consider the mindset of a bond trader and describe the ways we might measure U.S. credit risk.

The Mindset of a Bond Trader

“This next part of my post might be difficult to accept. Many will simply write off the theory as the ravings of a lunatic.” Kevin Muir’s quote precedes a discussion about whether or not a U.S. corporate bond can trade at a yield below that of a similar maturity U.S. Treasury bond.

Can a corporate bond be even less risky than “risk-free”? The concept of “risk-free’ier” is mind-bending.

Fresh out of college, on day one on a trading desk, a bond market trainee is taught the practical (non-academic) concept of spreads. Unlike stocks, which trade at a dollar price and are not easily comparable to the price of other stocks or indices, all bonds trade at a yield spread to some benchmark, usually UST. Frequently, in fact, the dollar price of a bond is not even computed until after a trade is consummated.

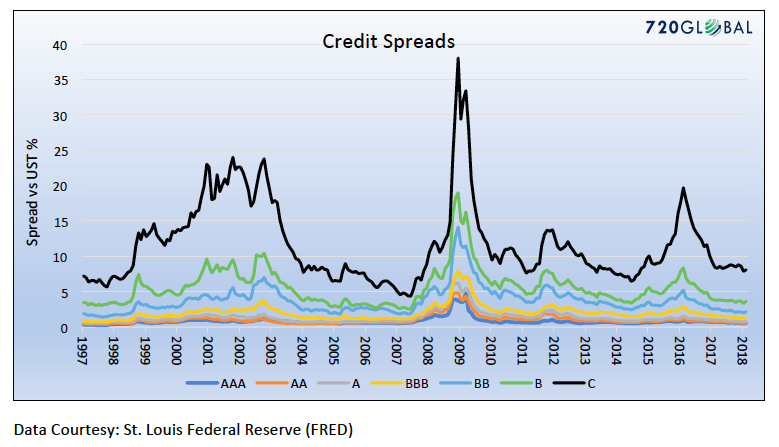

To better describe this pricing methodology let’s relate it to the solar system. Bonds closest to the sun (UST) are the highest rated. As one travels away from our starting point, and the distance between planets and the sun increases, the perceived credit risk and therefore the yield spread over “risk free” Treasuries increases. In the fixed income universe, AAA-rated corporate and municipal bonds tend to trade with the tightest (or smallest) spread to comparable maturity UST as they have lowest default probability. Traveling further out the credit curve toward lower-rated bonds, the spread increases as default risk increases and the certainty of repayment decreases. The graph below shows the gyrations of various corporate bond indexes aggregated by credit ratings and their spread to UST over time.

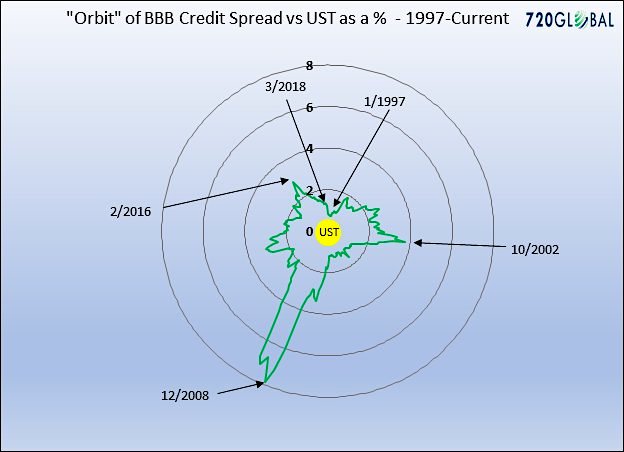

In bond trader parlance, one would say the up and down movements of the lines above represent tightening (spread is declining) or widening (spread is increasing) relative to Treasuries. The graph below takes the orbit, or the percentage spread between BBB rated corporate bonds and UST from 1997 to today, and plots it in a circular format to help further highlight this concept. (The orbit-like axis markers (0-8) are the percentage spread between BBB bonds and UST).

Back to the solar system. If I told you that, over the last few years, Mercury was tracking progressively closer to the sun, you would likely assume the orbit of Mercury is changing. Although inconceivable based on current scientific knowledge, what if it was determined that Mercury’s orbit was unchanged and the altered distance was due to the re-positioning of the sun? Similarly, what if the spreads of non-Treasury bonds were not 100% reflective of the factors that determine the yield for each security but also a change in the perceived risk in the benchmark itself?

Altered State

The U.S. Treasury Department is expected to issue over $1 trillion of debt in each of the next four years. This is additive to the $21 trillion debt load that is currently outstanding and must be refunded when bonds mature. Even more troubling, the growth rate of forecasted debt issuance is almost twice the size of the Congressional Budget Office’s (CBO) most optimistic economic growth forecast. As I have argued on many occasions, such a divergence between the debt burden and the means to service and payoff the debt cannot continue indefinitely.

Deficits and debt do matter, and given this unsustainable situation, there is inherent credit risk in UST despite what finance professionals may tell you.

Ironically, there are currently two popular ways to measure the credit risk of the risk-free security, and neither of them currently reflect the absence of risk.

continue reading on the next page…