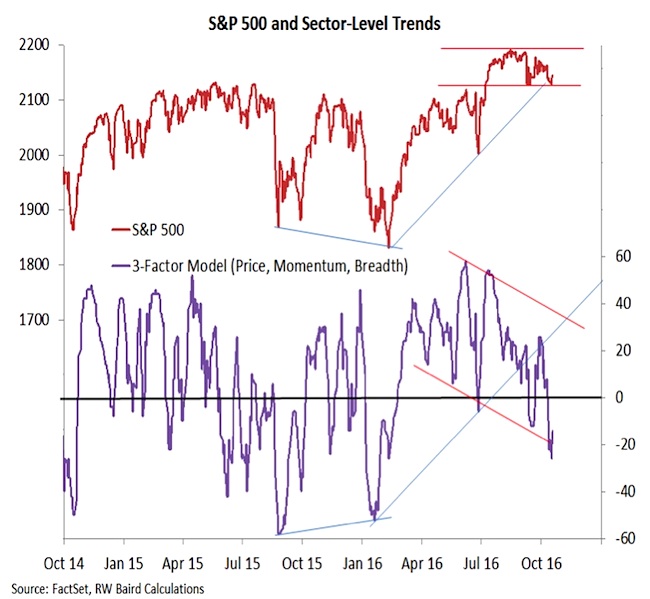

Sector Level Stock Market Trends

Sector-level trends have continued to struggle as the breakout on the S&P 500 has been unable to generate a follow through. That sector level trends have been making lower highs and lower lows while the S&P 500 has moved sideways suggests there could still be near-term downside risk for stocks as Election Day approaches. We do not see evidence yet from s short-term breadth perspective that positive divergences are in place or that a significant capitulation has emerged.

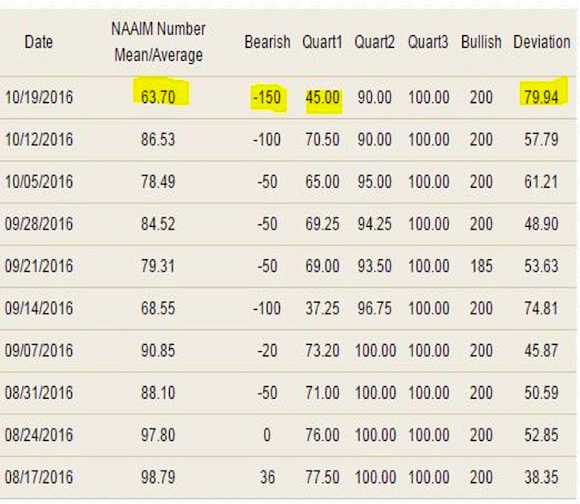

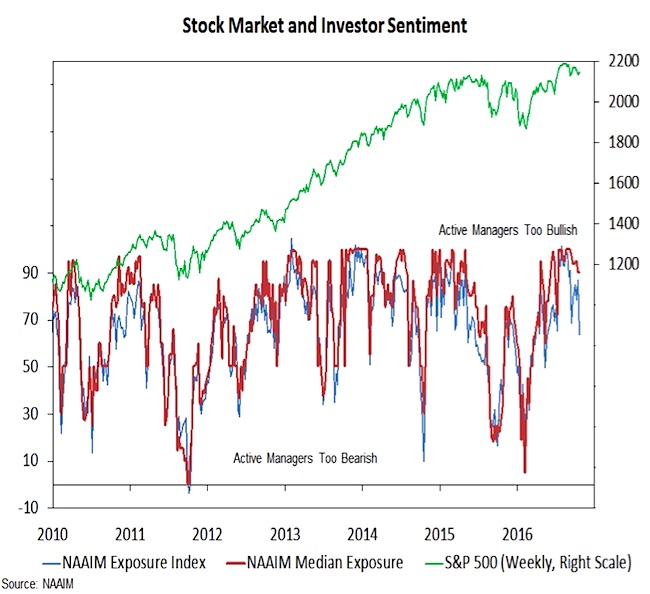

NAAIM Investor Sentiment

The two weekly sentiment data points that we pay the most attention to are the surveys done by Investors Intelligence (measuring advisory service bulls and bears) and the NAAIM (measuring equity exposure of active investment managers. On both measures we are seeing evidence of movement away from optimism. Evidence of outright pessimism is scarcer. This week’s II data showed bulls dropping to 43%, their lowest level since the wake of the Brexit vote. Bears are still at a relatively muted 24% and the bull-bear spread (at 19%) is higher than what we would likely see at a meaningful low for stocks (10% or less).

The latest NAAIM data (shown in the table above and in the chart to the left) shows what could be a meaningful increase in caution among investment managers. The NAAIM exposure index dropped to its lowest level since May and investment managers in the bearish half of the distribution significantly reduced their equity exposure. The median (Quart2) exposure remains elevated at 90%, but it has started to come down. We saw a similar move in mid-September, but then optimism quickly resurfaced. We are not looking for the NAAIM index to return to its early year lows, but several weeks at or near 50 could signal that optimism is sufficiently washed out.

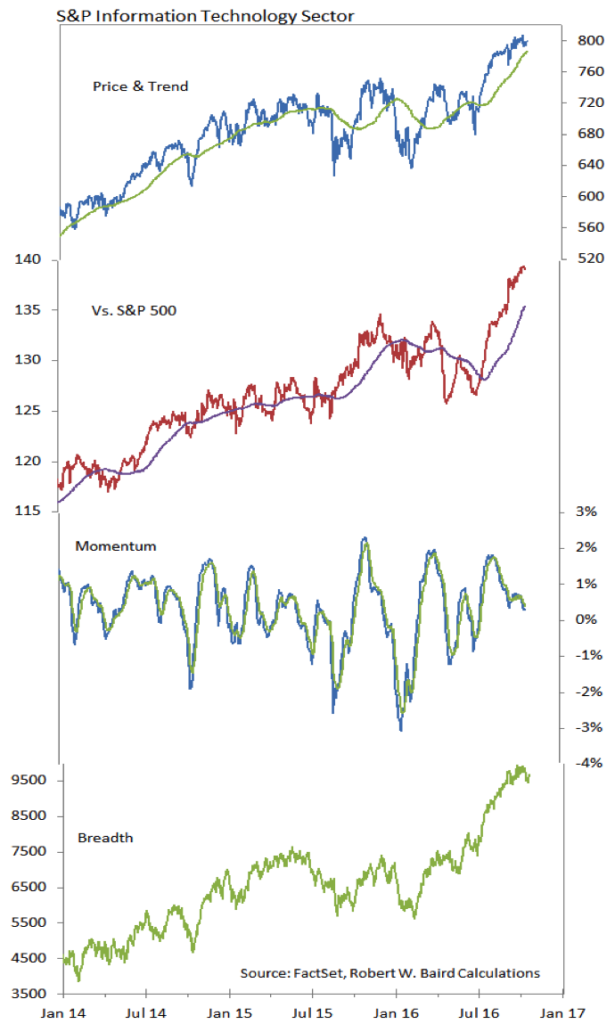

S&P Information Technology Sector

The Information Technology sector has enjoyed a tremendous run over the past few months, and has, since the beginning of August occupied the top spot in our relative strength rankings. The price and breadth trends remain robust, but momentum has started to falter a bit. If this continues, the sector could enter what would likely be a healthy consolidation phase. Given the run it has had, a pasue at this point could help provide more stable support for the longer-term trend.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.