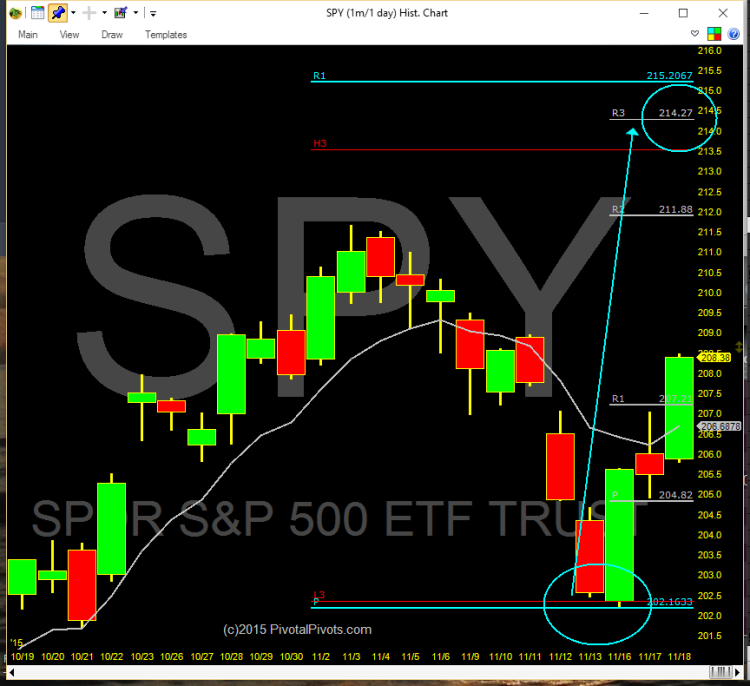

After a sharp decline last week, stocks got off to a fast start this week. On Monday, all of the major stock market indices (S&P 500, Russell 2000, Nasdaq, and Dow Jones Industrials) all bounced off their monthly(P) price pivot points.

Coincidence? I think not. Computer algorithms are programmed to buy and sell at pivots.

But there’s more. The pivots also left a clue.

Since the monthly(P) pivot was support, the computer algos should take the S&P 500 ETF (SPY) to the MonthlyR1 pivots around 213.5-215 by the end of this month. That would mark a new high for the year.

As well, Thanksgiving week tends to be bullish from a seasonality standpoint, so we cannot rule out a continuation of this sharp move higher into next week.

S&P 500 ETF (SPY) Chart – with monthly pivots

Lastly, the Bradley Model had a major trend change cycle date this week. I tweeted about it yesterday. The timing model has a minor one next week, which could mark a short-term high.

Today was a 2015 Bradley Model major trend change date. We should rally to the next date on 11/26(Thanksgiving) . pic.twitter.com/Gie7B9ZrHe

— Jeff York, PPT (@mpgtrader) November 18, 2015

Thanks for reading and best to your trading.

Twitter: @mpgtrader

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.