Commercial Hedgers just hit their most extreme net short position ever in silver futures.

Just 5 weeks ago, on March 28, we noted that the so-called “smart money” commercial hedgers had reached their largest net short position in silver futures in more than a decade (i.e. bearish silver futures). Well, for us to dedicate another post to this situation in silver prices within such a short time frame, there had to be either a massive reversal in that positioning, or a further expansion in shorts to an all-time record. As the title suggests, the latter is the inspiration for this post.

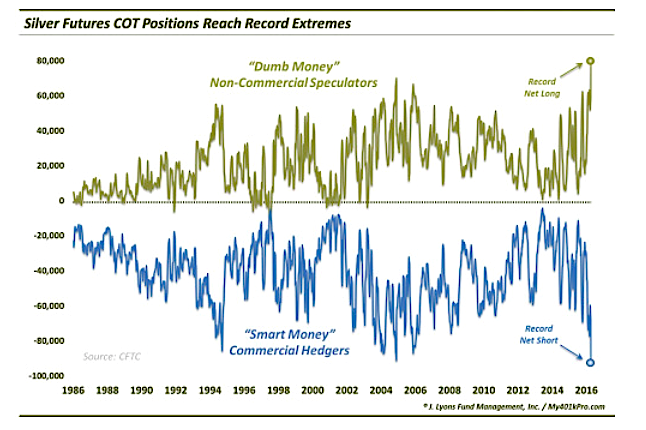

Specifically, as of Tuesday, April 26, commercial hedgers held a net short position of 91,302 silver futures contracts. Since the CFTC began reporting the Commitment Of Traders’ data in 1986, that is their largest net short position on record. Of course, on the other side of that position, we find the non-commercial speculators holding a record net long position of 78,773 contracts.

What is the significance of this situation? As we have explained before, the non-commercial speculators category mainly consists of commodity funds who are making directional bets in the futures markets. These funds are primarily trend followers and, thus, will build up a position in the direction of the trend. On the other side of those trades are commercial hedgers whose main function in the futures market, as their name implies, is to hedge. By definition, therefore, they typically build up positions contrary to the prevailing trend. And in this case, they are as bearish silver futures as ever.

As a result, at key turning points in a contract, these groups’ net positioning is often at an extreme, with hedgers correctly positioned for the turn and speculators incorrectly positioned. It is for that reason that the hedgers are often referred to as the “smart money” and the speculators, the “dumb money”.

These tags represent a bit of a misnomer, however, as neither group has a monopoly on right or wrong positions. Indeed, during long trends, the “dumb money” speculators may be correctly positioned for a considerable length of time. It is at the turns that the group will most often be off-sides, and vice-versa for the “smart money” hedgers.

Of course, identifying the turning points in the underlying contract and delineating when the groups’ positioning is extreme enough to matter are the challenges. An apparent extreme can continue to become even more extreme before any consequences are felt. Premature record commercial short positions in crude and the U.S. Dollar in recent years come to mind as examples.

Thus, the positives that silver bulls have going for them are A) the trend is on their side, B) the metal has continued to be firm in the face of the bearish silver futures COT positioning, and C) a market that does not do what it’s “supposed to” is likely telling us that its current trend is strong enough to overwhelm these ancillary factors for the moment. However, with the COT positioning at its most extreme ever, the potential headwind for silver upon a turn lower could be considerable should the speculators race to unwind their record long position.

Assuming silver prices do run into a setback, it will interesting, and telling, to see what form such a setback takes. If the metal is able to consolidate its gains of the past few months by more or less going sideways while the COT extremes are worked off, it may argue for another eventual leg higher in the metal. On the other hand, should the full potential of the unwind of COT extremes come to pass, it could conceivably undermine the 2016 reflation scenario, at least as far as silver is concerned.

But that is getting a bit ahead of ourselves. For the moment, silver’s intermediate-term bull market remains in force, albeit with a record level of bearishness on the part of the “smart money”.

Thanks for reading.

More from Dana: Will The Rally In Disney (DIS) Be Frozen Here?

Read more from Dana’s Tumblr Blog

Twitter: @JLyonsFundMgmt

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.