One of the most significant economic sectors on the planet is agriculture, which has been greatly affected by climate change and recent geopolitical events.

When the cost of living goes up substantially with inflation, the price of real assets like food, fertilizer, seeds, energy, and land also skyrocket.

Harsh weather, social unrest, and recent geopolitical events have contributed to supply restrictions and price volatility, directly affecting grain production and global agricultural trading.

That’s why investing in commodities is one of the most innovative ways to protect your wealth during inflation and even make money – no matter what the stock market does.

So, if you’re looking for an investment that will help you keep up with inflation and diversify your returns, then real assets and agriculture commodities could be suitable for you.

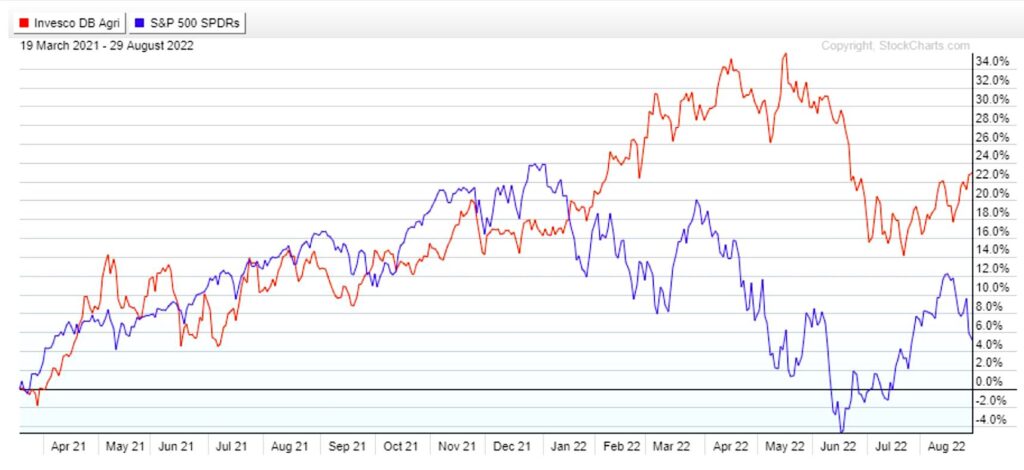

S&P 500 Compared to Invesco DBA Agriculture ETF Last Two Years

For example, take the Invesco DB Agriculture Fund, which provides exposure to a diversified basket of soft commodities.

It is intended for investors looking for a low-cost way to participate in commodities futures with a total expense ratio of 0.93% and offers a diversified basket of agricultural commodities.

Because the fund is well diversified across agricultural commodities, it is much less volatile than trading an underlying commodity directly, and by actively trading this ETF, you can also minimize drawdowns.

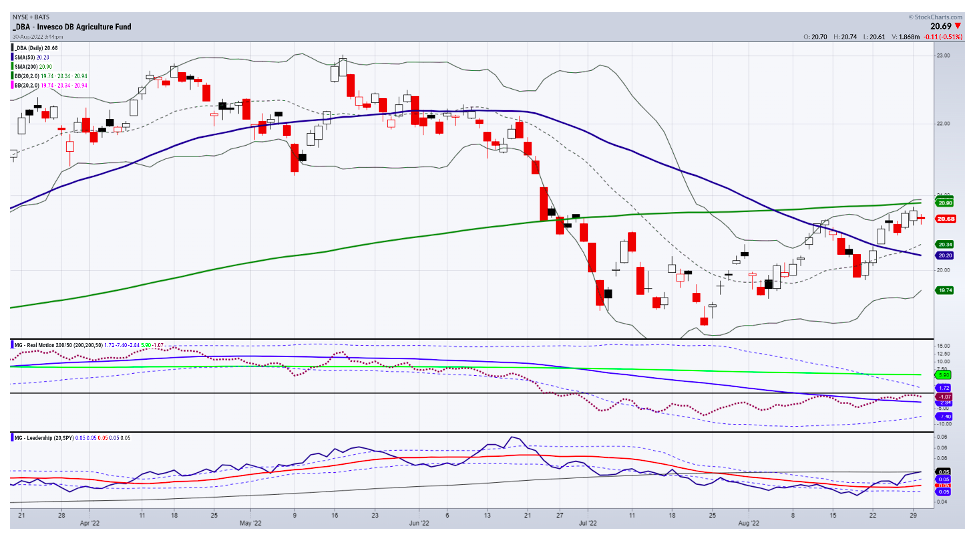

The DBA chart shows outperformance to the SPY over the last 2 years. The Daily chart shows that DBA has held over the 50-DMA and once it clears the 200-DMA could see much higher levels.

Unlike stocks, bonds, and other traditional investments, commodities offer a direct way to profit from inflation. And an actively managed ‘real assets’ allocation to your portfolio is a great way to do it.

To learn more about how to protect yourself against inflation, reach out via chat, phone, email, or book a call with Rob Quinn, our Chief Strategy Consultant, by clicking here.

Mish in the Media

Coindesk with Christine Lee 08-30-22

Coast to Coast with Neil Cavuto 08-30-22

Stock Market ETFs Trading Analysis and Summary:

S&P 500 (SPY) Now an unconfirmed phase change to bearish-400 pivotal.

Russell 2000 (IWM) Held the 50-DMA and if continues to do so could see some buying.

Dow Jones Industrials (DIA) Now an unconfirmed phase change to bearish-321 pivotal.

Nasdaq (QQQ) Now an unconfirmed phase change to bearish-305 pivotal.

KRE (Regional Banks) 62.00 the 50-DMA.

SMH (Semiconductors) Confirmed bear phase however 215 pivotal support.

IYT (Transportation) 227 the 50 DMA.

IBB (Biotechnology) Confirmed bear phase. 124 resistance 117 next support.

XRT (Retail) 64.00 area the major 50-DMA support.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.