Examining the markets over the last several months, it comes as no surprise that the recovery in equities has been a bit lopsided from a capitalization perspective. Large cap dominated portfolios have nearly erased their losses stemming from the August-September correction, while more growth orientated small cap stocks have lagged.

From a performance perspective, small cap stocks, indices, and ETFs are still roughly 6-8% off their 2015 highs, allowing a lot of room to play catch-up.

This is most likely the result of the steep losses that transpired in the energy and biotech sectors, which dominate many small and mid-cap indexes.

Yet while small cap stocks led on the downside and exhibited lack luster performance during the majority of the rally, there is some recent evidence that suggests there could be a changing of the guard.

Here are a few points to consider:

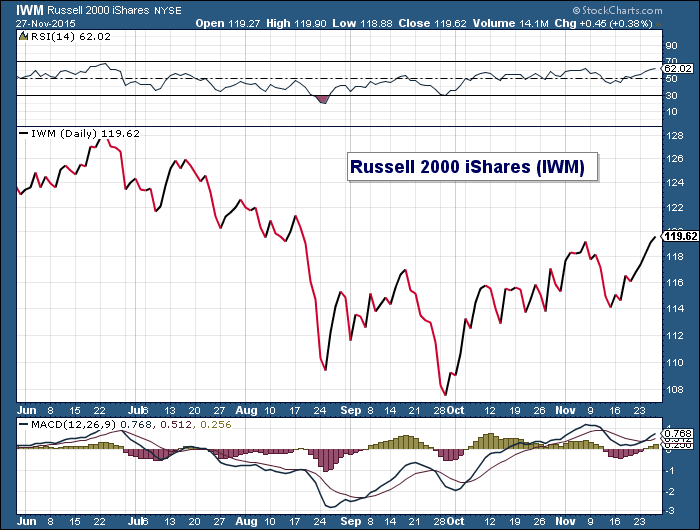

- The recent price action of broadly diversified indexes such as the iShares Russel 2000 ETF (IWM) or the Vanguard Small Cap Index ETF (VB) have uncharacteristically exhibited better performance on a day-to-day basis over the last few weeks despite the random bouts of equity volatility. In fact, over the last several trading sessions, small cap stocks have posted performance measures of roughly +1.8% in comparison to 1.25% for the S&P 500 Index.

- From a seasonal perspective, small and mid-cap stocks have outperformed large cap names during the months of October through February every year for the last 15 years. This is typically the result of the abundance of bull markets that have been spawned following weak September equity returns, small cap stocks (and potentially mid-caps as well) typically lead on the upside during new up-trends.

- From a psychological perspective, it’s easier to put excess cash to work when equities still have a healthy buffer between current prices and broaching new highs. I would always rather purchase stocks 10% or more from their most recent highs instead of just 2-3%. Psychological relative valuations matter, despite richer fundamental P/E valuations in smaller names.

- From a broader fundamental perspective, a higher U.S. Dollar should be growth prohibitive for many larger companies that derive a large share of their earnings abroad. In fact, of the total S&P 500 earnings, roughly 40% will be generated from foreign sources. Smaller companies typically operate and derive the majority of their earnings within the U.S., which largely negates currency fluctuations as a revenue inhibitor.

Russell 2000 iShares (IWM) Chart

Examining small and mid-cap stock exposure within your current portfolio strategy requires a close look at your tolerance for volatility. Yet, if I were a long-term investor with cash to put to work, I would make sure that it found its way into a few of the ETFs mentioned above.

Investors not interested in breaking their portfolio into a capitalization weighted shell game could choose a blended completion index such as the Vanguard Extended Market ETF (VXF). VXF has filled the key role of diversifying the capitalization structure of our Flexible Growth and Income Report portfolio since inception, and we even recently added to the position in an attempt to capitalize on these crosscurrents.

While these ETFs may not be as exciting as a new flat screen TV or some other Black Friday door buster; it’s my personal belief they will provide a better rate of return over time!

Thanks for reading.

Note that this post was written in conjunction with Michael Fabian.

Twitter: @fabiancapital

Gather more insights from David’s investment blog.

The author and/or their portfolios have positions securities in mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.