The precious metals industry has been wrought with frustration for the past several years, with Silver NYSEARCA: SLV and Gold NYSEARCA: GLD rallies failing to get the type of traction one would see in a bull market.

The exciting rally that captivated the first decade of the 21st century was followed by 7 years of frustration.

That’s typically what a bottoming process feels like. Patience is a virtue.

That said, gold bulls have been particularly hampered by Silver’s inability to rally along with Gold. In short, Silver carries similar beta to Gold that small cap stocks carry to the broader stock market. A true bull market in precious metals needs Silver to be in over-drive. Is that time now?

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

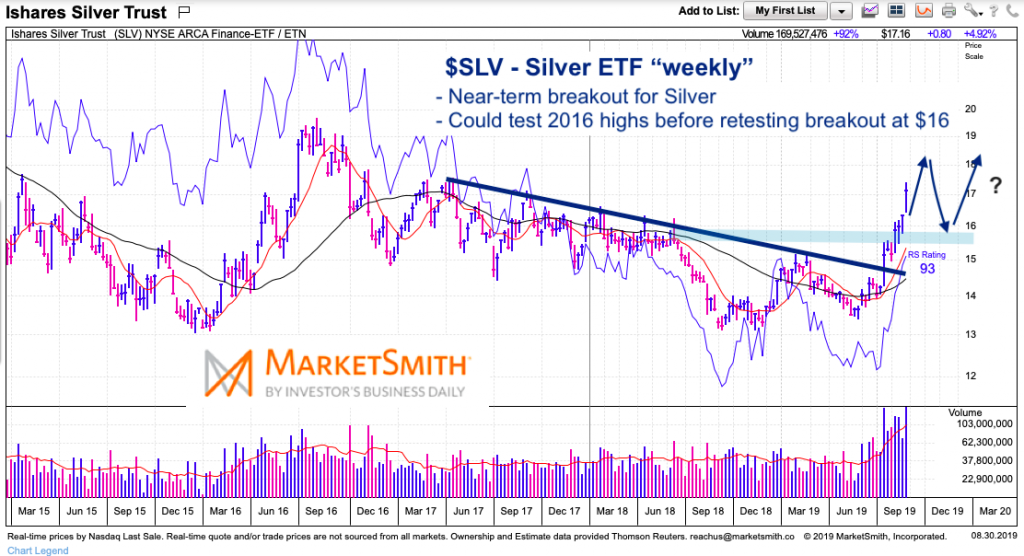

$SLV – Silver ETF “weekly” Chart

I shared this chart on Twitter on yesterday (Friday). It shows how Silver has broken out of a near-term downtrend, as well as lateral resistance.

This has given the industry life again – a new bull market may be in the making. Near-term upside includes a potential test of $18 / $19 price area. Watch the $16 breakout price area as support.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.