In September, we alerted readers to watch Gold and Silver prices for a development that could signal a market low. We believe that low arrived on November 30, and prices are now tracing an upward pattern that should continue until the middle of 2015 or beyond. For several reasons, we expect the current price area to serve as a base for both precious metals to rally. This article presents our forecast for silver prices, which we believe will test targets in the 20’s in coming months.

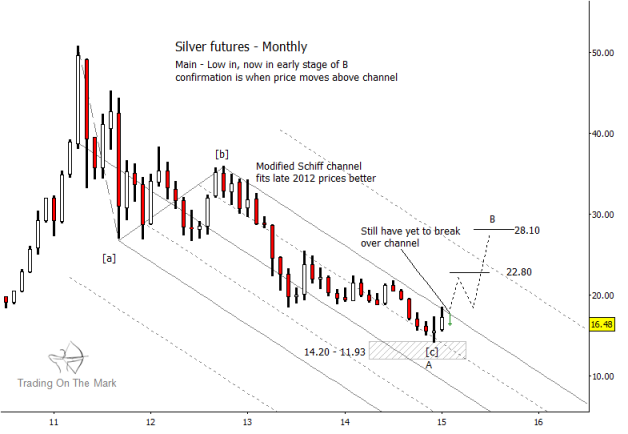

Even though we are watching for higher silver prices, we expect the rally to take a three-wave corrective form. The monthly silver chart below shows some of the context around that prediction. For both gold and silver, there are numerous signs that the price decline from 2011 was merely the first part of a larger corrective structure. Typically, we would expect the correction to consist of three large waves, and both gold and silver have completed the initial A waves of their patterns. With the end of its A wave, silver reached the target area we had been writing about since September 2013.

Now, silver is pushing against the upper boundary of the price channel on the monthly chart. With a breakout, we expect silver futures to test the area around 22.80 and later the area around 28.10 based on common retracement levels. Those are rough targets, and we will refine them as the pattern develops.

Silver Futures Monthly Price Chart

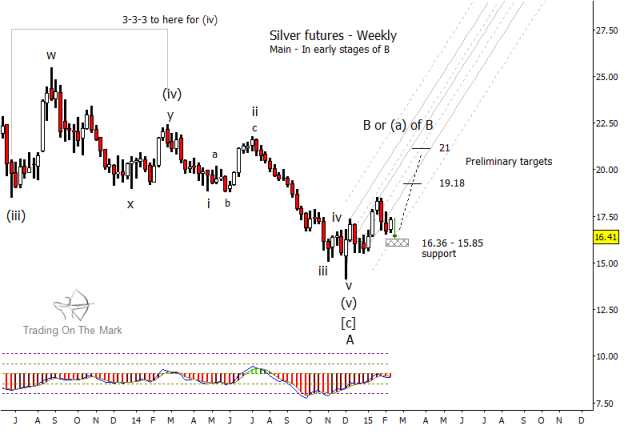

The weekly chart below shows how price may be forming a new upward channel, and it also presents resistance targets calculated from price action since the November low. For several reasons, including channel support and also our Elliott wave count on a daily time frame (available to our subscribers), we believe the current area is the right place to look for support. Note that the upper target of 21 on the weekly chart is not far from the resistance area around 22.80 on the monthly chart. Either or both of those levels could result in a pause or retracement in the spring.

Silver Futures Weekly Price Chart

Watch our website for a companion article forecasting a similar rally in gold, which we expect to post later today. Thanks for reading.

Follow Tom & Kurt on Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.