Though it’s been obscured in market-related news coverage over the past few weeks by Syria and today’s FOMC, the political brinksmanship over the US federal budget and the debt ceiling is yet again mounting.

Though it’s been obscured in market-related news coverage over the past few weeks by Syria and today’s FOMC, the political brinksmanship over the US federal budget and the debt ceiling is yet again mounting.

Deadlines (namely, October 1) are approaching fast; and though the US House of Representatives is prepared to pass a CR (Continuing Resolution) to provide stopgap funding for the federal government through December 15, 2013 that the Senate and President can work with (albeit with significant amendments) the possibility of a government shutdown is real; and sounds very dire.

So how much punishment can we expect equity and bond markets to sustain if the US government goes over the edge?

The only plausible baseline is to look at the last government shutdown: 18 years ago during the standoff between Clinton and a similarly “recalcitrant” House of Representatives led by Speaker Newt Gingrich.

The S&P’s reaction speaks for itself:

S&P 500 (SPX) – Monthly: Government Shutdown and Near-Government Shutdown (click to zoom)

Even intra-month volatility November 1995-January 1996 was minimal. Talk about shrugging off a “crisis”.

In contrast and of more recent memory, to the right is the debt ceiling showdown of Summer 2011. One can argue over whether the proximate cause of the August-October 2011 correction was the near-government shutdown and (further-)diminished fiscal policy credibility enjoyed byCongresss; or in response to the first-ever sovereign downgrade of the US by Standard & Poors. The correction was brief, severe (just shy of a legitimate bear market); and quickly pushed down into the past by a relentlessly advancing market.

How about bonds: do they tell a different story?

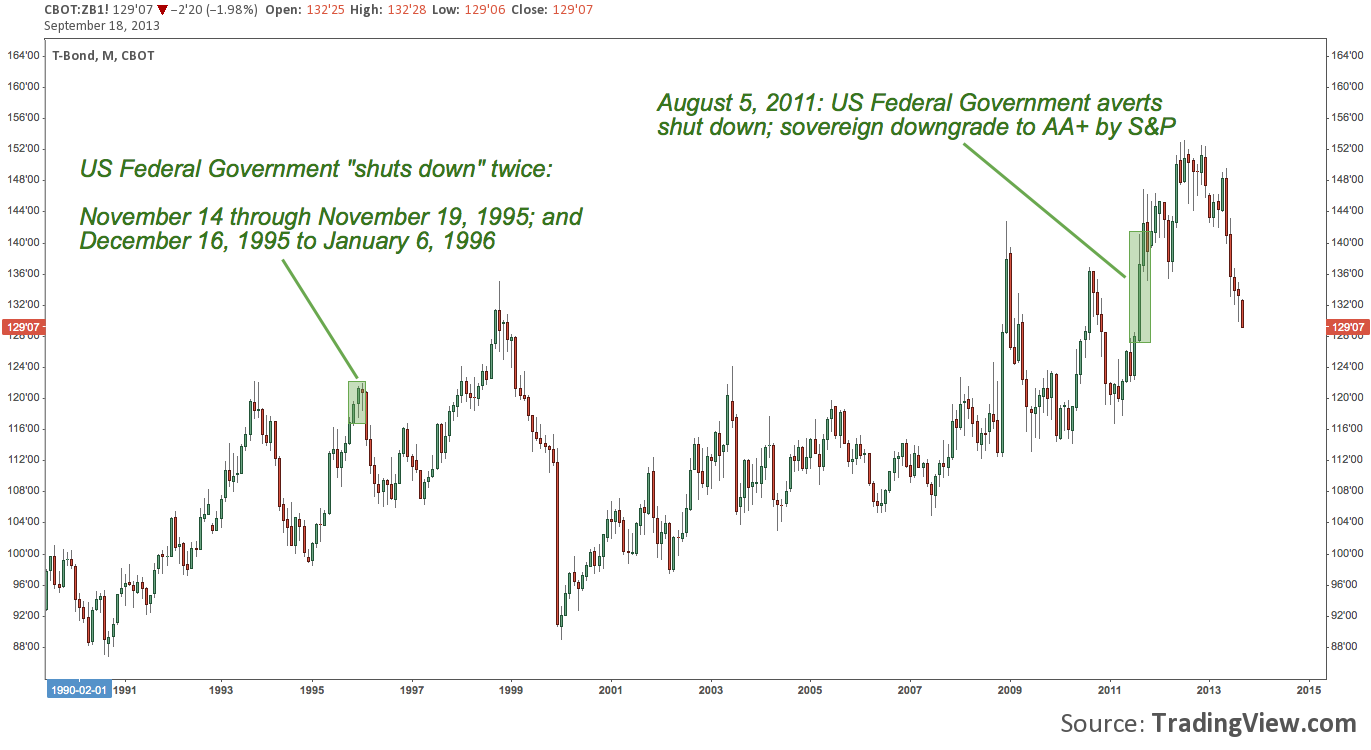

US 30-Year Treasury Bond Futures (ZB) – Monthly: Government Shutdown and Near-Government Shutdown

The 30-year ramped into the climax of the Clinton-Gingrich standoff; and did not begin to sell off until after the federal government reopened for business in January 1996.

Once again, 2011’s near government shutdown played out with marked difference. Here, though US sovereign debt – that is, Treasuries – was downgraded, the 30-year staged a dramatic advance in a truly ironic bid for safety and a testament to the sanctity of US Government debt and the US Dollar’s reserve currency status if ever there’s been one.

Every moment in the market is unique, and today is certainty filled with anxieties all its own; but if history is any guide – fortunately, we’re painfully under-served with examples of US Federal Government shutdowns – however pitched the political theater becomes, equity markets may just take a shutdown in-stride (another sovereign downgrade is another matter). Bonds did suffer a rockier road over the 6 months following the 1995-1996 shutdown – though its worth mentioning they advanced during the shutdown – but bottomed and swiftly pivoted higher beginning in the Fall of 1996.

Twitter: @andrewunknown and @seeitmarket

Author holds no positions in instruments mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.