Since the start of 2019, the S&P 500 (INDEXSP: .INX) is up by an impressive 13.9%, including dividends.

At the same time, bonds – as measured by a total bond market ETF – are up 6.2%.

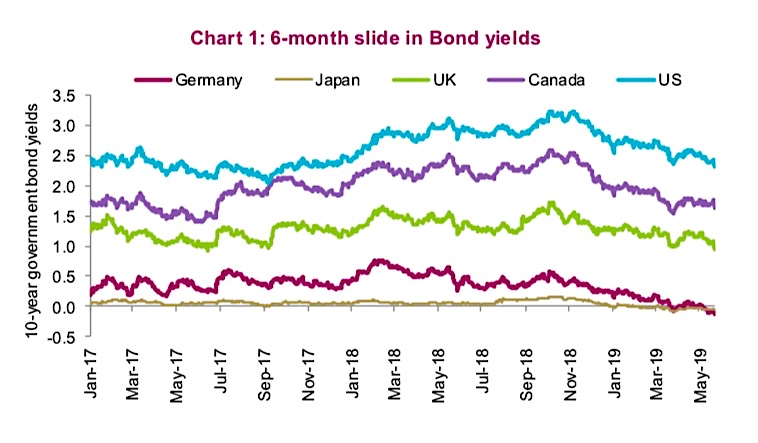

In other words, bond yields – which started falling during the fourth-quarter equity market correction, have continued to do so.

In early October 2018, the U.S. 10-year Treasury yielded 3.2% (INDEXCBOE: TNX). Today the same bond fetches a yield of only 2.33%. Bond yields around the globe have moved materially lower over the past few months. Ten- year German bonds are now yielding -0.11% and French bond yields are positive, but not by much at 0.3%. (see chart 1 below).

So here we sit, uncomfortably, with the bond market implying global economic growth may be decelerating faster and an optimistic equity market signaling things have improved materially since the year began. It is likely in the coming months that one of these markets will be proven right and one will be proven wrong.

Let’s put the 2019 equity rally into better context. The year started coming out of a very oversold market and there have since been three key equity-friendly developments:

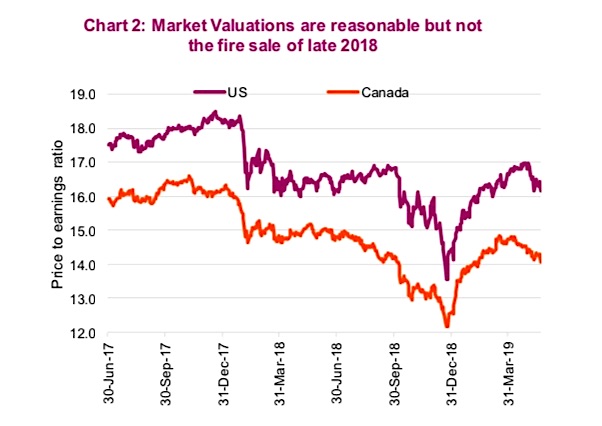

1. Valuations. The market was cheap after the Q4 sell off with the S&P 500 trading below 14x. This was a tailwind.

2. U.S. Federal Reserve. The Fed backed off its rate-hiking path, which provided another boost.

3. Lower bond yields. This helped fuel higher stock prices through multiple expansion.

The issue now may be these tailwinds are pretty much played out. Valuations for the S&P 500 are now above 16x, so no great bargain there. We would be hard pressed to see the Fed become more dovish given very low unemployment. And while bond yields can always fall further, in doing so equity markets would likely pivot from welcoming lower yields to being overly concerned about slowing economic growth.

It is all up to the data now

With the previously mentioned market tailwinds largely exhausted, it may be up to the economic data going forward. Of course, the one big exception would be a rapid resolution to the U.S.-China trade conflict, but that is more of a guessing game than anything else.

If the economic data continues to decelerate, bond yields would continue to fall. While falling bond yields provided a positive influence on the equity markets initially, at this point the markets would likely view this as a negative due to growth concerns and the risk of slower earnings growth.

If the economic data improves, bond yields would likely grind higher. This would create a very strong tailwind for equities given still- reasonable valuations, yields rising from a low base and improving optimism for earnings growth.

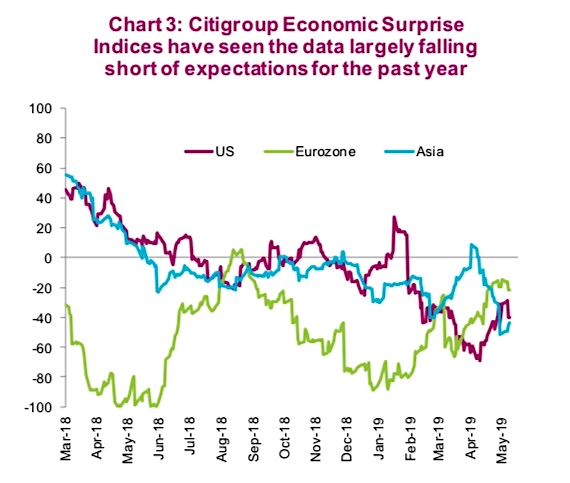

Recent economic data has continued to disappoint. The Citigroup Economic Surprise indices for the U.S., Eurozone and Asia have been consistently below zero for much of the past year. And the data of the past few months has been generally worse.

Conclusion

The equity markets can likely hang in there for some time, weathering poor economic data. But it will weigh on confidence – an attribute not as plentiful today given the recent escalation of trade tensions. The next few weeks will be crucial with global manufacturing data releases, consumer confidence and employment reports. Sometimes economic data matters more than other times – this is one of those times. Long live all economists.

All charts are sourced to Bloomberg & Richardson GMP

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.