This post came over via Shane Obata and was written by Craig Basinger, Richardson GMP’s Chief Investment Officer.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

The only constant in the investment landscape is change. I would still classify myself as a youthful investor. Having started investing / managing money in the mid-1990s, many peers clearly have longer tenures. Yet, even in my short twenty years on the “Street” there have been incredible changes.

Clients used to call for stock quotes, before basic information became easily accessible. Today, with a few clicks of a mouse, you can access asset allocation, macro strategy, manager selection tools and lots of information on individual companies and ETFs. With a couple more clicks, you can buy or sell some or all of it. Market access and information – it is all out there and there is a ton of it.

The markets have changed as well. No more trading in 8ths and 16ths, it is now down to a fraction of a penny. The cost of transacting has come down precipitously over the past twenty years. Increasing use of ETFs has changed the landscape into a spectrum of active to passive investment strategies. When Vanguard launched the first index fund, brokerage firms got together and printed an ad calling indexing ‘un-American’. How times have changed. Then there is the rise of the quants or high frequency traders, with their algorithms (algos) trying to snip fractions of pennies on trades or implement differentiated strategies. Now we trade using algos to avoid being snipped.

The markets have changed and mostly for the better. More open information and lower cost to transact are good for investors, but has it also increased ‘short-termism’? Have investor time horizons really shrunk, evident in increased trading and turnover? Are markets reacting faster to news as there is more fast money at work?

In this report we will share our research on this topic, which we are calling Short- Termism. It is not a simple tale.

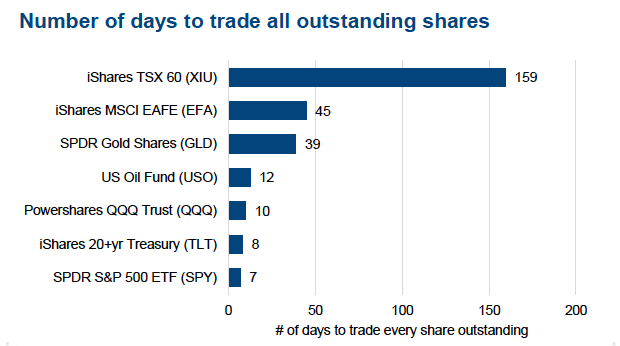

Number of days to trade all outstanding shares

The SPDR S&P 500 ETF (SPY) is the largest ETF on the planet with assets of $175 billion. Based on the average daily trading volume over the past year, all the shares changed hands every seven days (chart at the bottom of page 1). That should be both surprising and a tad disturbing. The SPY is the definition of cheap beta, a very cost effective vehicle to gain exposure to the S&P 500. We hold it in a number of our investor profiles as a core buy-and-hold position, so it isn’t us trading the heck out of it. Seven days is pretty ridiculous, implying the shareholder base is turned over 37 times in a year (assuming fixed shares outstanding, which isn’t the case but the point remains). Some other ETFs have similar shareholder turnover including the iShares 20+ Year Treasury Bond (TLT) on the bond side at eight days, the NASDAQ-100 QQQs at ten days and the United States Oil ETF at twelve days. But some don’t, such as the biggest Canadian equity ETF iShares S&P TSX 60 (XIU). It takes 159 days to trade all the outstanding shares. I guess that still is a relatively short period but certainly not nearly as ridiculous.

To put this into perspective, Royal Bank takes 340 trading sessions to recycle its shareholders once, or 1.35 years based on 252 trading days per year. Johnson & Johnson and BCE are about the same. This would certainly support the view that ETF investors tend to have materially shorter investment horizons, aka fast money.

Manic ETF investors

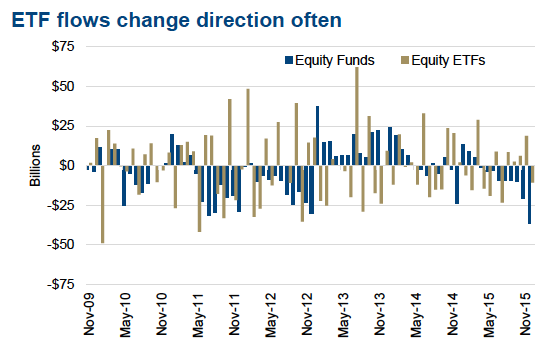

Chart at the right represents the monthly flows in/out of equity mutual funds and equity ETFs. There are two important implications. The first being how quickly and often the ETF flows change direction. The other is the magnitude of the flows. Based on the data, the ETF flows are a bit bigger than equity fund flows, in both directions. However, if you consider the total asset base for each, the bigger ETF flows become more impactful. There is $1.65 trillion in equity ETFs compared to $15.3 trillion in equity funds, which means if flows were equal the ETF flows should be 1/9th the size of fund flows.

The average ETF investor, based on volume, would clearly indicate a high degree of short-termism. This holds some validity as when most investors buy a fund, they are investing in the investment process of the manager. This naturally leads to longer holding periods as the efficacy of the manager cannot be judged on one or two quarters or even years. ETFs on the other hand are a quick way to add exposure to a market or sector that can easily be removed. The market is rising and you want more market exposure, so you buy an ETF. Up 10% more, you may take your money back or if it reverses, sell and move on. This sounds much more like speculating/gambling than investing.

Less due diligence – Example: You’re an investor and after reading an article about the sun you decide that you want to add some solar exposure for your portfolio. There are about 50 companies globally with market caps over $1 billion U.S. involved in solar. Let’s say you short list to five and conduct detailed research on each. You have now vested a significant amount of time and finally decide on two companies. Or, you could have taken the short cut and purchased TAN, a solar ETF that holds 24 names. Now ask yourself under which scenario would you be more committed to the investment and likely have a longer time horizon.

Investors are often their own worst enemy (SPX Performance CHART)

This is important. The 10-year annualized return for the S&P 500 was 7.67% while the asset weighted large-cap fund returns were 7.03%. Some outperformed, some underperformed, slap on some fees and the result is 64bps less than the index. However, investor returns were only 5.26%, a drop of another 177bps. How, you wonder? Well investor behaviour and the timing of purchases and sales hurt performance. Selling after the market has dropped (capitulating) and not buying until the market rallies. Chasing individual fund performance hurts too. Often a strong fund track record attracts more client assets and if the performance reverts back to the average, investors can lose more money on a dollar weighted basis even if the fund still has a positive track record.

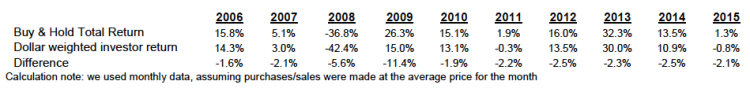

Dalbar provides long term studies on investor behaviour and how the timing of fund buy and sell decisions hurts performance much more than fees. Essentially they calculate money weighted returns which incorporates investor buy and sell decisions. We took a similar approach and looked at ETF returns.

Given all the flows in and out, are investors adding value or hurting themselves?

We really hope our math is flawed somewhere (unlikely) but it would appear the manic ETF trader approach is literally shooting themselves in the foot. The timing periods are somewhat different than above so excuse the inconsistency. Over the past ten years ending in 2015, a buy-and-hold investor in the SPY (S&P 500 ETF) would have an annualized return of 7.2%. Dollar weighted for the SPY ETF was 3.6%. The table below includes the annual return for the ETF compared to the dollar weighted return. It would seem the manic ETF trader is not adding value and appears to be squandering about half of the returns over the past decade.

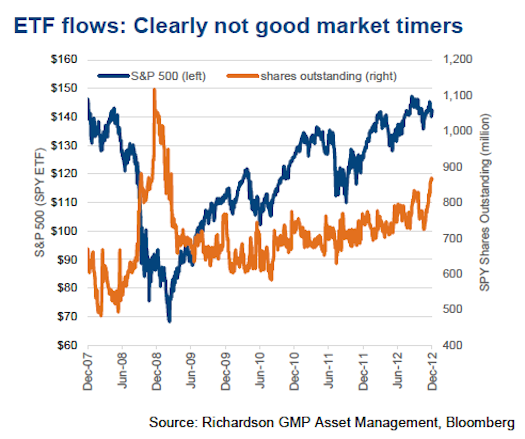

The cause of the poor dollar weighted investor returns can clearly be seen in the next chart. The number of shares outstanding for the SPDR S&P 500 ETF (SPY) ballooned as the 2008 bear market gained traction. In other words, more units were created. Shares outstanding peaked near or just before the market bottom and rapidly reversed (capitulation?). Equally important, the number of shares outstanding didn’t start to rise again until 2011. That is to say, it took a full two years of market recovery before flows started coming back into this ETF. This led to 2008 and 2009 as the big years of underperformance.

Important Caveat: There is one big problem with this analysis, because you don’t know who the ETF owner is or why they own it. This analysis incorrectly assumes all are regular rational investors trying to make money, and that is not the case. The spike in shares outstanding for the SPY during the 2008 bear market was partially due to increased shorting, which also can result in ETF unit creation. SPY has always had a high percentage short interest as investors use it to hedge or speculate. Shorting would explain some of this spike but certainly not all of it. Plus many fund managers use ETFs to manage cash flows which could distort the truth as well.

While the SPY is just one ETF, it is the biggest and would imply very poor market timing based on flows. But given the multiple uses by various market participants of this popular ETF, we looked at how other ETFs stacked up. Ideally we are looking for those that aren’t skewed as much by short sellers or other non-traditional motivated buyers or sellers.

continue reading on the next page…