“It takes real knowledge and market know-how as well as lots of courage to sell, and particularly to sell short, because you will make many mistakes. However, I don’t see how anyone can really do well in the market and protect assets if they don’t learn how, when, and why stocks should be sold.” ~William J. O’Neil

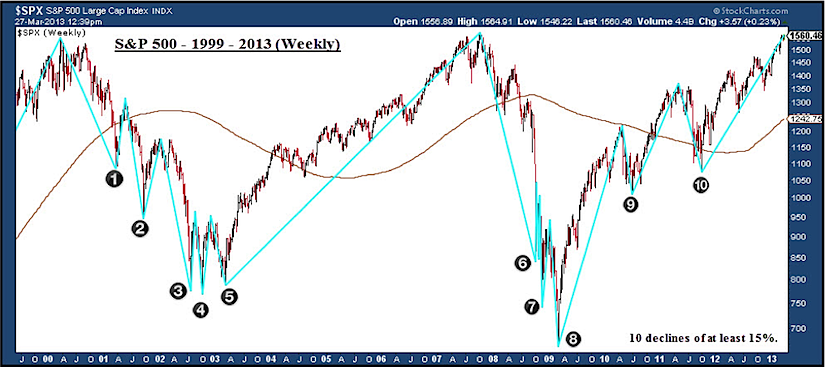

Since I started in the business, short-selling has always been viewed as inherently much riskier than trading from the long side. One of the reasons I think there is a reluctance or fear of short selling is that most books and other literature on trading find their origins in the super-cycle equity bull market of the 1980’s and 1990’s. For example, from 1990 to 1999 the S&P 500 had only two declines of 15% or more. However, from 2000 – 2013 there have been ten declines of 15% or more. Please look at the charts below.

S&P 500 (1999 – 2013)

The following are some of the criteria that frame my selection process for a short candidate. Please note that I am not talking about short-selling ETFs, only equities. However, in some cases, the same process is applicable.

PRICE / VOLUME

- Trade with the trend. If the market is trendless or in downtrend then you have the environment to short. If the market is trending higher the focus should be the long side.

- 200-day moving average. I prefer short-selling stocks that have a 200-day moving average that is flattening or even better, declining. William O’Neil discusses how the optimum short point comes 4-6 months from the high which plays right into these criteria. It takes a similar amount of time for the 200-day sma to turn flat or down.

- Avoid a liquidity trap. Stay away from stocks that trade less than 300,000 shares a day. Based on my short trades over the last seven years the average daily volume has been approximately 400,000 shares a day.

- Avoid low priced stocks. As a general rule stick to stocks that are priced at least $20.00 / share. The fewer shares you own the better.

- Avoid small floats. The stock may be priced greater than $20.00 and with decent volume, but if the outstanding float is small there is a risk of being shaken out easily due to a wide bid-ask spread or increased intra-day price volatility.

- Check short interest. A high short interest is not a deal breaker, but combined with low volume or a small float, it can be dangerous.

INDUSTRY GROUP / FUNDAMENTALS

- Define industry group ranking trend. Generally, avoid short-selling stocks in the lowest ranked industry groups, because most of the member stocks have already traded below their sweet spot. I prefer to target industry groups that have dropped out of the top rankings with notable downside acceleration.

- Define position within the industry group. Make sure you are not short-selling the industry group leader. Leading stocks tend to be more volatile and can force you out of position very quickly. Target the stocks that barely participated in the most recent group strength…the group laggards.

- Identify broad industry group themes / catalysts. Avoid short-selling stocks in industry groups that have been involved in merger speculation, favorable changes in regulation or any other positive catalysts.

- Other important considerations. I recommend reviewing the earnings surprise history, estimates trend and any new products or management changes that could positively affect the stock moving forward.

TRADE ENTRY / EXIT

- Short into strength. The optimum entry point is when the stock advances into a key price resistance level and/or moving average. Often when a stock breaks a key support area and/or moving average it will recover that price level almost immediately. Institutions tend to target those support levels to add or initiate positions.

- Use Conservative Profit Targets and Tight Stops. I tighten my stops to 5% from the 8% I use for my long positions. If a short position shows a gain of 15% or more I am looking to close the position. The caveat to the rule is if the stock shows a +20% gain in 7-10 trading days. I will put that short position aside and give it some more time. In 2008 that caveat allowed me to capitalize on some of the major declines in emerging market stocks.

WHAT YOU KNOW / OTHERS

- Emerging Market ADRs. I tend to traffic in the emerging market ADRs, because they are not heavily followed so the analyst factor is almost non-existent. Additionally, when emerging markets break the move is often very swift and large.

- High Dividend Stocks. Since the lows of 2009 high dividend stocks have gotten a decent bid, particularly during the market weakness. I would avoid this group.

- Margin Calls. Always maintain a list of mega cap names like Procter & Gamble (PG) or Exxon Mobil Corp (XOM) to look for the capitulation phase of a major decline. For example, in October and November 2008 many of these mega cap stocks got hit with margin calls (go look at the charts). Short-selling at this stage can be easy pickings.

Sumner Redstone was one of many big names that got hit with margin calls in October and November 2008…

If a professional trader goes to the trouble of calling a market top and / or a major breakdown for a stock then they should take advantage of that hard work. Keep your expectations low. Accept a lower batting average and smaller average gains, but tighter your stops and always stack probabilities on your side.

Twitter: @hertcapital @seeitmarket

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.