Is September scaring you enough?

After all, the month started out shaky and ended the first week worse than it began. So, does this mean the stock market is headed for a much bigger fall?

Some analysts are saying that we can expect weakness and chop until the election.

When we examine the weekly charts, we see a return to August lows possible.

We see a return to May lows as a gift.

We will go through the whole family, and to mix it up a little, begin with Bitcoin.

Remember, Crypto is our Family’s “tween” and is currently acting like one.

Note that this fall to the 50-week moving average, which could be the support level to bounce from.

Our Real Motion Indicator is approaching oversold. Where would we think the worst is over?

On a weekly basis, we want to see Bitcoin have a bullish momentum divergence (red dots clear back over the 50-WMA-blue line) and,

We want to see the price close out next week back above 58,200.

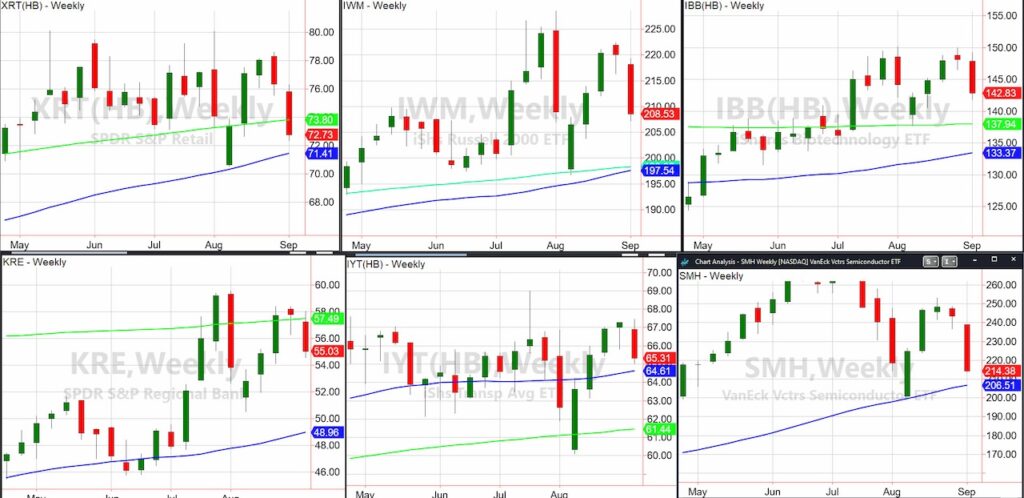

See the image at the top of the article for the weekly charts of the stock market ETFs that we follow.

You can see why I say the August lows could be the bottom of this correction.

You can also see that if Transportation IYT or Retail XRT fail their key 50-WMA (blue), then the May lows become interesting.

Focusing on the small caps, IWM, the weekly moving averages are sitting right at the August lows.

THIS IS KEY.

I feel strongly that unless IWM can get back over 215, any move closer to 200 is a buy opportunity.

Retail (Granny) XRT, had a rough week.

However, that too is looking at the August low and maintaining the 50-WMA as support.

Plus, should XRT crawl back over 74.00, we might not see a big rally, but at least we can feel better that the worst is over.

Bulls want to see IYT hold above its 50-WMA. Otherwise, we believe IYT can get closer to the 200-WMA, but it will not fail it again.

Moving on to Semiconductors SMH, I have said repeatedly that this sector topped out.

Now, SMH becomes integral not for its leadership role, but for its ability or inability to hold up over the 50-WMA.

If SMH breaks that and the August low, we will continue to raise even more cash and add to our long bond position.

We do not need SMH to rally, but we do need the chip sector to tread water.

Biotechnology IBB hasn’t failed anything too significant as far as chart support.

Yes, IBB could not get past 150. However, we think a move closer to 135-137 is another buy point.

Regional Banks KRE has huge support around 52.00.

Given the trading range KRE sat in for nearly a year, this move lower feels more like basic long liquidation in a market correction than a commercial bank disaster on the horizon.

If you put this all together, essentially our view is that this correction is yes, seasonal, no, not end of days, and yes, a buy opportunity

UNLESS

Semiconductors have some black swan event.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.