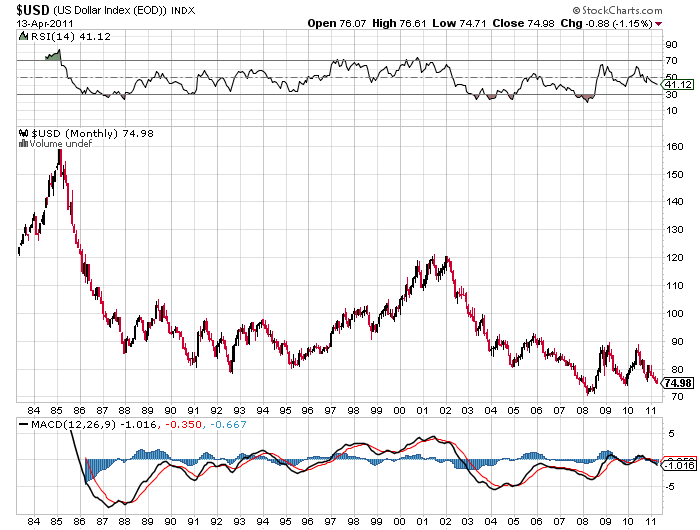

It’s everywhere. It is held in U.S. bank accounts, found in our wallets, printed daily, and some say it played a role in building a house of cards. The popularity of the Dollar is strong in domestic fed bank speak, but credit and budget concerns have left it laughably weak around the world. Many market pundits and analysts have written off the dollar, citing The Great Recession, Bernanke’s printing press, and Standard and Poor’s recent downgrade of the US credit outlook. This abysmal market sentiment coupled with a long-in-the-tooth trend, however, have contrarians calling for a dollar trend change.

It’s everywhere. It is held in U.S. bank accounts, found in our wallets, printed daily, and some say it played a role in building a house of cards. The popularity of the Dollar is strong in domestic fed bank speak, but credit and budget concerns have left it laughably weak around the world. Many market pundits and analysts have written off the dollar, citing The Great Recession, Bernanke’s printing press, and Standard and Poor’s recent downgrade of the US credit outlook. This abysmal market sentiment coupled with a long-in-the-tooth trend, however, have contrarians calling for a dollar trend change.

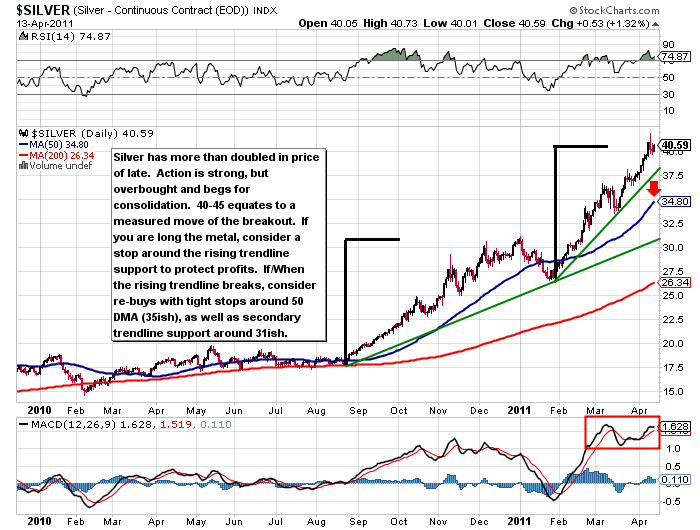

It’s everywhere. It is found in old U.S. currency coins, bullion bars, minted coins, jewelry, silverware, photographic materials, electronics, etc… The price and popularity of Silver has skyrocketed. A simple silver coin search on Craigslist or eBay nets a feeling like the 1980’s baseball card fad. Welcome to Tinseltown. And like most commodities, many view silver’s fortunes as being tied to dollar weakness and market crises. So watch closely, because apparently there are only two options on the table: The end of the dollar as we know it or a trend change. Moreover, the fortunes of the dollar will no doubt alter Silver’s near term and mid term prospects.

For clues on how this may play out, we’ll need to take a closer look at the long and short term technical set-ups. With that, let’s dive into this week’s annotated charts, starting with a long term view of Silver vs. The Dollar.

At first glance, it is clear that prolonged dollar weakness and easy money have allowed silver to take flight. But, one question that begs to be answered is why silver waited so long to break out. Is the recent parabolic run trying to tell us something? Could it be a warning sign of a coming dollar mini panic? Although this would briefly fulfill the prophesy of dollar doomsayers, it would also likely assist contrarians in marking a long term trend change… a trend change that would finally reward savers. And finally assist in correcting and consolidating silver’s price gains.

In the short term, both silver and the dollar have risks, but for different reasons. The chief concern for silver is the correlation between parabolic price action and unhappy endings, while technical and sentiment issues dog the dollar.

However this plays out, one thing is for certain: Market trends do change. It’s just a matter of when and from what level. And after 25 years of downtrend, maybe the dollar is nearing its turn. Could be a “U” or an “L” turn, but a turn nonetheless. And not to worry metalheads, a period of correction and consolidation will offer an opportunity to add to the collection. For there is a feeling in the air that the silver fad is here to stay. Have a good week.

Previously published as a blog by Minyanville.

—————————————————————-

Your comments and emails are welcome. Readers can contact me directly at andrew@seeitmarket.com or follow me on Twitter on @andrewnyquist. Thank you.

No positions in any of the securities mentioned at time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.