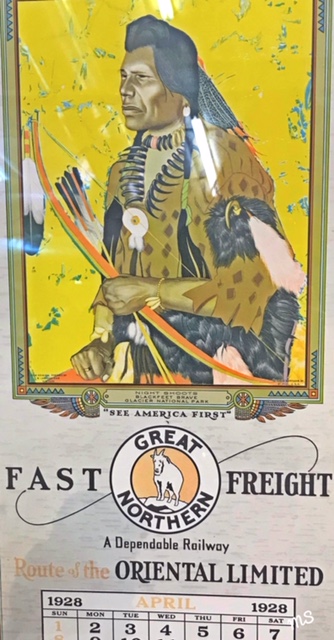

This is one of a collection of five in the Great Northern Railway calendars from 1928.

The calendars feature the artwork of Winold Reiss, who worked extensively with the Blackfeet Indians in the early 1900’s.

I found it at a flea market.

I like the “See America First” quote, that the year is 1928, and that the “Dependable Railway” runs on the Oriental Limited.

This calendar reminds me of some present-day market themes.

The populist movement.

The year before the crash.

The irony of featuring American-Indians, who lost even more of their territory because of the railroads.

And an Oriental theme, given two current pieces of news, trade talks and the impending Chinese New Year.

And an Oriental theme, given two current pieces of news, trade talks and the impending Chinese New Year.

The relevance to the Daily?

It offers me a fun way to look at the Transportation Sector (IYT).

This FAANG rally has been impressive.

However, it is relatively meaningless for the overall U.S. economy.

Transportation IYT, is a key member of the economic Modern Family of stock market ETFs.

Without a strong transportation sector, investors should have concerns.

Maybe or maybe not 1928 concerns, but concerns.

Why?

Over last weekend, I featured that IYT (among other sectors) had an inside week. The high that it had to clear was 180.34.

Whether it clears intraday or even on a daily close is not as meaningful as where it closes by the end of day Friday.

If it fails to close above 180.34, it fails 2 critical technical areas. The outside week high and a weekly exponential moving average.

A close above, bulls can remain comfortable.

However, a close below will serve as a cautionary tale, regardless of Facebook and Apple’s strong earnings.

S&P 500 (SPY) – 266.70 the top of the outside week high, is now the pivotal support. 271-272.65 is the overhead resistance.

Russell 2000 (IWM) – 147.54-147.92 is now the pivotal support to hold.

Dow Jones Industrials (DIA) – 248.55 now pivotal area with the 200 DMA at 249.82

Nasdaq (QQQ) – 166 is the outside week high now support to hold. 170.15 the overhead resistance.

KRE (Regional Banks) – 53.00 broke so we now see it as resistance to clear with 51 major support to hold.

SMH (Semiconductors) – 97.30 resistance. 93.50 pivotal and 92 support

IYT (Transportation) – 180.34 is the outside week candle high that must hold.

IBB (Biotechnology) – 110 resistance with 106.00 support

XRT (Retail) – You should watch this – cannot clear the 200-WMA-having a second inside week thus far, under the 10-DMA and, if fails 43.00-43.30 soon, a sign that demand for goods is less than the supply of them

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.