The stock market was narrowly lower last week while Crude Oil prices spiked, along with the United States Oil Fund ETF (USO) spiked.

Investors are taking a moment to pause and digest news of the attack on a Saudi Arabian oil facility and prospective troop deployment.

I pointed to a probable “pause” in the S&P 500 Index and broader stock market in my latest Market Week show.

Only a group with sophisticated technical skills could have executed the attack on the Abqaiq oil processing plant in Saudi Arabia.

Some have speculated it was Iran.

In any case, the Saudis are now determining when they can bring the facility back to full operations.

Crude Oil Futures (CL) Daily Chart

Turning to the markets, our approach to technical analysis uses market cycles to project price action. On the chart above, we can see that oil spiked into the rising phase of its current cycle but quickly transitioned into the declining or corrective phase.

Next week, we project choppy price action for crude oil, possibly continuing to ease into its support zone. Our target is $57.50, and after that, we are looking for another spike higher.

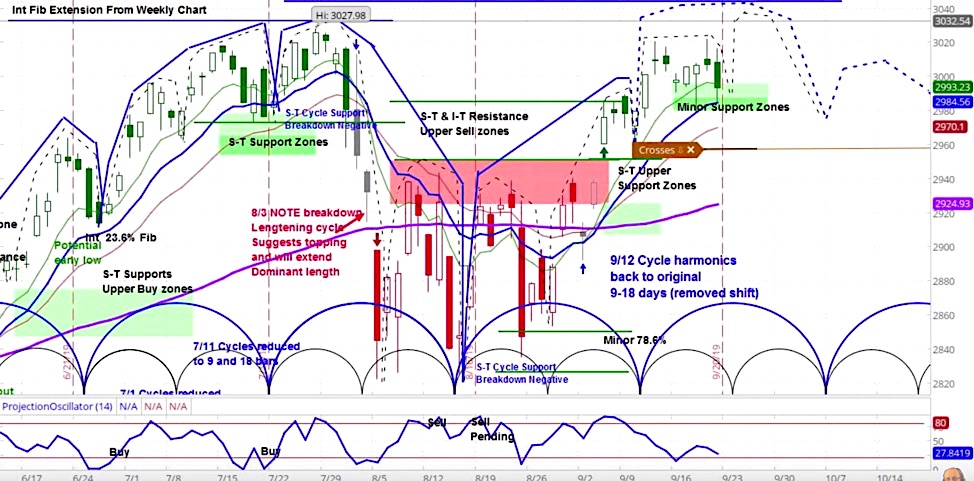

S&P 500 (SPX) Daily Chart

The attack did not have a similar impact on the stock market, with the S&P 500 (SPX) chopping around last week. Looking forward, we expect a dip early in the week and then recover into the rising phase of the new minor cycle. Given its positive momentum, this could possibly lead the market to a new all time high, as shown on the chart above.

Despite what we believe could be a test of market records, our analysis shows risks are growing. October could bring what has been a historically tough month for the stock market, with a sinking spell that could be painful to investors.

For a more detailed analysis of both of these charts, check out the latest episode of the askSlim Market Week show.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.