The post-election rally continued last week with the S&P 500 Index (INDEXSP:.INX) gaining nearly 1.00%. The Russell 2000 (INDEXRUSSELL:RUT), which is home to small-cap stocks, did much better soaring 2.59%. And this small cap leadership has give the market reason for optimism.

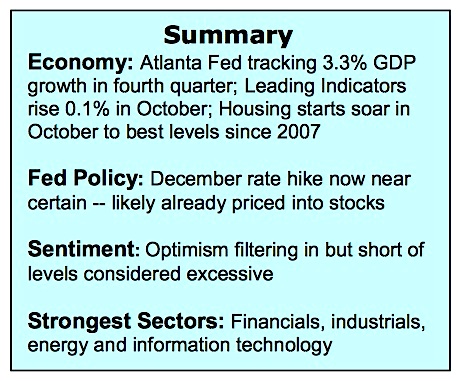

The bullish action in the equity markets is the result of new-found optimism that fiscal policy will achieve what monetary policy failed to deliver which is sustainable GDP growth above 3.00%. A shift in market psychology is readily seen in the flow-of-funds statistics that show massive outflows from bond funds into equity exchange traded funds. Data from Trimtabs Investment Research shows a whopping $44 billion moved into stock funds since the election while $18 billion exited bond funds. Although this dramatic shift in asset allocation could be overdone very near term, the fact that investors have been favoring bond and bond equivalents for several years suggests the reallocating could be in the early stages.

Small-cap stocks have performed much better than large-caps stocks since November 8, with the Russell 2000 Index rising more than 10% versus 2.00% for the S&P 500 Index. We anticipate that this small cap leadership will continue given small-sized companies will benefit most from proposed lower corporate tax rates and less regulation.

Furthermore, the strong dollar that hinders large multinationals that depend on exports, is a benefit to many smaller-sized companies that are largely importers of raw materials and goods. Stocks enter the new week in an overbought condition. This could result in increased volatility but the surge in volume and upside momentum favors additional gains into year end.

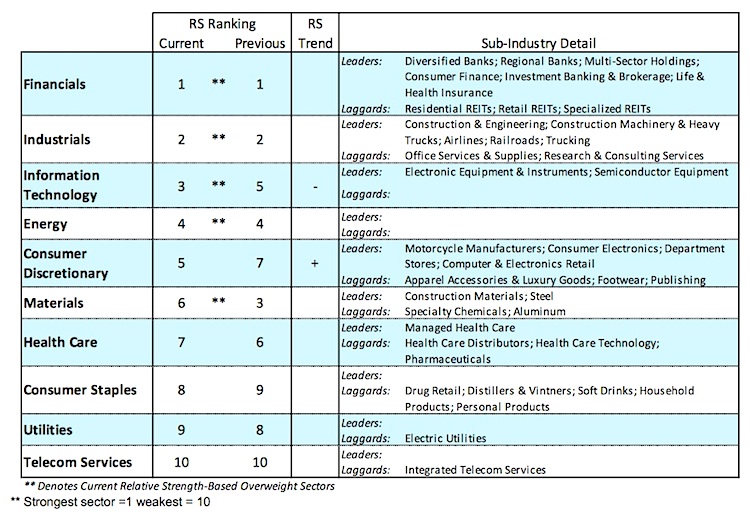

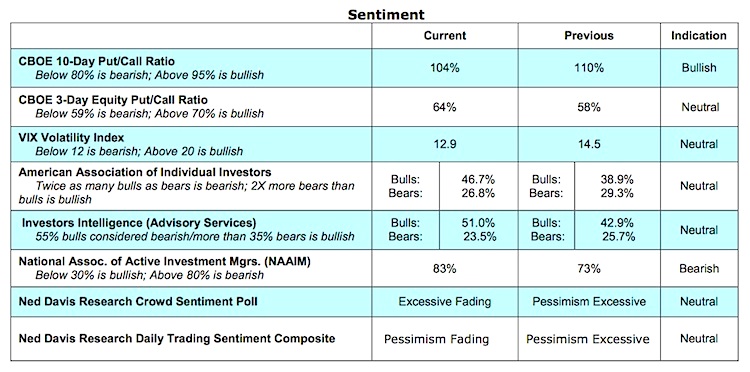

The technical condition of the stock market has improved into the rally. Most of the leading indices are hitting new highs with only the Dow Transports lagging. Improving breadth is seen in a rising percentage of the industry groups within the S&P 500 that are in uptrends. Last week 63% of the 100 industry groups were in uptrends versus 50% two weeks ago. In addition, the NASDAQ and NYSE witnessed a significant increase in the number of issues hitting new 52-week highs. It should be noted that the new low list also expanded due primarily to bond-related issues as rates jumped along the curve. Investor sentiment, that was decidedly bearish two weeks ago, shifted toward optimism last week. The Investors Intelligence (II) data and the survey from the American Association of Individual Investors (AAII) showed a significant increase in the bullish camp. This is viewed as a tailwind for stocks until such time that optimism becomes excessive or extreme. Evidence of this would be a jump in bulls in the II data above 56% and an increase in bulls in the AAII report above 50%.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.