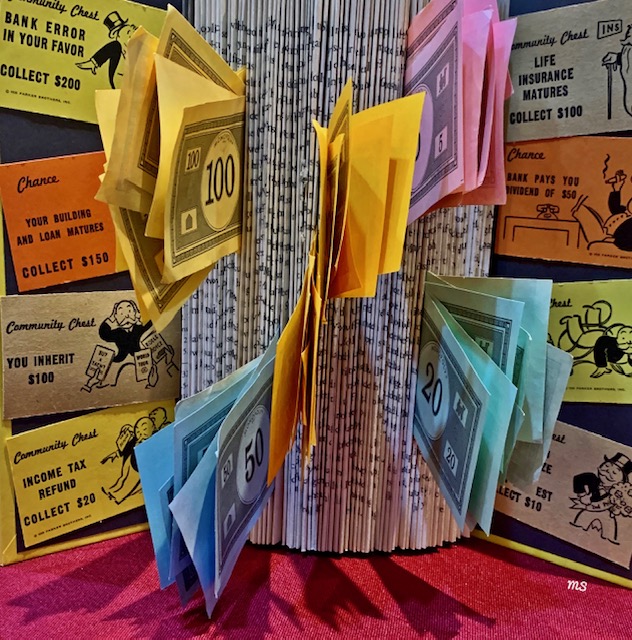

One thing for sure, I have talked about the Russell 2000 Index and ETF (IWM) enough for you all to know, that we really wanted to see this index move across the monopoly board.

Over the weekend I wrote,

“With an inside week under its (IWM) scarf, the range to watch is 157.19-159.88.”

And so, within the first 30 minutes of the trading day, IWM did indeed clear 159.88.

As the biggest percentage gainer of the 4 stock market indices, the Russell 2000 closed up over 2.0%.

This of course, helped spark the rest of the Modern Family of ETFs.

Biotechnology IBB, which we focused on as last week’s superstar, today cleared the former 2019 high at 116.25 and rose over 2.35%.

Granny Retail XRT rose over 1.6%, Sister Semiconductors SMH rose by over 2.4%, Transportation IYT by 1.45% and Regional Banks by 1.0%.

The real superstars though, continue to be the S&P 500 and the NASDAQ 100, both of which made new all-time highs.

Do you know how much the Russell 2000 IWM must rise for us to see new all-time highs?

173.39 is the all-time high print in the Russell 2000, made during the last week of August 2018.

Even with today’s run, IWM remains 15% from its ATH.

If IWM can accomplish a move like that, where does that put the S&P 500?

Where might the rest of the Family be trading?

And finally, if it doesn’t get there, how fast will our monopoly players go directly to jail?

15% higher for the S&P 500 puts that index over 35,000.

As far as the rest of the Family, they have not all traded in tandem since 2015.

So first, we need to see all of them move relatively in unison.

And, if I had to pick one sector to watch, it’s Transportation IYT. IYT’s ATH is 209.43 or 16% from current levels.

In other words, over the next few months, the 2 major “inside” of the market barometers, have a lot more catching up to do.

What might we expect if neither IWM or IYT rally by 15-16%, or worse, start selling off?

Think Monopoly.

There are common pitfalls in the game. The number one pitfall

is buying the Railroads. Interestingly, the cost of buying all four railroads, exceed any gains.

S&P 500 (SPY) 313.37 the new all time high. That makes 311 the new pivotal price support.

Russell 2000 (IWM) 160.46 is now the new pivotal price support with 162.74 next price resistance.

Dow Jones Industrials (DIA) The all-time high is at 280.84. So close today at 280.81. 279 is price support.

Nasdaq (QQQ) All-time highs at 204.26. The new pivotal price support is 202.40

KRE (Regional Banks) Closed over 56, which now must hold.

SMH (Semiconductors) 135.26 is the all-time high. 133 is pivotal support.

IYT (Transportation) 195 is price support now with 198.26 and then 200 as price resistance.

IBB (Biotechnology) 116 is now price support with 120-123 as price resistance. ALL time here was made in 2015.

XRT (Retail) 44 is price support and 45.41 price resistance.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.