A couple weeks back, I wrote about the Russell 2000 Index and why it was important for investors to be monitoring it closely in the early going of 2016.

In short, the Russell 2000 small caps index was testing a key support level.

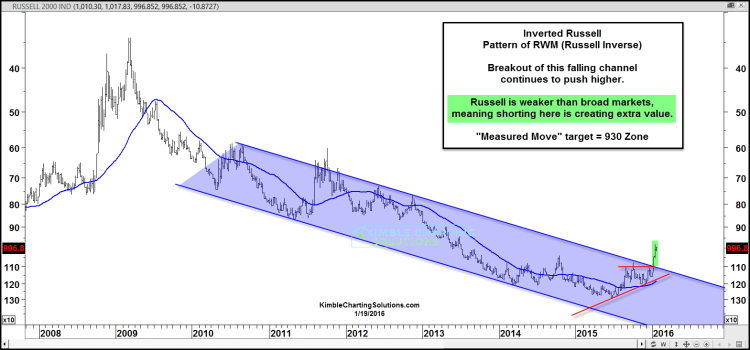

To make the chart interesting (and to reduce investor bias), I inverted the Russell 2000 chart to highlight the importance of this price test/level.

Well, two weeks later, the verdict is in. The Russell 2000 lost that level and has been falling to lower prices since then (and much faster than the other indices in 2016). In my prior post, I also mentioned that a broken trend line could lead to 930, which is the measured move price target (keep in mind the level is referenced as resistance due to our use of an inverted chart):

“If small caps take out this resistance at point (1), the measured move suggests the index could reach the 930 level.”

The small caps index has been much weaker than its fellow broad stock market indices.

Below is an updated Russell 2000 Index chart (inverted once again!).

Since losing this key price level, the Russell 2000 has flushed to lower prices, providing shorts with huge gains. Thanks for reading and stay disciplined.

Twitter: @KimbleCharting

The author does not have a position in the mentioned security at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.