The Russell 2000 Small-Cap Index is presently running into a confluence of key resistance points. Can the Russell 2000 Index rally past this level?

We’ve talked quite a bit about the importance of the rotation that we’ve seen in the stock market since the rally kicked off in February. Specifically, previously lagging areas of the market picked up the slack in early April when the rally was looking tired.

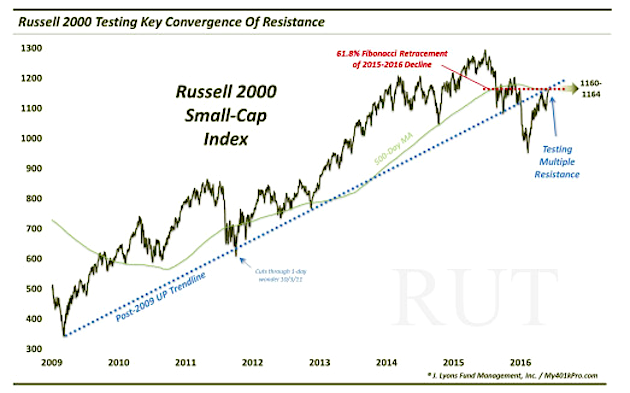

Well, the same rotation trend has continued amid the bounce off of the May lows of a few weeks ago. Among the leaders during this current bounce have been small-cap stocks (riding a nice Russell 2000 Index rally). However, they are currently up against a stiff test of resistance as today’s Chart Of The Day of the Russell 2000 Small-Cap Index (RUT) reveals.

On the positive side, the RUT has clearly surpassed its April high of 1154.15. However, there are multiple lines of resistance just above there, which the index is presently bumping into.

Russell 2000 Index Chart

The Russell 2000 Index rally has been impressive but it will need to break out decisively above a confluence of resistance. The potential levels of resistance near here include the following big 3:

- The underside of the post-2009 Up trendline (broken on January 6), currently ~1161

- The 61.8% Fibonacci Retracement of the June 2015-February 2016 decline ~1162

- The 500-day (~100-week) simple moving average, currently ~1164

Each of these levels represent considerable hurdles on their own. The fact that they all converge here makes the area all the more challenging.

On the other side of that coin, though, is opportunity – should the RUT break through the 1160-1164 area. That development would open up further – potentially significant – upside. On a preliminary basis, the index may be in the process of doing just that as a late-day rally saw the RUT accelerate to the upside upon breaking above 1164. It was able to close the day at 1170.58.

Does that mean that the bulls have passed the test? The way modern markets work, it is much too soon for them to declare victory, in our view. There needs to be follow-through by the index lest we witness another false breakout. So let’s just say the test isn’t over yet. However, given the close above the aforementioned key resistance, the bulls have at least aced the first portion of the test going into the essay.

Thanks for reading.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

More from Dana: Gold Volatility Expectations On The Decline

Twitter: @JLyonsFundMgmt

Read more from Dana’s Tumblr Blog

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.