The current inexorable stock market rally has folks wondering where it will at least take a breather, if not put the breaks on.

The small-cap segment of the market has been particularly relentless, with the Russell 2000 Index (INDEXRUSSELL:RUT) up 8 of the last 9 days, 15 of the last 19 and 24 of the last 31.

Based on one piece of charting analysis, however, it is now reaching a level that may finally produce at least a pause in its breathless advance.

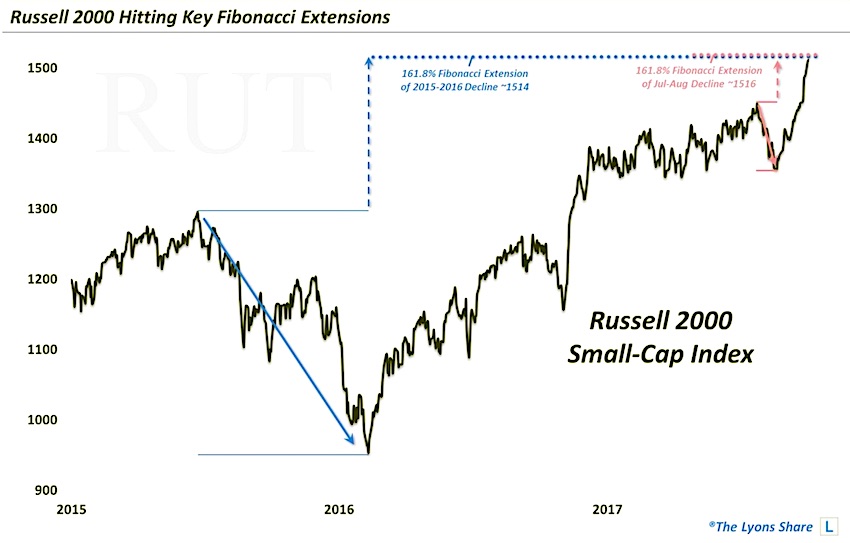

We’ve discussed Fibonacci Extensions in the past on several occasions. As a refresher, these Extensions mark various magnitudes of potential price support or resistance following range breaks, based upon the Fibonacci mathematical sequence. The 161.8% is perhaps the most important Extension, based on the sequence. It signifies a move of 61.8% of the former range – out of the range.

For example, in this case, we see the Russell 2000 now reaching the vicinity of the 161.8% Fibonacci Extensions of the following noteworthy recent declines. That is, the RUT is now above the top of the declines by a margin equal to approximately 61.8% of the respective ranges of the declines:

- The 161.8% Fibonacci Extension of the 2015-2016 Decline ~1514

- The 161.8% Fibonacci Extension of the recent July-August Decline ~1516

Here’s what it looks like on the chart.

So, will the small-cap rally put on the brakes here? There is no guarantee that it will. However, this is as good a spot as any, in our view, for the Russell 2000 to at least take a temporary respite – particularly given the multiple levels aligned in the same vicinity.

Do we think the rally is over? No – it just may be a bit extended in the near-term, though.

Twitter: @JLyonsFundMgmt

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.