Evidence continues to build suggesting that stocks have shifted into a bear market. In that environment, traders often find it tempting to look for the “home run” short position – something we caution our subscribers not to expect. Going forward, it appears likely that the stock market indices can continue to decline until about 2018 or 2019, but they may do so in a choppy fashion.

Therefore, the best trading strategy will be to look for good entries and exits as price approaches potential price targets rather than to look for a home run (looking for the market to crash).

The next such downward trade may be nearby. In this post, we show where a turn might occur in the Russell 2000 ETF (IWM), the fund that tracks the well known index of small caps stocks, the Russell 2000.

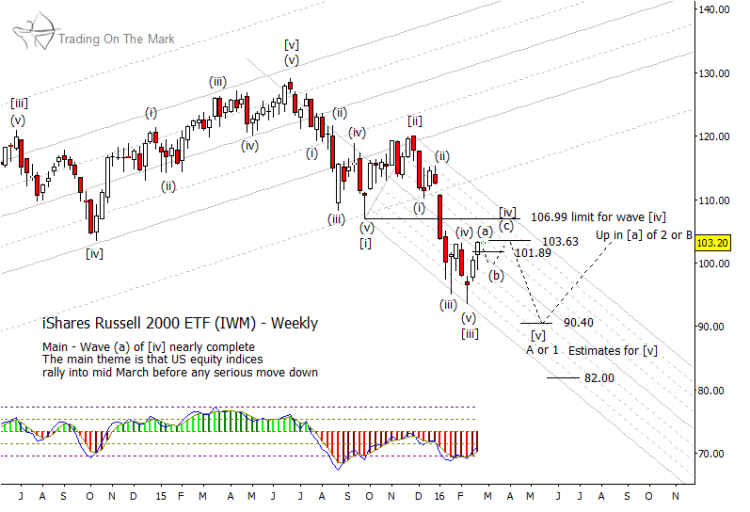

Our Elliott wave count has evolved during the three weeks since our last post on this topic, and the projections for turns and price targets on the Russell 2000 ETF are slightly different.

In our primary scenario, the decline from mid-2015 appears to be part of an impulsive five-wave series, which itself should be the start of an even larger decline. Currently, we are looking for the area where the downward fifth wave of the impulse should begin, and and 103.60 or just there above seems to fit the bill.

After price turns downward, we will be able to update the support price targets (areas) where traders might expect the next bounce. Sticking with our primary scenario that calls for a lower low sometime this spring. Areas near 90.4 and 82 can serve provisionally as price targets until additional information comes in.

It is not a certainty that IWM will make a new low this spring. There are scenarios in which price could make a higher low and then bounce out of the downward-sloping channel shown on the chart above. For that reason, it is especially important for those who are trading short to take protective steps to prevent losses if the market goes against them. Bring exit stops to “break even” relatively quickly.

Even if the trade works as planned, there can be dangers. Traders seeing a fast downward move can sometimes feel emboldened to stay entirely in a position even after primary price targets have been tested. In that situation, a quick bounce can erase all of a trader’s gains. Based on our current analysis, it will be helpful to trade this market with the expectation that it will be choppy rather than thinking it will simply move lower in a linear fashion.

The latest edition of our newsletter discusses an alternative scenario for the Russell 2000 ETF (IWM), as well as presenting a bigger-picture view of where the Dow Jones Industrial Average may be heading. You can gain access to our newsletter here!

Further Reading: “Biotech Stocks Look Ripe For A Countertrend Rally“

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.