Part One of this article showed how growing wealth inequality might pressure the Fed to taper QE and/or raise interest rates. Given the indirect market liquidity resulting from the Fed’s stimulus, a reduction is likely a headwind for many asset prices.

In this follow up we discuss another proverbial needle looking for asset bubbles; Financial Stability.

Financial “Stability” Blindness

Fed members are not as open about their desire for higher asset prices as general price inflation. Instead, they often cloak support for rising asset prices with the term financial stability. Based on many Fed statements, financial conditions are stable when equity prices are rising and unstable when falling.

The reality is financial stability, as it relates to markets, is based on valuations and liquidity, not the direction of prices. Markets are most stable when their prices fairly reflect fundamental conditions. As they stray from fair value, prices inherently become more unstable.

Today’s extremely high equity valuations and historically tight credit spreads are signs of bubbles. Unfortunately, most often, such periods are followed by market instability. Not only do price corrections roil investors, but they also hamper financial conditions across the economy.

The reason the Fed promotes higher asset prices is the so-called trickle-down effect. Effectively, they believe rising asset prices benefit economic activity and the welfare of the nation’s citizens. As we will discuss, such a policy is flawed. The Fed wants to boost economic growth with rising asset prices. But to do so today, they must ignore asset bubbles that are forming from excessive monetary policy. The cartoon below is a somewhat accurate portrayal of the flaws of trickle-down policies.

On May 5, 2021, Fed President Williams stated: “I don’t see those higher asset valuations, say, in the stock market or the housing market as being a significant risk for financial stability right now,”

“It’s really hard to spot bubbles with any confidence before they burst.”- Neel Kashkari Minneapolis Fed

Who Benefits From Trickle Down “Financial Stability”?

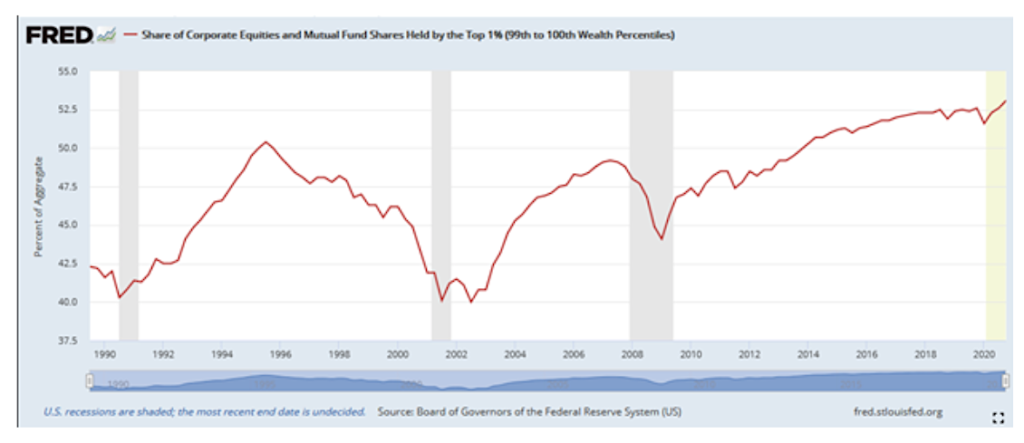

In addition to eventual financial instability resulting from asset bubbles, the other problem is they do not benefit all citizens equally. As shown below, the share of equity holdings by the top 1% has grown significantly in the last 20 years. Moreover, the last 20 years mark extended periods of excessive monetary stimulus.

The lowest income class has average expenditures of nearly $38,000 versus income after taxes of $25,000. This figure is skewed by a few wealthier people with low incomes and high savings. However, a large majority of households in this bucket must spend every dime they make. For the majority, this leaves them with near-zero to save and invest.

The highest income class only consumes 53% of their income on average. Accordingly, they are left with almost half of their income to save and invest.

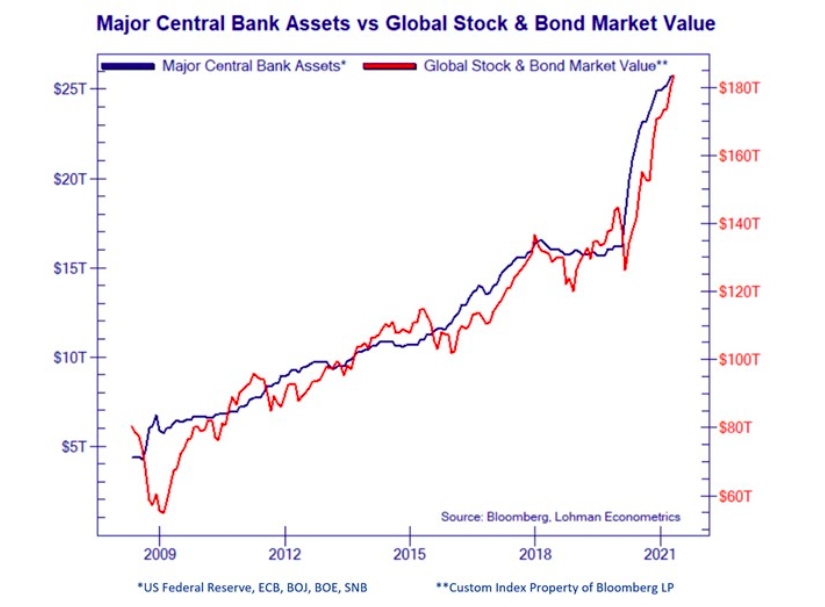

QE and historically low-interest rates greatly benefit asset prices. As a result, the wealthier benefit much more from rising asset prices than the poor. The graph below, courtesy of Lohman Econometrics, shows the correlation between global central bank assets and global asset values.

As we stated in part one, politicians wanting to win over voters will likely have to deal with the wealth inequality problem. One possible way for them to scapegoat the issue is to question the Fed on their financial stability policy.

Defining Excessive Policy

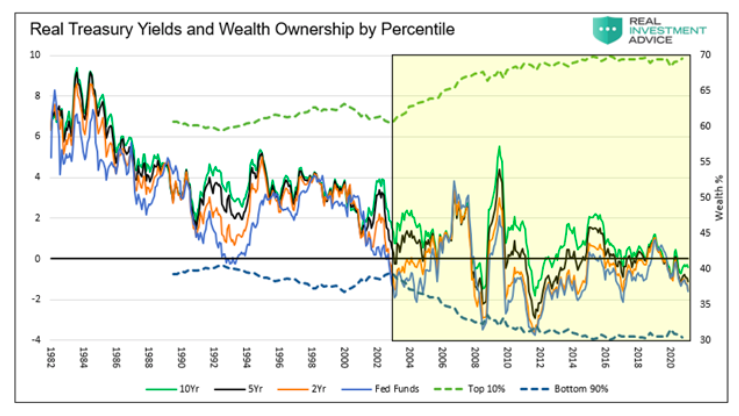

Investors should never accept a rate of interest below the rate of inflation. Such a condition called negative real yields is often due to an overly aggressive central bank.

The yellow shading in the graph below highlights negative real yields have been the norm for the better part of the last 15+ years. The chart also shows the percentage of wealth owned by the top 10% (green dotted line) accelerated during the negative real yield era. Their gains came at the expense of the bottom 90% (blue dotted line).

Rising House Prices

The Fed is purchasing $40 billion in mortgages a month. As a result, mortgage rates and spreads are at or near historic lows. The benefit of lower mortgage rates is greater affordability for buyers. While that helps everyone, low rates also drive up home prices. Per the Case-Shiller 20 City Composite Home Price Index, home prices are up nearly 17% since the Fed started buying mortgages in early 2020.

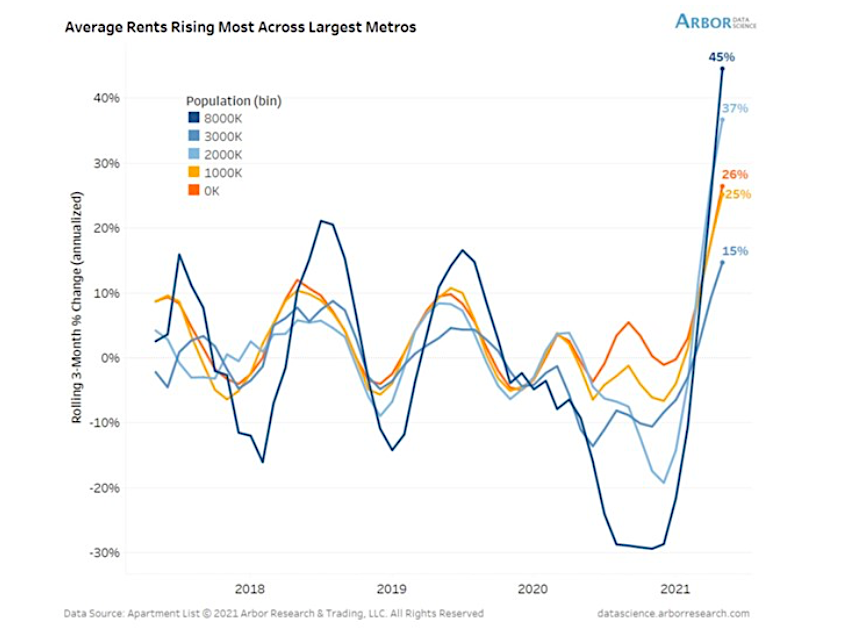

As an aside, higher prices often result in higher rent payments. As shown below, we are just starting to see rent prices pick up following the surge in home prices.

Who benefits more from rising home prices, the wealthy or the poor? Who tends to rent more, the wealthy or the poor? Fed policy directly supports the housing market, and its benefits are overwhelmingly bestowed upon the wealthy.

Jerome Powell acknowledged the surge in home prices in his latest press conference but quickly refuted the blame. Oddly, he had no intelligent answer for why the Fed is buying $40 billion worth of mortgages monthly and driving mortgage rates lower, ergo prices higher.

Tapering MBS QE

The pressure on the Fed to decrease their support of the mortgage market is heating up. Even the Fed seems to recognize it.

Boston Fed President Rosengren said, “the mortgage market probably doesn’t need as much support now.” Similar to comments from Dallas Fed President Kaplan, it seems Rosengren is indirectly pushing for a tapering of MBS-QE.

There is little doubt, more pressure on the Fed will arise from the media and politicians if home prices continue to soar. We would not be surprised if the Fed begins to taper MBS purchases as early as the June 15-16, 2021 FOMC meeting.

A Ray of Honesty at the Fed

The potential sources of financial instability are soaring real estate valuations and broad asset market valuations. On May 6, 2021, Fed Governor Lael Brainard, the board’s financial stability committee head, spoke with brutal honesty about financial markets and financial stability. To wit:

“Vulnerabilities associated with elevated risk appetite are rising.” “The combination of stretched valuation with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event.”

In no uncertain words, Brainard cautions financial stability is at risk. Since her comments, there has been nary a whisper from Fed members on financial stability.

Summary- The View from the Fed

The Fed did not understand the escalating level of financial instability leading to the Great Depression, Dot-Com bust (2000), Financial Crisis (2008), and other more minor financial crises. Do you think they will this time?

Unlike those periods, rising wealth inequality resulting from surging asset prices is making front-page news. The media is picking up on inequality which will undoubtedly lead politicians to act. The Fed may likely be in their sightlines. As discussed in Part One, rising wealth inequality, driven by inflation and/or “financial stability,” are potential needles waiting to pop the Fed-driven asset bubbles.

We end with a quote from Stanley Druckenmiller- “I don’t think there’s been any greater engine of inequality than the Federal Reserve Bank of the United States the last 11 years.”

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.