My family and I just went to Dollywood yesterday and I greatly enjoyed riding the roller coasters with my kids. The plunges, twists and turns are exhilirating and make me feel alive. But as I looked around at the other people waiting in line, I didn’t see too many retirees. It seems roller coasters are a ‘younger’ person’s pursuit. And, based on how sore I am this morning, I understand why!

The last market commentary included a picture of a waterfall event in the S&P 500 index that occurred on December 12, 2014. I used that example to illustrate the risk then present in equities and how the volume (number of shares traded) is much higher on the down moves than the up moves. In that comentary, I said that I continue to favor U.S. Treasury Bonds (TLT, EDV) over equities at this time and that I’m perfectly comfortable avoiding equities.

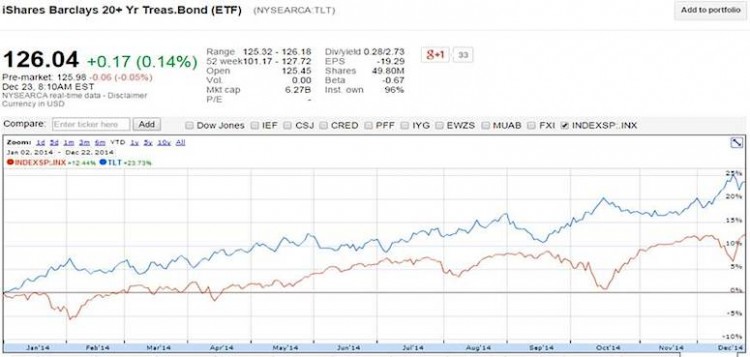

Since then, the equity markets have rallied back to all time highs! Check out the chart on the right highlighting decline and subsequent recovery. You can see that the decline in the S&P 500 Index (SPX – Quote) started on December 8th and bottomed out on December 16th.

Since then, the equity markets have rallied back to all time highs! Check out the chart on the right highlighting decline and subsequent recovery. You can see that the decline in the S&P 500 Index (SPX – Quote) started on December 8th and bottomed out on December 16th.

The decline was right at 5%. From there it shot off the bottom like a rocket and recovered 7 days of losses in just 3 sessions. The rally also included one of the strongest 2 day rallies we’ve seen in years, recovering 5.3% in 3 days.

For those of you keeping score, the S&P 500 Index is now up year-to-date 12.45% as of last night (12/21). The Russell 2000 growth index is up 3.28%.

Meanwhile, the boring bond trade (TLT – iShares 20+ Year Treasury Bond) that I have been advocating for months and months is up over 20 percent year-to-date. Yes, you are reading that correct: the ‘boring’ 20+ Yr U. S. Treasury Bond index is outperforming the S&P 500!

Wall Street wants you to focus on growth, but if you are retired or near retirement like my clients, then you realize that your number one priority must be avoiding significant losses. Once you are retired and are no longer contributing to your retirement funds then the greatest risk you face is losing 20% or more of what has taken you years to accumulate. In other words, the risk associated with earning a return matters.

So let’s take a look a why I am currently favoring ‘boring’ bonds. In the chart below I am comparing the S&P 500 index (red line) with the iShares Barclays 20+ Yr Treasury Bond (TLT) (blue line) over a year-to-date timeframe.

Notice that since the beginning of the year that red line dropped below the 0% return level at least 3 times before it gathered some momentum in the middle of April. Then it retreated back in October and barely remained in positive territory before surging to new highs. Then it lost over 5% in early December and recovered in 3 days.

The ‘ride’ associated with the S&P 500 index this year feels a lot like the ThunderHead roller coaster that my kids and I rode several times yesterday. (that’s not us, but it is the same roller coaster). I don’t think that’s what my client’s are looking for when it comes to investing their nest egg—the money that will determine their quality of lifestyle and their ability to remain retired!

On the other hand, the blue line representing the bonds is much more appealing to them. Notice that it moved into positive territory right at the start of the year and never once approached the 0% return line again. Also notice that it seemed to surge when the stock market plunged while maintaining its gains when the stock market recovered.

I am not saying that retirees should only be invested in bonds. I AM saying that it is about RISK-ADJUSTED RETURNS. Risk adjusted means taking into account the ups and downs of the journey.

Let me be clear—I am an equity investor and had over 70 stock positions just months ago, but in my opinion the risk associated with equities right now does not make sense to me. Based on my research and probability model, I feel that bonds provide a better risk-adjusted return right now. All that may change over the coming weeks or months and as the data and the risk metrics change, so will what I invest in. Thanks for reading.

Follow Jeff on Twitter: @JeffVoudrie

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.