By Alex Salomon

By Alex Salomon

If you have been reading seeitmarket.com articles since at least September, you probably read several columns from different commentators all pointing out to the same “advice”: Fall was a cooler Season to be a short or medium term Apple, Inc (AAPL) investor and it was wise to book profits. The warnings came from a wide array of writers and proved prescient.

If you are new to seeitmarket.com, it is never too late to get in the groove of things and get some “Apple fix”!

The first thing, the most important thing I would like to point out, is that investors can never lose sight of their own time frame. Your time frame is just that, and yet, so paramount: it is YOURS. So when you read or hear, currently on a daily basis, that Apple is a broken stock, just remember: it is broken on a daily chart, even on a weekly chart, yet on a monthly or higher frame, if you have owned and added to Apple for more than a CNBC minute, then your time frame points out to a perfectly fine technical chart, just a healthy correction.

I insist so frequently on tuning out the noise as a fundamental rule for trading. It applies to personal time frames, to personal stress levels.

If you are a medium-term holder in AAPL, things are dicey. If you are a long-term holder, things are still healthy (for now).

It does not mean it will not get dicey for long-term holders as well, but for the time being, it is a pause on a money machine!

The second thing, and almost equally important, is that a broken stock chart is different from a broken company. Frequently, they coincide. But there are exceptions, and for the time being, applying objective metrics of growth, market share, positioning, cash reserves, Apple is not a broken company. It may or not be slowing, it may or not be losing an edge, but on objective metrics, all other things being compared to other companies, it remains impressive.

Thirdly, also, please keep in mind: we really do not know a thing about what Apple stock will do! No matter how you slice the fruit, it remains guesses and conjectures!

A friend and I were talking on Friday, and no one knows whether Apple will soon pull a Facebook rip (from $19 to $28, when most commentators were calling for $19 to $15 and lower). We just don’t know.

It took 15 days for Facebook to do the inconceivable: rip 50% (November 16 to December 1). You will not find a single column about Apple being able to rip from $500 to $750 in the next 15 days, but the truth remains: no one knows. It could crater to $400 or slash through all guesses and expectations. Just that: guesses and expectations.

The only clear part of the equation? Apple is expected to report earnings on January 22, 2013 and they could be the catalyst for a strong movement.

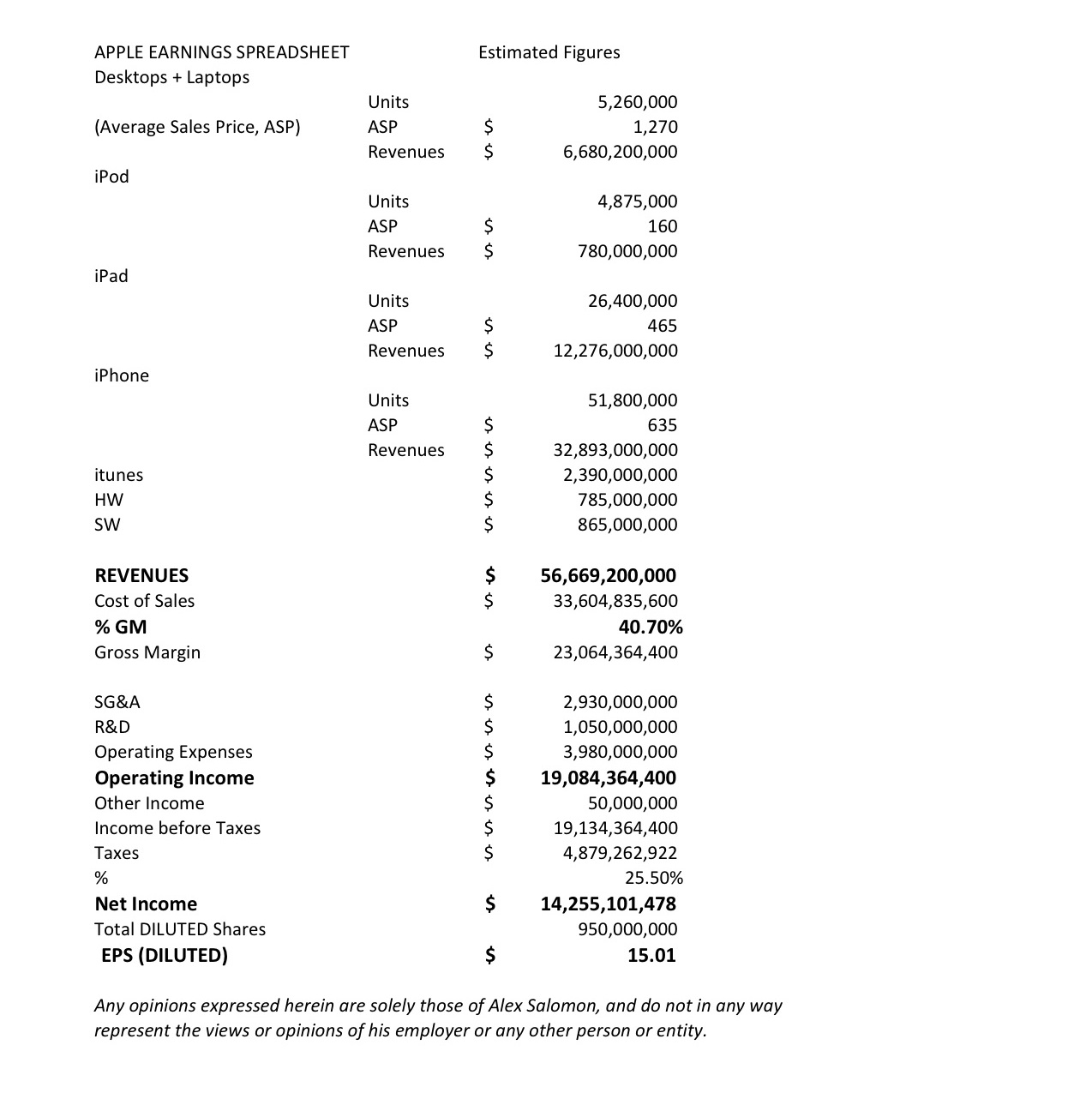

In a latter column, I will build a case for my expected price by January 31, 2013 (hint? Higher than now). But in the meantime, I wanted to relay my thoughts about AAPL stock to readers, along with providing a spreadsheet modeling Apple’s upcoming earnings.

I will wrap up this column (let’s call it a preview) by saying that the estimates in the spreadsheet are my own; I will revisit them and dissect them in the near future; on aggregate, I truly believe it was a good thing that Apple corrected and rebalanced. It was healthy and could provide fuel to another strong run for equities. See spreadsheet below.

As always, trade safe, trade disciplined, and trade YOUR time frame!

Twitter: @alex__salomon @seeitmarket Facebook: See It Market

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of his employer or any other person or entity.