The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Reverse stock splits are trending once again, a sign of pessimism for corporate America

- Recent splits include: Churchill Downs, Blue Apron and Thomson Reuters

- Ahead of Q2 earnings season, traders might consider eyeing new stock split candidates, and what reverse vs. traditional splits might mean for the companies that announce them

High profile stock splits from Amazon, Alphabet and Tesla stole the headlines in 2022, and by comparison 2023 may seem a little light on that front, but don’t be fooled! With two weeks still left in the quarter, Q2 2023 is on pace for the highest number of split announcements since Q4 2020, albeit with none of those mega cap names that garner the most airtime.

As of June 15, 78 stock splits have been announced for the second quarter. If the last two weeks of Q2 bring five or more split announcements, that would propel it to the hottest quarter since 2016.

An Important Cue from Financial Execs

Stock splits are often used as a signaling mechanism by a firm’s management team, but what exactly is being signaled depends on the type of split being utilized. A traditional split, where shareholders receive additional shares, is typically done to lower a stock price that has gotten too high and increase liquidity, making it more accessible for new entrants. It tells the investing public that the company is confident that their stock will rise back to the pre-split level and is generally seen as a bullish signal by investors who in turn tend to take the stock higher. On the flipside, a reverse stock split is done to reduce the number of outstanding shares and thus increase the price of a stock that has fallen and is perhaps at risk of being delisted. This move is typically seen as bearish for the company, and the stock often moves lower as a result.

Reverse Splits Outpacing Traditional Splits Once Again

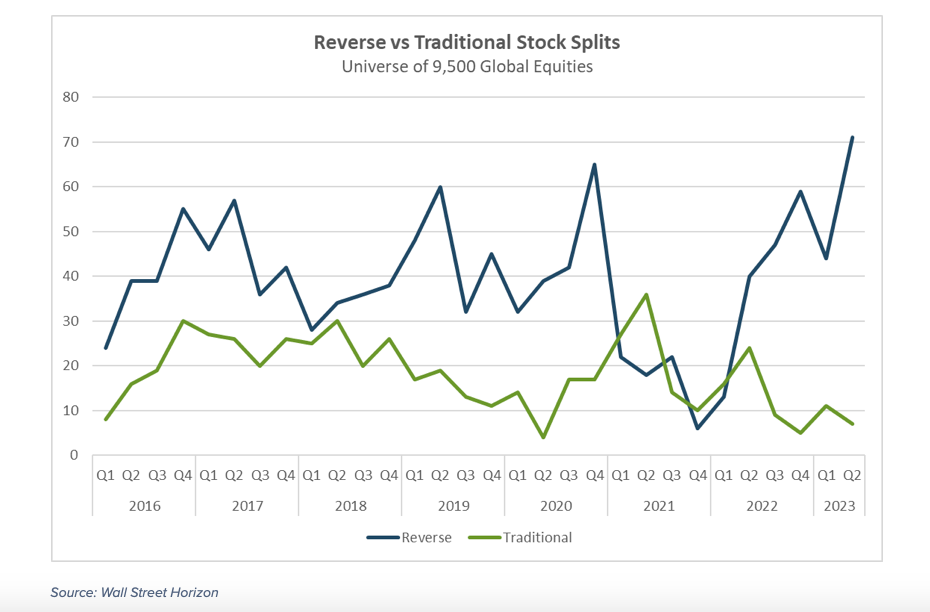

Wall Street Horizon data shows that after several quarters favoring traditional stock splits, reverse stock splits are once again more popular with publicly traded corporations. Across our coverage universe, which now spans more than 9,500 companies worldwide, reverse splits were more popular each quarter from 2016 through 2020. In the wake of the COVID-19 pandemic, as WFH and tech stocks surged, traditional splits stood in the limelight, with a greater number of those splits occurring in Q1, Q2 and Q4 2021 and Q1 2022. Since that time, reverse splits are on top once again, an interesting trend as corporations have struggled with headwinds ranging from inflation and higher interest rates to a tightening labor market and recession worries.

This read on splits activity shares a similar sentiment with our Late Earnings Report Index (LERI) which showed that CEO uncertainty during the Q1 earnings season was at its highest level in three quarters.

Chart 1: Reverse Splits Surged Compared to Traditional Splits in 2022 and H1 2023

Recent Splits

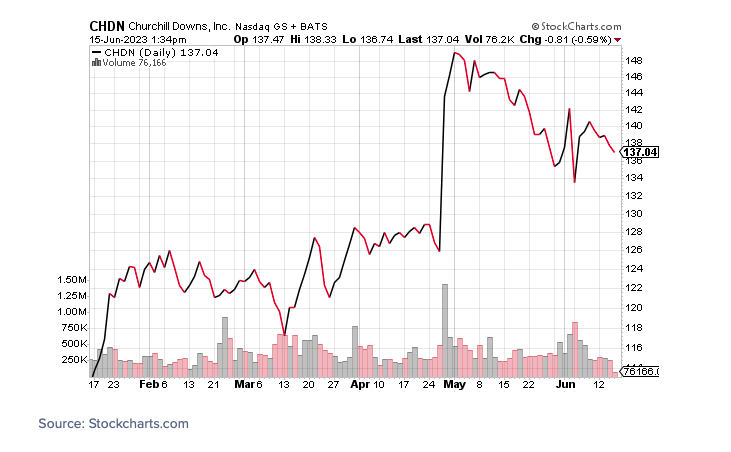

Churchill Downs (CHDN)

Now that the races that make up the Triple Crown officially ended with Belmont last weekend, let’s talk about Kentucky Derby parent company Churchill Downs. The publicly traded company operates several racetracks, casinos and an online gambling portal which is growing rapidly in the US. After announcing and approving a 2-for-1 split on April 25, 2023, shares have climbed nearly 8%, on pace with the S&P 500. The company reached an all-time high close of $145.94 on May 12, 2023.

Blue Apron (APRN)

It’s been a rough couple of years for meal-kit provider Blue Apron. After getting a boost in the wake of the COVID-19 pandemic as people were shut-in with more time to cook at home, the stock has more recently been sitting at all-time lows. In order to increase their price, APRN announced a reverse split on June 7, which sent the stock down dramatically by 30% in the days that followed. Since then the stock has recovered slightly, but is still down 18% from pre-split levels.

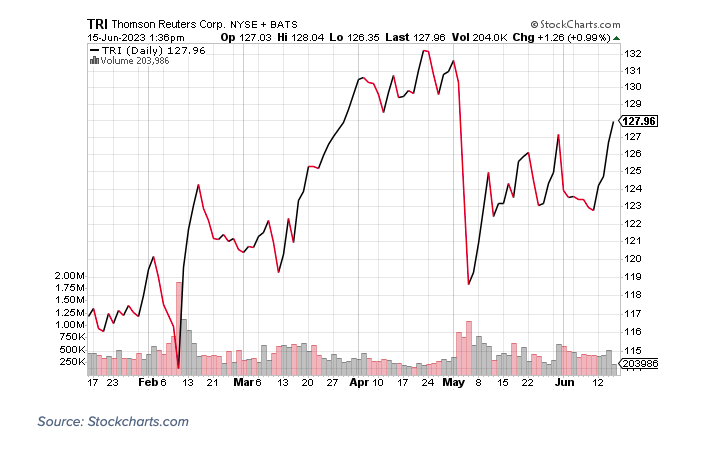

Thomson Reuters (TRI)

Canadian financial services giant, Thomson Reuters, announced on April 4 their intention to return $2.2B to shareholders through cash distribution and a reverse stock split from the sale of a portion of its shares in the London Stock Exchange Group. That decision was approved by shareholders on June 14. While reverse stock splits are usually accompanied by a downturn in the stock as mentioned above, investors instead took TRI higher, also encouraged by the news that Jefferies Financial Group had acquired a new position in TRI through the purchase of over 55,000 shares. Thomson Reuters shares were up roughly 3% the day after those announcements.

Conclusion

After a decade of low activity in the wake of The Great Recession, stock splits have been more widely used over the last several years. Traditional splits were briefly popular post-COVID, but reverse splits are once again preferred by public companies. Splits are one of many pieces of corporate body language that traders should pay close attention to. As Q2 earnings season begins in one month, investors should keep an eye out for potential stocks that might announce stock splits, or consider what it means for a specific company when they announce a reverse vs. traditional split. Paired with other bespoke metrics, this could reveal compelling information about the financial health of that company.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.