EURUSD & USDJPY: In Europe and Japan, easy monetary policy will be present for an extended period of time. The ECB and BOJ have made it clear that they will do “whatever it takes” to protect their countries from deflation. The ECB recently announced a set of new measures intended to support the Euro Zone. Equities have responded positively but the Euro has not. EURUSD is trading at 1.1389, up from a low of 1.0538 on Dec3’15. Japan is facing the same issue. Even though Japanese equities are up since oil bottomed on February 11th, the Yen is the strongest it has been since Q4 2014. It is unlikely EUR and JPY strength will persist for the same reasons mentioned in the previous paragraph.

World Reserve Currency

The US Dollar is the most widely held reserve currency in the world. It represented 64 percent of official foreign exchange reserves at the end of Q3’15. Countries tend to hold Dollar-denominated assets because they are relatively stable. Foreign central banks also use the USD as collateral for loans and to protect their currencies. For example, if the ECB feels as though the EUR is too strong, it can sell Euros to buy Dollars, thereby reducing the amount of USD in circulation. In theory, this would weaken the Euro.

The foreign exchange market also speaks to the structural importance of the USD. According to the BIS’ Triennial Central Bank Survey, “FX deals with the US Dollar on one side of the transaction represented 87% of all deals initiated in April 2013.”

Lastly, it is important to recognize that many commodities are priced in the US Dollar. Therefore, people who want to buy or sell them are required to hold Dollars.

These facts help to explain why demand for the US Dollar will persist. It is still the world reserve currency and that will not change in the near future.

Major Risks

The two major risks to the USD are a dovish Federal Reserve and slowing US economic growth.

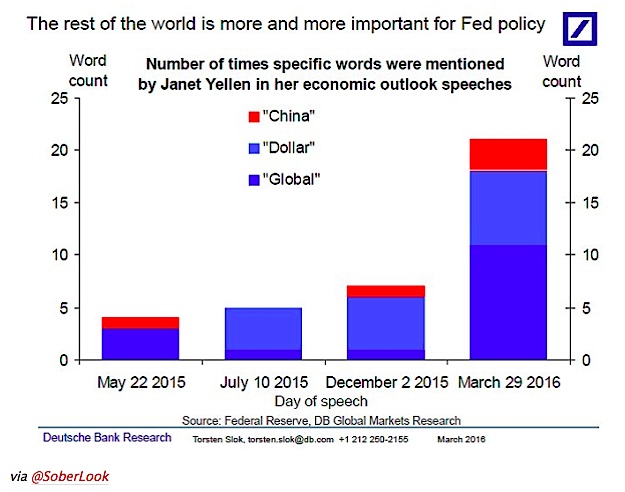

The Federal Reserve is the world’s central bank. Even though both of its mandates are domestic, the Fed has become increasingly concerned about the global economy. This is evident when we look at the rising number of times the Fed has mentioned key terms such as “Global” and “Dollar” in recent meetings.

A strong USD is good for US consumers and bad for commodities & exporters. The Federal Reserve is well aware of this relationship; however, it alone does not guarantee dovish monetary policy. Not long ago, market participants thought that 4 rate hikes in 2016 was a possibility. Now, it is unclear whether or not we will see 1. As of March 29, the probability of a hike in December was just 65%. The market is positioned for easy US monetary policy. As such, positive surprises from the US or negative surprises out of Europe or Japan will force investors to reassess their outlooks. If that happens then the Fed may turn more hawkish, which would be positive for the US Dollar.

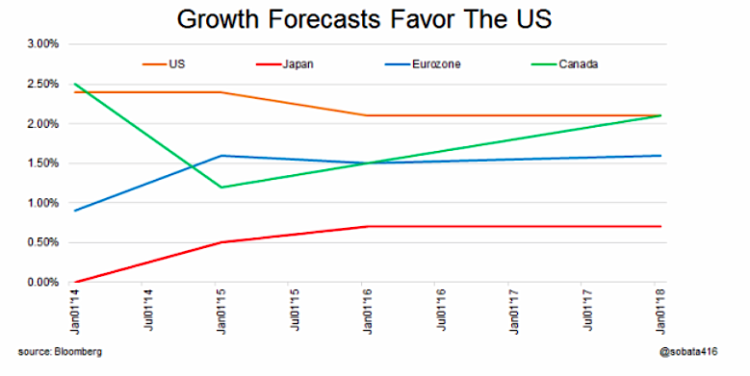

Slowing US Growth

The US economy continues to muddle along, backed by steady employment and consumption growth. The Eurozone is doing fine but most of its gains are attributable to Germany. Other major players such as France and Italy have not fared as well. Moreover, Japan continues to tread water. Canada has rebounded. That said, its economy is dependent on commodity prices, which may roll over in the short run.

All in all, the US still looks good on a relative basis. Especially versus developed market peers.

Return of the King

Rate differentials, relative economic strength and divergent monetary policies should provide support for the US Dollar. In addition, it will likely benefit from safe haven flows when global risks return to the headlines.

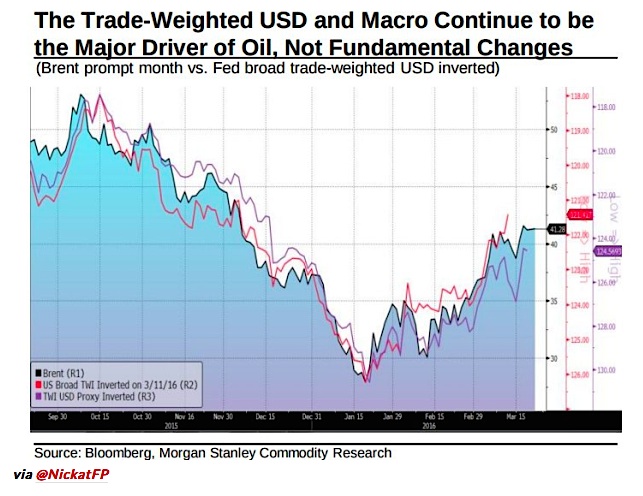

If the Dollar resumes its uptrend then commodities will suffer.

Oversupply in many industries such as oil, iron ore and coal remains an issue. On the demand side, China’s deceleration is not helping. The emerging markets are inextricably linked to commodities. If prices fall then the EMs will underperform.

There can only be one king…

Thanks for reading.

Twitter: @sobata416

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.