One of my more popular, virtue-signaling, tweets recently was about how I have maxed out my Roth IRA for 16 straight years, 457(b)/401(k) 8 straight years, and HSA 7 straight years.

I often say I am a single dude, with no house, no kids, a cheap car, and generally healthy who does not (yet) have to care for his parents.

So I have it easy. It is not a stretch for me to be a big-time saver & investor.

99% of Americans are not in as flexible of a situation as me. I get it.

So nobody wants to hear a hyper saver preach about the benefits of retirement accounts. But here it goes…

And it starts with planning.

I often provide Retirement Planning workshops to my colleagues, and have this hierarchy of savings strategy:

- 457(b) up to the match

- Use the Auto-Escalation Feature

- Pay off high interest rate debt (>6%)

- Hold 6-months of cash in a savings account for emergencies

- HSA– invest, and let it grow (save you receipts)

- Roth IRA

What you can do today is review your 401(k)/457(b) contribution amounts, and upwardly adjust those if your budget has become more flexible versus a year ago.

Check to see if your employer offers a matching feature to an HSA plan.

Open a Roth IRA at a low-cost (or no-cost) brokerage firm. Be aware that you have until April 15, 2020 to make 2019 IRA & HSA contributions, so time is still on your side.

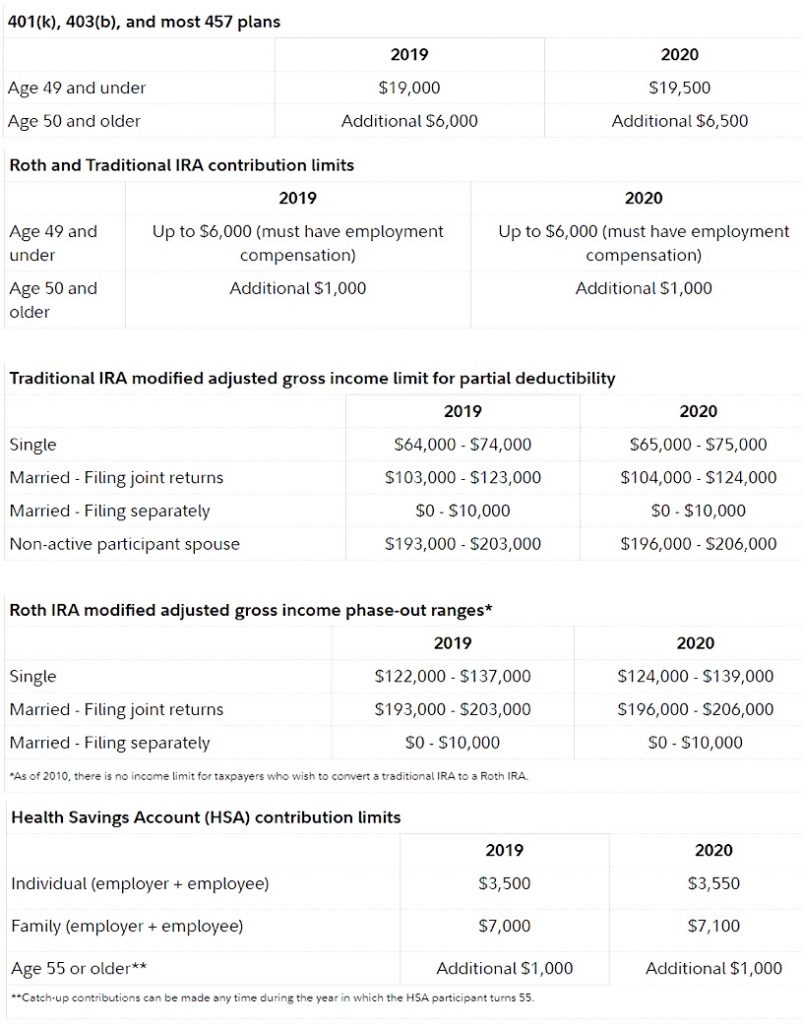

Those 50 and older have increased contribution limits of which to potentially take advantage, and if you are 55+ then you have an additional ‘catch-up’ HSA contribution at your disposal.

Below is a chart from Fidelity Investments detailing 2019 and 2020 limits to various retirement accounts. Notice most of the limits increase a little bit year-over-year, so there is opportunity to save more, but the higher priority action is that you get in the habit & process of saving something. Maxing out each account is often not a realistic goal.

I am a Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT). I have passed the coursework for the Certified Financial Planner (CFP) program. I look to leverage my skills in an hourly-fee consultant role for financial advisors – that could be portfolio analysis, planning, writing etc. Please reach out to me at mikeczaccardi@gmail.com for more information. Connect on Linkedin.

Twitter: @MikeZaccardi

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.