Despite a recent pullback, the US dollar has firmed up a bit in 2018. A strong US economy helps, as does a Federal reserve that continues to push on with interest rate hikes and quantitative tightening.

This combination is putting pressure on emerging market currencies.

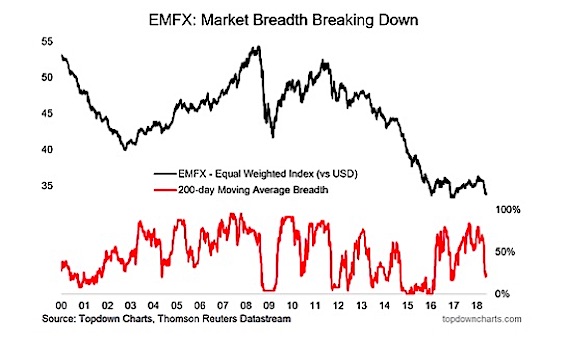

Today’s chart spotlight highlights my equal-weighted index of 25 emerging market currencies (vs the US dollar Index), and 200-day moving average breadth across those 25 countries.

As I mentioned over on my site:

“The key point is that the Topdown Charts EMFX index has made a sharp turn to the downside, and market breadth has completely broken down.”

Investors could argue that market breadth is getting oversold here. As well, valuations have pulled back from overvalued to neutral.

That said, I personally don’t care for the current risk-reward for EMFX at this point given the current global macro backdrop.

Emerging Markets Currency Spotlight

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.