Consider this a Public Service Announcement

Read everything Jess of Monday Morning Macro has written if you are serious about protecting your money.

She is “In The Zone” with this whole Repo Madness: ♥Far Too Little, Far Too Late ♣

Wait, what? You haven’t heard what’s going on in the plumbing of our great economy, markets and more specifically the recent US dollar funding crisis that occurred overnight?

$1.3 trillion in “excess reserves”, a Fed cutting rates, and the US financial system was urgently short $53 billion in immediate funding. – Zerohedge

In short, for the first time in more than a decade, the Federal Reserve Bank of New York stepped in to relieve pressures in the Repo market that were pushing short-term interest rates higher than the central bank wanted.

Strains developed Monday in short-term financing markets that suggested the central bank could lose control of its federal-funds rate, a benchmark that influences borrowing costs throughout the financial system. – WSJ

Here’s a Quick Primer on what is Repo and why we care all of a sudden: by @lebas_janney.

The freeze in overnight Fed lending was likely from the Treasury Sell-off last week that triggered the Growth-to-Value unwind I warned about, and now with Oil much higher, this puts at risk certain Hedge Funds from blowing up. Saudis liquidating positions to extract cash is another theory. Either way, NY Fed had to step in with EMERGENCY MEASURES.

“Bottom line: here’s what the market thinks of the Fed’s temporary solution… It’s a joke.” – @MacroMorning

Liquidity in funding markets only really matters when it’s not there. Jess already alerted us in August that 2yr Treasuries were at their cheapest levels in a generation – the Fed’s “worst case” scenario: Liquidity, Funding & the Gathering Storm.

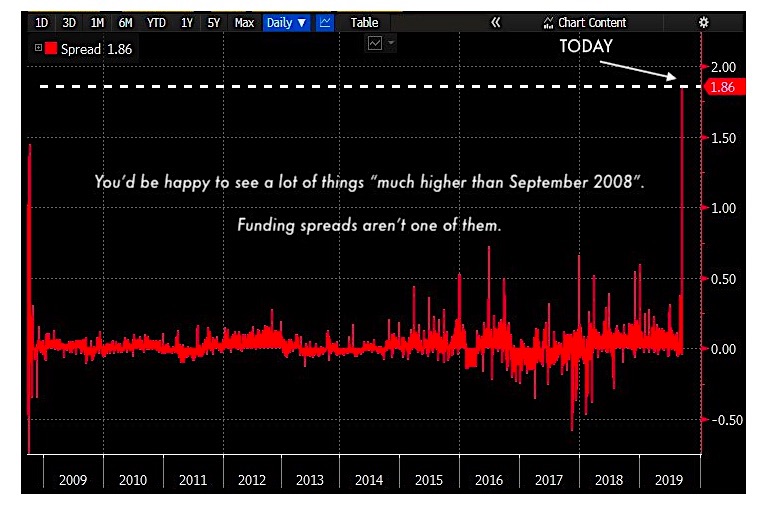

Soon after, we had a 3.5 standard deviation move in Bonds, an 8.5 standard deviation move from Momentum to Value rotation… the largest one-day surge in Oil Prices in history and then Funding Spreads exploded HIGHER than Sept 2008 – and ALL in the span of Two Weeks!

If this is not foreplay for a Flash Crash, I don’t know what is!

QE or Bust

In addition to the sudden liquidity drain that occurred, here is an overview of the current market conditions (not even considering the geopolitical risks) that equate to Financial Tightening as summarized by @RaoulGMI. No question: this is the perfect storm that can exacerbate the problems inherent in the faulty plumbing:

- We are in a Fed easing cycle

- ISM is below 50 and falling

- Yield Curve is inverted

- The bond market just tightened 50bps in the sell off

- The money markets have tightened to wipe out the coming 25bpc cut

- And will tighten much more as a HUGE $600bn of liquidity is drained (treasury funding debt/deficits)

- Oil prices tighten financial conditions

- The dollar is rising again, tightening conditions

- The US and China are engaged in economic warfare which equates to more tightening

- There are increasing tariffs on the EU too

- Brexit

To which I say: USD makes the weather and the rate of change determines the severity. If the USD takes off in earnest, or the Oil Spike or the Bond Sell-off or, or, or… there is real risk of Fed losing even more control. And the only thing to fight QT is QE, last time I checked.

A fellow FinTwitter is skeptical that QE will even help:

Next Fed embarrassment? When QE via Repo & slashing IOER doesn’t fix the credit cycle…rolls over anyway. – @gamesblazer06

With Central Banks on parade this week, we may find out sooner rather than later…

Historic FOMC Meeting

Tomorrow, we have the minutes and press conference for the US Fed meeting, followed by BOJ and SNB rate decisions later in the week.

What the bond market wants is clear language that the Fed plans to move away from the ‘midcycle adjustment’ commentary and transition toward an easing cycle, but what the panicked funding market is intonating is anything less than signaling Quantitative Easing will disappoint.

In a nutshell, falling global growth/GDPs, growing/massive debts, USD shortage especially during inflation spikes (like we had with oil) and illiquid funding markets can cause the Fed to lose control of funding markets and Fed Effective rates – circa 2008.

With that, “QE” will likely be Algo Porn Wednesday – in FOMC minutes or at Powell presser – and silence thereof will be deafening.

Know What You Own!!

You are getting this Free Bait (Daily Market Thoughts) as part of LaDucTrading’s Free Fishing Lessons! Take the next step: Come Fish With Me.

Twitter: @SamanthaLaDuc @LaDucTrading

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.