Sometimes bank stocks matter, sometimes they don’t.

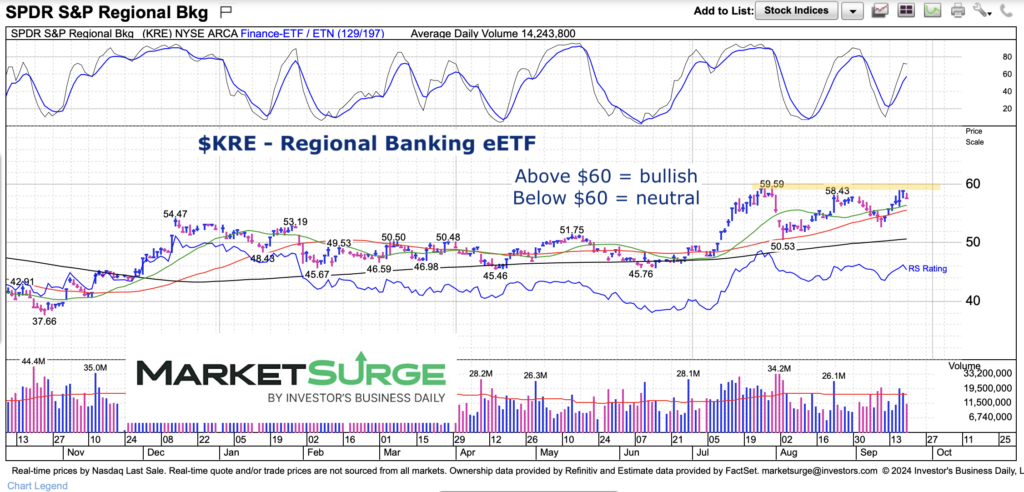

But heading into October and year-end, and following a 50 basis point interest rate cut, I’d say that what happens next for the Regional Banking ETF (KRE) is important.

So today we look at the chart and let the price action speak for itself.

Let’s just say that the coming days/weeks are important.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$KRE Regional Banking ETF Chart

As you can see, KRE is bumping up against the $58/$59 area for the third time. A breakout here would be very bullish for the broader market, while more sideways (or lower) action would be neutral.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.