Generally speaking, banking stocks have been resilient since the spring 2023 low.

Each time they pull back, there have been buyers at key support levels.

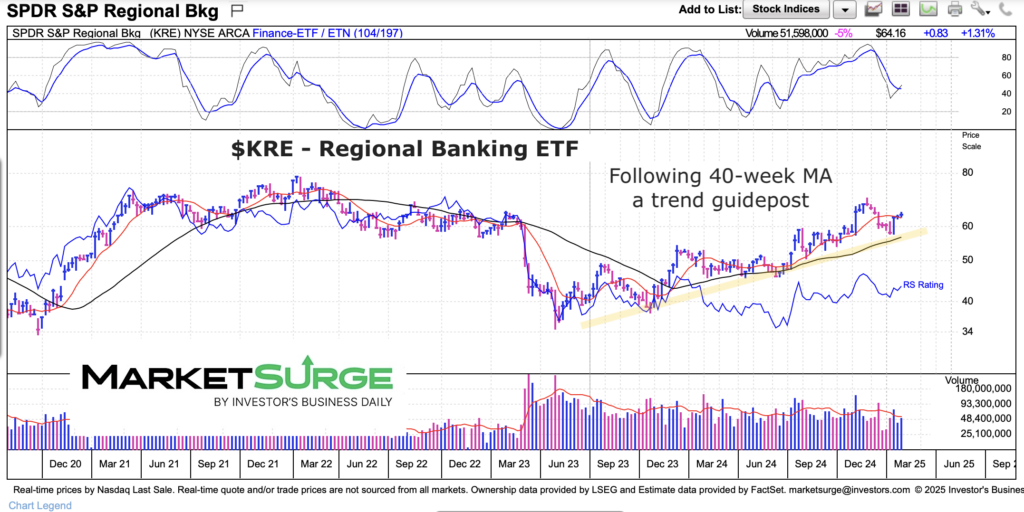

This is what an up-trend sounds like. Today, we’ll look at a chart showing this – the Regional Banking ETF (KRE).

While KRE is not the cleanest (nor strongest) chart, it does show why it’s important to remain in trend as an active investor.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$KRE Regional Banking ETF “weekly” Chart

Below is a weekly chart of KRE. As you can see, there is a clear up-trend in place dating back about 22 months. This trend aligns well with the 40-week Moving Average (MA). Note that the last two pullbacks have been rescued at the 40-week MA so this is a key level to watch.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.