Red Hat (NYSE:RHT) stock price traded 6% lower on Thursday morning, after posting earnings that beat Wall Street expectations.

The open-source software company reported earnings per share of $0.85 and total revenue of $823 million, compared to analyst estimates of $0.81 and $827 million.

The company expects earnings of $0.87 versus the consensus of $0.92, while its revenue guidance was in line. “Our focus on customers helped drive strong results, as we delivered double digit growth for key financial metrics,” explained CEO James Whitehurst.

However, analysts such as JP Morgan’s Mark Murphy downgraded the stock, pointing to, “a lower renewals portfolio and headwinds against middleware growth.”

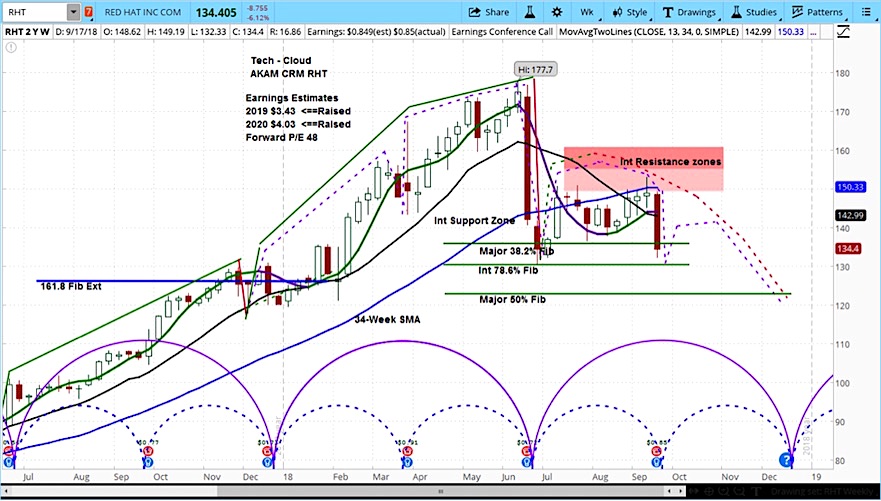

Our analysis focuses on the market cycles for Red Hat stock (RHT). The chart below shows the stock has begun the declining phase of its current cycle. This illustrates near-term downside risk, followed by a minor recovery, then more downside risk.

Our price target is $120 by year-end.

Red Hat (RHT) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.