Tilt is a poker term for a state of mental or emotional confusion or frustration in which a player adopts a less than optimal strategy.

Do you think this can apply to the markets as well? Absolutely it can. Have you ever had a period of trading where nothing seems to go your way and you start to doubt your process and your decision-making? Well, that is being in Trading Tilt.

If you can recognize that you’re in Trading Tilt, you can do something about it.

Here are a few suggestions:

- Close any positions that have gotten out of hand. That could mean:

- A trade that has been adjusted more than 2-3 times.

- A trade that has exceeded you initial risk tolerance

- A trade that is keeping you up at night

- Walk away from your computer. Clear your head and stop tick watching.

- Only check prices at the end of the day. If your positions are within your risk tolerance leading into a trading day but you recognize you are in Tilt, don’t check the markets at all. Just log in after the close and check on your positions. Chances are they will still be within your risk limits.

- Avoid overtrading. One of the worst things you can do if you’re in Tilt, is to place more trades. A better solution would be to reduce your number of positions until you are mentally back at your peak.

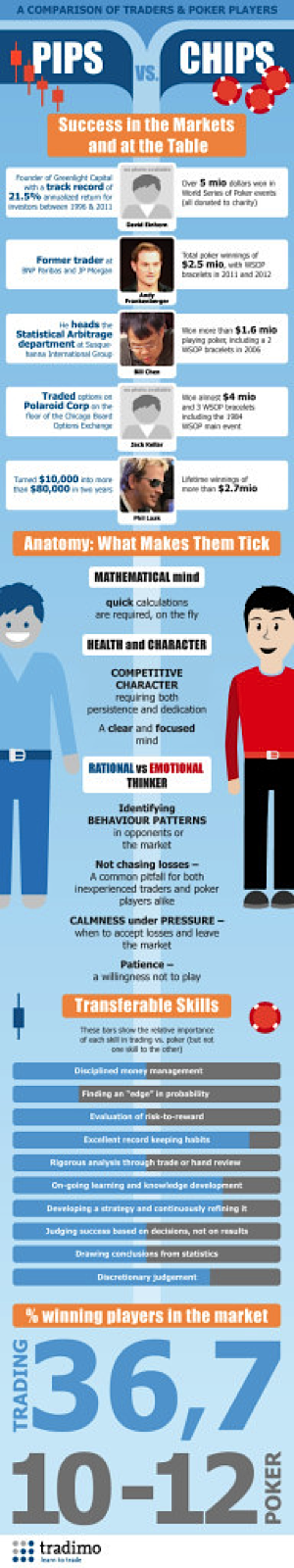

There is no coincidence that a lot of traders are also great poker players, because the psychology is so similar. Here is a great infographic from Tradimo looking at some great traders who are also great poker players:

Trading is as much a confidence game as anything else and being in Tilt will significantly affect your trading psychology. Learn to recognize when you are in Tilt and do something about it.

Follow Gavin on Twitter: @OptiontradinIQ

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.