The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Key Takeaways:

- S&P 500 EPS growth for Q2 2023 is set to come in at -7.2%, the lowest rate in nearly 3 years and potentially the third consecutive quarter of negative earnings growth

- Themes from Q2 and for H2 2023: possibility of recession, increasing interest rates, employment situation

- The LERI shows corporate uncertainty increasing to its highest level since the pandemic

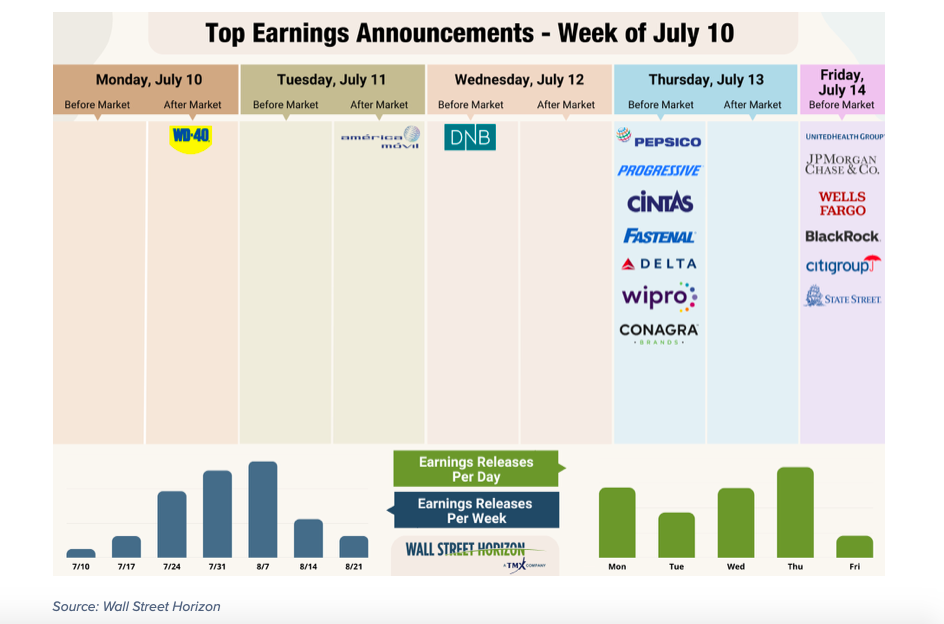

- Peak weeks for Q2 season run from July 24 – August 11

So Will There Be a Recession in H2 or What?

As we head into the second quarter earnings season, many things will be on investor’s minds, but one question in particular is still nagging: “Is a recession still impending or have we missed it?” In the coming weeks those investors will be looking toward corporate America for answers to that query.

Technically speaking, we’ve already had an earnings recession, marked by two consecutive quarters of negative growth. Q4 2022 and Q1 2023 saw growth rates of -4.6% and -2.0%, respectively. The current expectations for Q2 2023 earnings are even worse, with S&P 500 EPS growth estimated to decline 7.2%¹ on a year-over-year basis, a two percentage point drop in three months.

But is the continuing earnings recession (during which companies have still surpassed expectations by ~73%, by the way) predictive of a broader recession? That’s hard to say. Typically a recession is first marked by a bottoming in markets, then earnings and finally the economy. That sequence is out of order this time. Markets are still robust, with the Nasdaq Composite, S&P 500 and DJIA all higher YTD (by ~30%, ~15% and ~2%, respectively) with many analysts predicting they bottomed in the fall of 2022. And after two consecutive quarters of GDP declines in Q1 and Q2 2022², GDP has risen for the last three quarters.

The biggest input into GDP? The consumer. Consumer spending comprises 70% of GDP. And the biggest driver of consumption? A strong labor market. When people feel stable in their employment, and their ability to get another job, they are more likely to spend discretionary income. The labor market continues to be tight, with the latest unemployment reading clocking in at 3.6%, June nonfarm payrolls coming in at 209k and private sector jobs increasing by 497k in the same month. However, labor is a lagging indicator, and many economists believe it’s been too robust for too long and could turn at any minute.

Labor is one of the topics likely to be covered by CEOs in Q2 reports, mostly the increased costs behind hiring and updates on previously announced cost cutting plans and how they’ve impacted the bottom line. And while much of the information in earnings reports regarding Q2 are backward-looking in nature, it will be guidance for subsequent quarters that gives the best hint as to how management is feeling about the financial health of their company.

LERI Update – CEOs the Most Uncertain They’ve Been Since the COVID-19 Pandemic

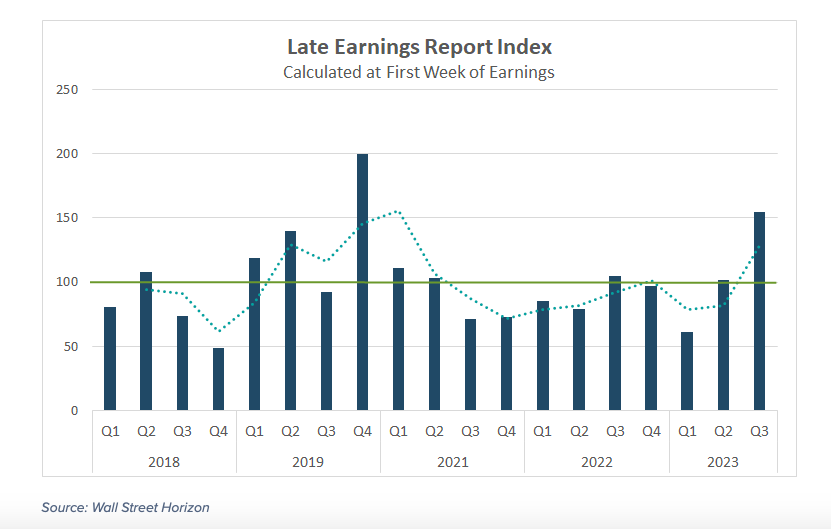

One early hint that CEOs might not be feeling so confident can be seen in the Late Earnings Report Index (LERI) reading for the upcoming earnings season.

The Late Earnings Report Index tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

While we won’t officially calculate the Q2 2023 earnings season (reporting in Q3 2023) LERI until the big banks (JPM, C, WFC) report Friday, July 14, the current pre-peak season LERI reading stands at 155, the highest reading since the COVID-19 pandemic. As of July 10, there were 31 late outliers and 18 early outliers. Typically, the number of late outliers trends upwards as earnings season continues, indicating that the LERI is poised to get even worse from here as corporations are increasingly more worried heading into the second half of the year.

The recent Measure of CEO Confidence published by the Conference Board confirms this ongoing pessimism from corporate America. The May 4 report showed the measure ticking down to 42 in Q2 2023, from 43 in Q1 2023, a measure below 50 suggests CEOs remain “largely pessimistic about what’s ahead in the economy.”³

LERI (Late Earnings Report Index)

Up This Week: Delta and Big Banks

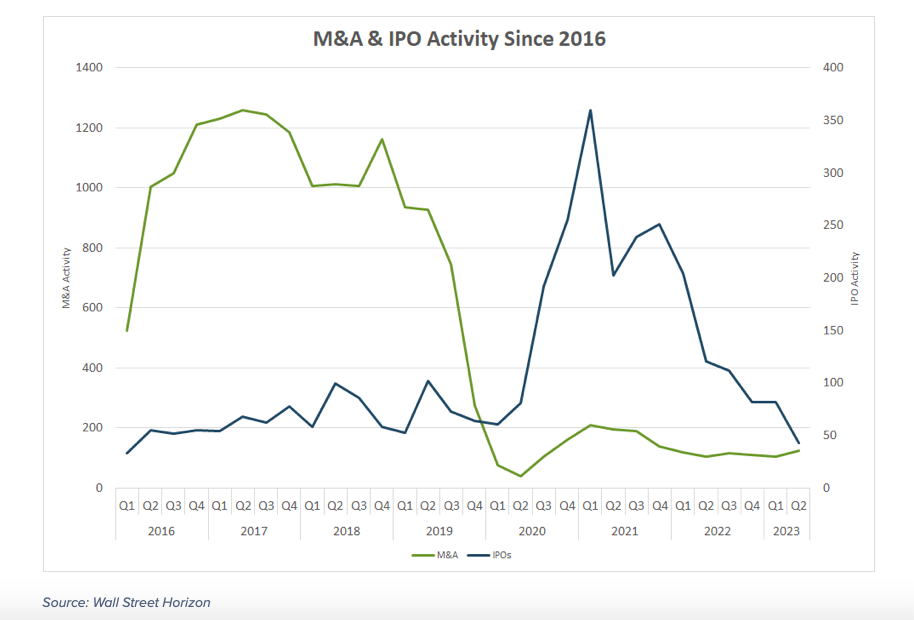

In its usual fashion, Q2 earnings season will begin with the big banks, with JPMorgan Chase (JPM), Citigroup (C) and Wells Fargo (WFC) reporting on Friday. Investors will be looking for comments that address any slowing of the US economy, especially as seen through softening loan demand and lackluster deal activity. Lenders in particular are expected to announce cost cutting programs, or give updates on how already in-process reductions are helping the bottom-line. Investment banks are expected to post weaker YoY profits as deal activity remains slow. The chart below shows just how far IPO announcements have fallen after peaking in early 2021, and how M&A announcements remains muted.

Delta also reports this Thursday, just as airlines struggle to keep up with the post-pandemic surge in travel demand as peak travel season kicked off last month. A crop of storms across the US at the end of June/early July, paired with Air Traffic Control issues and a FAA staffing shortage amounted to a chaotic beginning to summer travel. Despite missing estimates for Q1, Delta forecasted revenue and profit growth for Q2 that outpaced analysts’ expectations. They also announced on June 15 a resumption of their quarterly dividend which has been suspended since March 2020. The $0.10 per share payout will be issued starting in August.

Q2 Earnings Wave

This season peak weeks will fall between July 24 – August 11, with each week expected to see nearly 2,000 reports or more. Currently August 3 is predicted to be the most active day with 1,065 companies anticipated to report. Thus far only 41% of companies have confirmed their earnings date (out of our universe of 9,500+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.