The stock market has been very resilient, shrugging off early year selling.

While we aren’t fully our of the woods, it is apparent that investors are trying to turn any selling into opportunity and price consolidation.

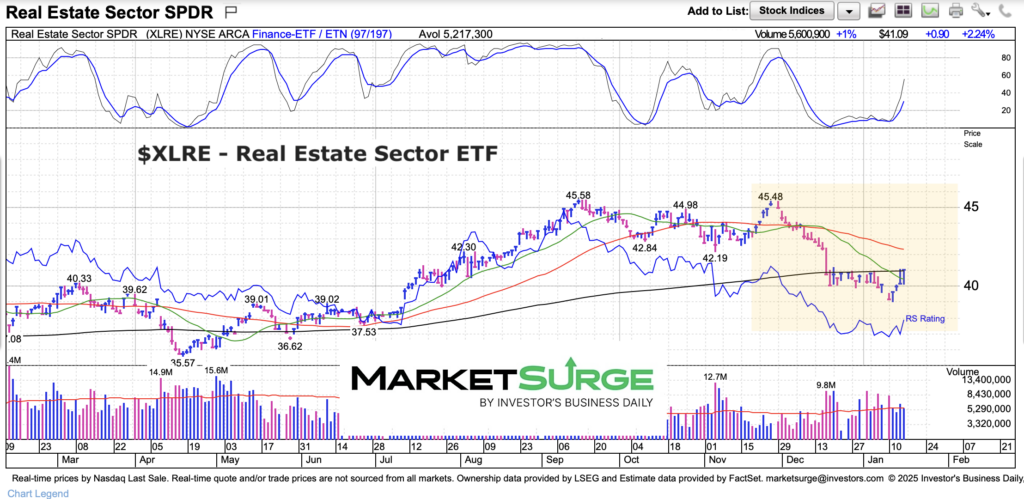

One sector that the broader market and economy need to step up and perform better is the Real Estate sector ETF (NYSEARCA:XLRE).

After a 13 percent decline, the Real Estate Sector (XLRE) is attempting to bounce. If this month’s low doesn’t hold, it would be a warning sign for the broader market that higher interest rates are wearing on a very important cog in the economic wheel.

Let’s look at the chart.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$XLRE Real Estate Sector ETF Chart

If XLRE can rally above the 200-day moving average, then the next important guidepost to watch will be the falling 50-day moving average. Technically, the chart needs some time to repair its price structure. If it doesn’t get better and turns lower once more, then broader concerns will likely arise.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.