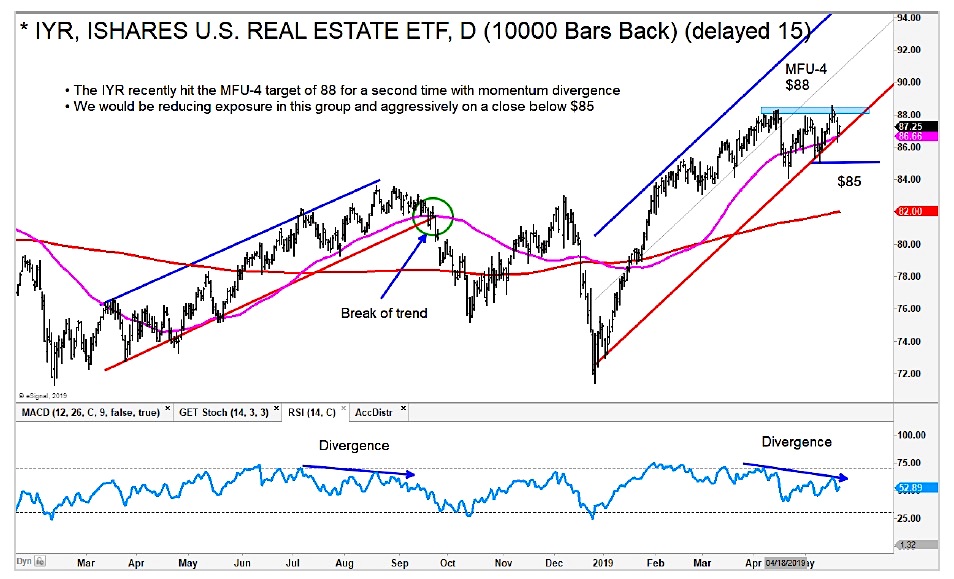

Our sector scans have produced a sell signal on the iShares Real Estate ETF (NYSEARCA: IYR).

The Real Estate ETF (IYR) recently hit an MFU-4 target of $88.

It’s worth noting that our $88 target was hit with a negative momentum divergence.

This is similar to what occurred in August of 2016 where the IYR achieved an MFU-4 target and then corrected -16%.

We would be trimming exposure here and looking at more attractive entries down the road a ways.

Here’s the “daily” chart for the $IYR Real Estate Sector ETF with annotated analysis.

US Real Estate ETF (IYR) “daily” Chart

The author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.