By Andrew Nyquist

By Andrew Nyquist

The bulls are definitely going to spend the weekend pounding their chests. And, to be fair, they have every right to be stoked. Heck, the S&P 500 continued to grind higher throughout the week and is now up a quick 4% for the year. But as I wrote about yesterday, the time for a pause and refresh has come. The market needs a pullback to squeeze out some of the excess bullishness and “breathe for a while.” Even if it is as little as 4 or 5 percent.

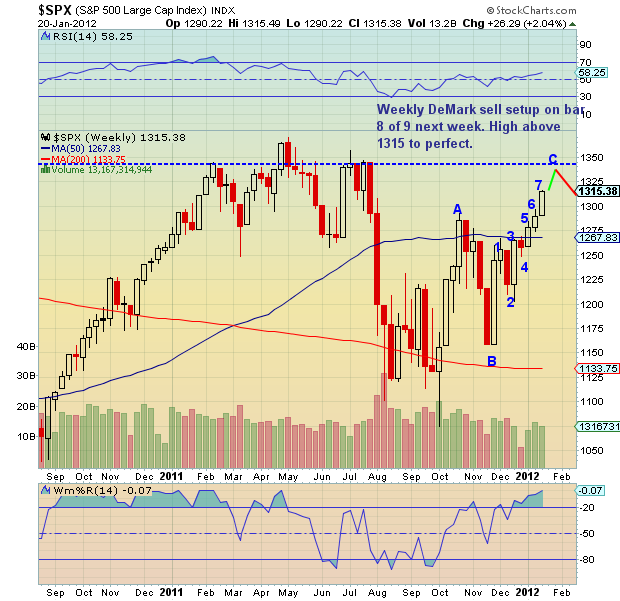

After showing resiliency and fighting off a daily DeMark perfected sell setup, the S&P 500 (and US markets) will encounter a similar test next week… only it will come from abroad. Perfected daily DeMark sell setups have recorded across European markets (indices) such as Germany’s DAX and France’s CAC 40. And although another quick burst higher early next week may occur, I’m thinking the financial markets start to pull in soon. Furthermore, if the markets burst higher Mon/Tues, I’ll be adding to my short-index fund positions (currently at 30-35%). The market will be healthier after a good pullback and will be in better shape for a run higher.

Annotated charts below for the DAX, CAC, S&P 500, and Dow Jones. Have a great weekend.

Author Note 7:35 pm 1/20/12: Tom DeMark out after the bell telling Bloomberg that the market may top early next week, looking for S&P 500 1338-1342 (roughly 2% higher than today’s close).

With this in mind, I did some additional chart work and found that the weekly chart of the S&P 500 was going on bar 8 of a 9 sell setup, needing to close above 1257.60 next week and 1277.81 the week after to “perfect” the setup — both very doable. The result would be a market top soon, followed by a correction. See additional chart below and note minor tweak to daily charts indicating that the lack of reaction to daily sell setup may be due to the need to fulfill the weekly sell setup and higher price objective before correcting/pulling back.

***Note that a weekly 9 sell setup requires 9 consecutive weekly closes, each close above the closing price of 4 weeks prior. Same goes for day counts, just with days instead of weeks.

———————————————————

Your comments and emails are welcome. Readers can contact me directly at andrew@seeitmarket.com or follow me on Twitter on @andrewnyquist or @seeitmarket. For current news and updates, be sure to “Like” See It Market on Facebook. Thank you.

Position in SH and SDS at time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.