The U.S. Federal Reserve is about to commence quantitative tightening (QT).

For those not all up to speed on “quantitative” maneuvers by central banks, QT and quantitative easing (QE) are two sides of a tool central banks have used extensively over the past decade or so.

To simplify things, QE is when the central bank buys bonds to support the market/economy. This has the dual effect of injecting cash into the economy (the seller of bonds gets cash to buy other things), and it pushes rates lower as bond prices rise to the Fed’s bidding. This cash and lower rates stimulate the economy and markets by injecting liquidity into the financial markets, and financial markets really like liquidity.

The opposite of QE is QT. The central bank sells their bonds or allows them to mature. If selling, another investor needs to have the capital to buy said bond, so they may sell another asset to raise money. This is removing liquidity. Letting a bond mature has the same impact because the issuer must sell new bonds to another investor.

Yes, this is a simplification of the effects. QE can be immunized, it can be used to buy other assets, etc. But without getting too deep into the mechanics, QE injects liquidity into the economy and QT removes it.

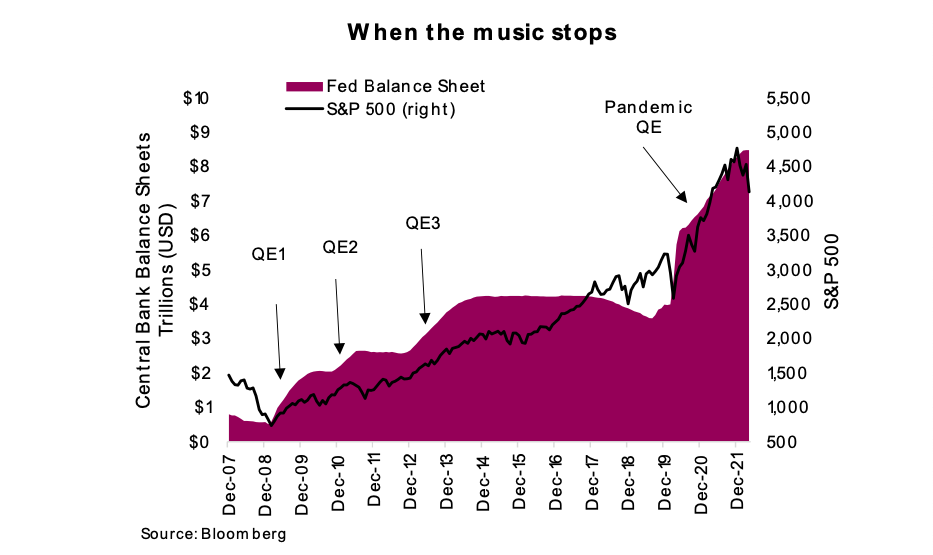

So why are we talking “Q” today? Well, if you thought the amount of QE following the financial crisis was big, the QE following the pandemic has been epic in both size and speed. This certainly contributed to inflating asset prices of all kinds; bonds, equities, real estate and as we are now finding, consumer goods and services too. This week in the USA, we are on the cusp of starting QT, the opposite of this liquidity injection. Will markets tumble and yields rise even more?

If everything else were static, QT would remove liquidity from the financial system. This would cause asset prices to fall, meaning equity and bonds prices would move lower (and bond yields higher). That is perfectly logical. But the markets are not static. They actually are filled with a healthy portion of smart people trying to get ahead of the next moves. The start of QT is not news — it has been telegraphed and announced multiple times. Which means, dare we say, it’s priced in?

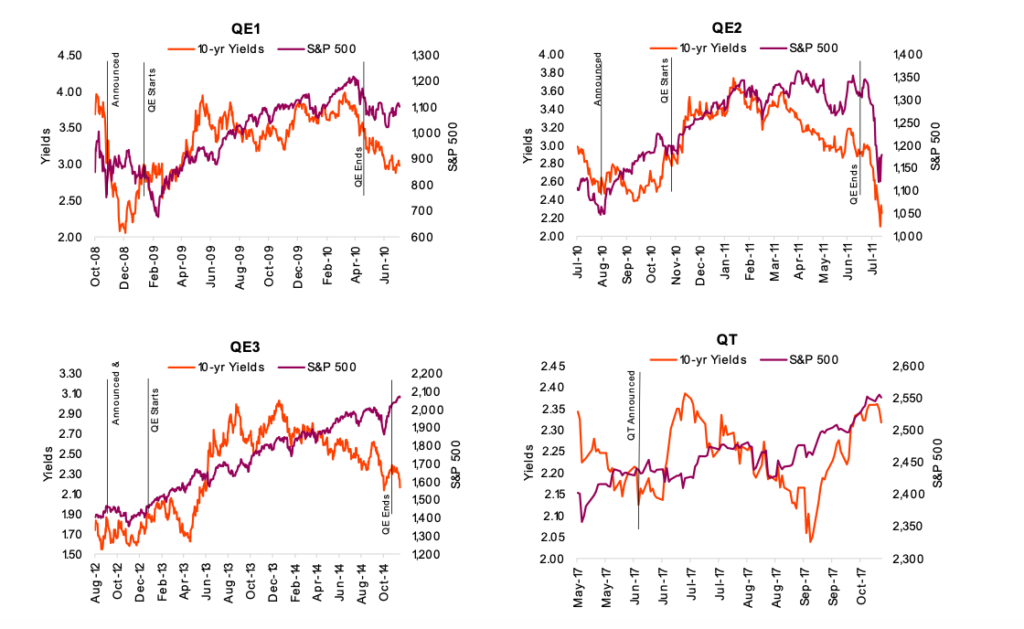

In fact, if you look at previous rounds of QE, it was the announcement that moved markets and bond yields — often weeks or months before the actual bond purchases. And when those actual bond transactions started, the market had often priced in the pending Fed action and, in most cases, had overreacted (i.e., gone too far).

The following charts pack a lot of information. Each one has the 10-year Treasury yield and S&P 500 during various QE programs. For QE1, 2 & 3, there is a vertical line when the announcement was made, a line when the actual QE commenced, and a line when it ended.

To varying degrees, bond yields tended to react lower to the announcement and then rise when the bond buying actually started. In each case, bond yields moved higher during QE, the opposite of what one would expect. Meanwhile, the equity market loves QE, and rises during these periods. The QT chart for 2017 shows a limited reaction in yields and the market. This is encouraging.

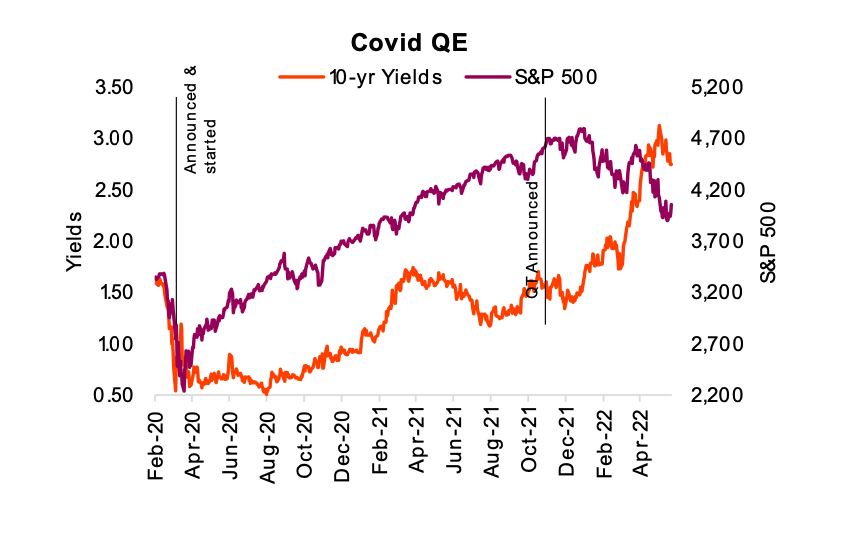

The Covid QE chart is a bit more complicated. The S&P 500 clearly rose on QE and peaked around the announcement of a pending QT. Interesting. However, there was still bond buying occurring, although at a declining pace. QT is just about to get started this week. Still, it appears the announcement carried the punch and perhaps the actual quantitative tightening won’t have much impact.

Is it all this simple? Of course it isn’t. Are there other forces at play affecting the bond and equity markets? Absolutely there are. For all we know, inflation, war and consumer sentiment are driving equities lower and yields higher, and there has been no effect of QT. However, given past experiences and a lot of hot takes we have read lately about the selling in equities “just getting started” because QT has not even begun, we feel that isn’t the case. That doesn’t mean equities won’t keep selling, but if they do, we would blame one of the other forces for the declines. Say, one of the not-yet-well-publicized factors or at least those for which the magnitude is not yet understood, like earnings slowing.

Investment implications

We are obviously in uncharted waters from the perspective of monetary policy and influence in the market. And while we all love to draw neat conclusions, such as QE lifts markets and QT hurts markets, there are always other factors at work. Change in economic momentum, investor risk appetite, valuations … the list is long and ever changing. Markets are lower this year for a host of reasons from inflation, war, slowing economic growth, normalization of expectations, and clearly the withdrawal of liquidity including the QT announcement.

Hard conclusions in the investment world are hard to come by. That being said, based on historical market reactions to QE & QT, we would not be overly concerned about the onset of QT. It was the announcement months back that was the bigger deal. And it is possible the bond and equity market may have already overreacted. We are focusing on other factors to inform our investment outlooks.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.