The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Important earnings season ahead as investors look for signs that we are headed for a soft landing

- The LERI shows corporate uncertainty easing to its lowest level since 2015

- Banks on deck this week: expectations are for improved lending, investment banking conditions, but headwinds still persist

- Peak weeks for Q4 season run from January 29 – March 1

The New Year got off to a bit of a rocky start as major indices (DJIA, S&P 500® and Nasdaq Composite) ended lower for the first week of the year, marking the first down week after a 9-week winning streak. In the continued 2023 trend of “good news is bad news,” it was strong jobs data out on Thursday and Friday that triggered worries that the US Federal Reserve might wait longer to cut interest rates.

As interest rates are one of the biggest drivers of market returns, a hot job market makes it less likely that the Fed will cut rates in the near-term, to the dismay of investors. The US Bureau of Labor Statistics announced on Friday that December Nonfarm Payrolls showed the economy added 216,000 jobs; Wall Street economists were expecting a payroll gain of 170,000.

In addition to that, wages increased more than expected. Average hourly earnings rose by 0.4% in December, continuing an upward trend from Q4 2023, and bringing the annualized growth rate over that period to 4.3%.[1] While this is great for American workers, it’s not great in the eyes of the Fed. Chairman Jerome Powell has indicated in past speeches that wage growth around 3 – 3.5% is consistent with the Fed’s 2% inflation target, and we are still running a bit above that.[2]

Another big driver of market returns, corporate earnings, take the main stage later this week. With the recent pullback in stocks, investors will be looking to Q4 results and 2024 outlooks for indications of improved growth prospects for US corporations. At present, Q4 2023 S&P 500 EPS growth is expected to come in at 1.3% according to FactSet. This would be the second straight quarter of growth after three down quarters. However, that figure has dropped more than is typically seen, previously expected to come in at 8.1% at the start of Q3. This denotes a 6.8% percentage point drop vs. the average of 3.6% seen in 2022 – 2023.[3] It’s important to remember that sell side analysts follow corporate guidance very closely when making their own estimates, and that aggressive cuts to Q4 expectations are due to companies themselves lowering estimates. One benefit, however, that drastically lowered estimates present is that companies will have a lower bar to surpass.

Amid shifting risks, including what lies ahead regarding inflation and corporate borrowing costs, Wall Street Horizon hosts a Data Minds event on January 11 to shed light on what could lurk around the corner in 2024. Our panel of experts will also discuss where AI goes from here now that some of its halo has faded.

Corporate Uncertainty Appears to Be Easing – But Still too Early to Draw Conclusions

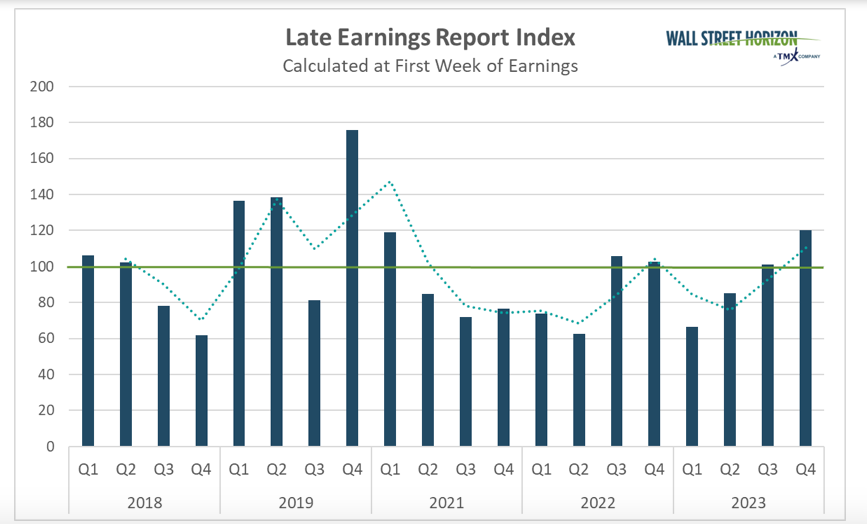

Despite lowering guidance more than usual for the upcoming quarterly results,[4] corporations have been delaying earnings less than we typically see, as measured by our proprietary Late Earnings Report Index metric, and this is a good thing.

The LERI tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The pre-peak LERI won’t officially be calculated until Friday, January 12, when the big banks begin to report, but it’s already showing surprisingly strong corporate body language about the upcoming earnings season. In the face of several lingering headwinds from 2023, the LERI is pointing toward a positive Q4 earnings season with a current reading of 62 (data collected in Q1), the lowest in our 9 years of collecting this data. Notably, more companies are scheduling their earnings announcements significantly earlier than normal compared to the number of companies who are pushing their announcement dates back significantly. Keep in mind, however, that this number will likely rise into the end of the week, as more companies confirm late dates as the earnings season rolls on.

Source: Wall Street Horizon

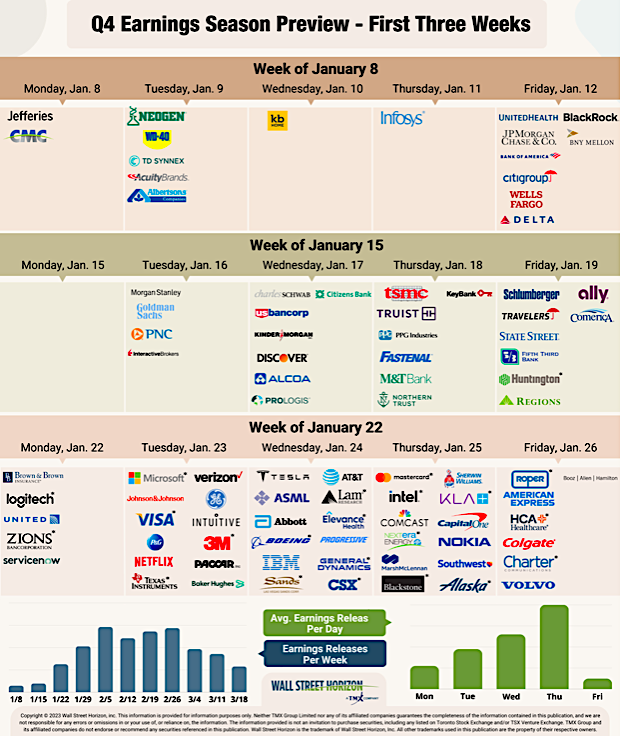

Up This Week: Big Banks

In its usual fashion, Q4 earnings season will begin with the big banks, with JPMorgan Chase (JPM), Citigroup (C), Wells Fargo (WFC) and Bank of America (BAC), reporting on Friday. Investors will be looking towards bank CEO comments for signs of a resilient economy and confirmation of a soft landing in 2024.

Two metrics of interest will likely be loan loss provisions and lending activity. Investors will likely want to see that provisions for credit losses have normalized, as a sign that banks see fewer short-term defaults and economic risks in 2024. They’ll also be looking for signs of improving lending activity which has remained suppressed due to higher interest rates and tighter lending standards.

Two potential bright spots may be investment banking activity and softening yields. At last month’s Goldman Sachs U.S. Financial Services Conference, banking executives indicated that dealmaking conditions are improving as the interest rate environment normalizes, and that goes for both IPO and M&A activity.[5] Also, lower YoY bond yields should have helped decrease the amount banks have to fork over for deposits to compete with higher yielding instruments.

Source: Wall Street Horizon

Q4 Earnings Wave

This season peak weeks will fall between January 29 – March 1, with each week expected to see over 1,000 reports. Currently February 22 is predicted to be the most active day with 599 companies anticipated to report. Thus far only 32% of companies have confirmed their earnings date (out of our universe of 10,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data. Keep in mind the Q4 reporting season is always a bit more prolonged, typically stretching over four or five peak weeks rather than the usual three peak weeks seen in Q1 – Q3.

Source: Wall Street Horizon

Copyright © 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon’s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

Sources:

1 Employment Situation Summary, U.S. Bureau of Labor Statistics, January 5, 2024, https://www.bls.gov

2 Opening Remarks, Federal Reserve, Jerome H. Powell, October 19, 2023, https://www.federalreserve.gov/newsevents/speech/powell20231019a.htm

3 Earnings Insight, FactSet, John Butters, January 5, 2024, https://advantage.factset.com

4 Earnings Insight, FactSet, John Butters, January 5, 2024, https://advantage.factset.com

5 Global banks forecast improved investment banking outlook, Reuters, Saeed Azhar, Tatiana Bautzer, December 5, 2023, https://www.reuters.com

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.