The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Encouraging inflation, jobs and retail reports led markets higher last week

- The Q2 earnings season wraps up with some final reports from retail and enterprise tech companies; S&P 500 EPS growth ends at 10.9%.

- The Q3 2024 earnings season will unofficially kick off on October 11 with reports from the big banks.

Promising data on inflation and retail sales led to a solid week for US Markets last week, with the S&P 500 logging seven consecutive days of gains.

Things kicked off with the Producer Price Index report on Tuesday morning, which showed that wholesale inflation rose 2.2% YoY in July, down markedly from the 2.7% gain in June.1 The Consumer Price Index followed on Wednesday, posting a 2.9% YoY increase in July, down from a 3% gain in June, and the lowest level seen since March 2021.2 With inflation moving in the right direction, the probability of rate cuts during the next three FOMC meetings have increased 100% according to the CME Group’s FedWatch Tool.3

Despite all of these encouraging figures on the inflation front, there were still some questions out there about whether the Fed had waited too long, is a recession in the cards? Is the softening consumer and cooling labor market indicative of a broader slowdown? Those jitters were somewhat quelled on Thursday when Retail Sales for July and weekly jobless claims were reported. Retail sales increased 1% last month, well-above the Dow Jones forecast for a 0.3% uptick.4 Jobless claims fell again last week, to 227,000, the second consecutive weekly decline after posting two increases above the 245,000 mark in July.5

On the earnings front, both Home Depot and Walmart kicked off the retail earnings parade last week, with different observations on the US consumer. While HD beat on earnings and sales expectations, they lowered comparable store sales guidance for the year, saying that figure would fall 3-4% vs. the previous forecast for a 1% decline.6 The home improvement retailer said homeowners are putting off projects as they begin to feel uncertain about the economy.

Conversely, Walmart noted a consumer that is still intact. The discount retailer raised their guidance for FY 2025, with sales now expected to increase by 3.75% – 4.75% vs. the prior guidance for 3% – 4%.7 Earnings per share expectations have also been adjusted to $2.35 – $2.43 vs. initial full-year guidance of $2.23 – $2.37.8 CEO Doug McMillon shared on the call “so far, we aren’t experiencing a weaker consumer overall.”9

And CFO John David Rainey noted the consistency in sales from month-to-month, but tempered that by saying “And while we have not seen any additional fraying of consumer health in our business, other economic data out there, as well as the state of affairs globally, would suggest that it’s prudent to remain appropriately cautious with our outlook.”10 He also noted in a CNBC interview that the back-to-school season “is off to a pretty good start.”11

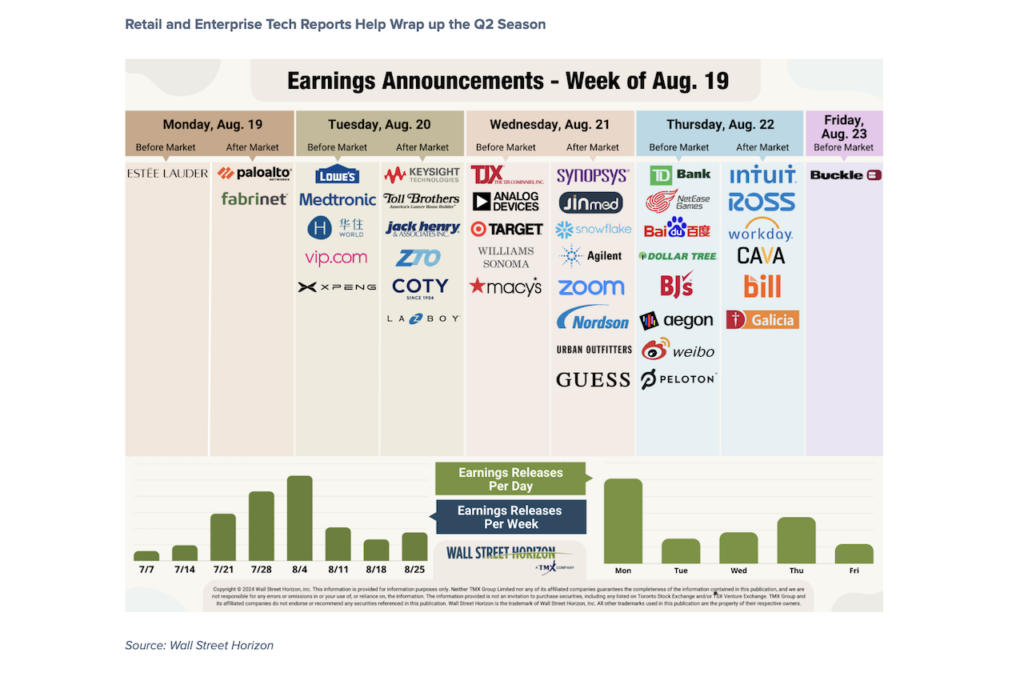

Speaking of the back-to-school shopping season, this week we’ll get reports from many of the retailers that are hoping to grab market share as students stock up for the fall. Those names include Target, Macy’s, TJX Companies, Urban Outfitters, and Ross Stores. The National Retail Federation released the results of their annual back-to-school in early July which showed expected spending per household will be down slightly at $875 vs. last year’s record of $890.12

With that the Q2 2024 earnings season will more or less conclude. With 93% of S&P 500 companies having reported earnings results for Q2, the current blended EPS growth rate is 10.9%, according to FactSet, an decrease from 10.8% in the week prior.13 Thus far 79% of companies that have reported have surpassed analyst profit estimates, while only 60% have beaten on revenues.14

Retail and Enterprise Tech Reports Help Wrap up the Q2 Season

Q2 Earnings Wave

This week 849 companies are expected to report for Q2. Thus far 74% companies from our universe of 11,000 have reported results. The Q3 2024 earnings season begins on October 11 when JPMorgan Chase, Wells Fargo and Citigroup all report.

Sources:

1 PRODUCER PRICE INDEXES – JULY 2024, U.S. Bureau of Labor Statistics, August 13, 2024, https://www.bls.gov/

2 Consumer Price Index Summary, U.S. Bureau of Labor Statistics, August 14, 2024, https://www.bls.gov

3 CME Group FedWatch Tool, https://www.cmegroup.com

4 Advance Monthly Sales for Retail and Food Services, United States Census Bureau, August 15, 2024, https://www.census.gov

5 UNEMPLOYMENT INSURANCE WEEKLY CLAIMS, U.S. Department of Labor, August 15, 2024, https://www.dol.gov/ui/data.pdf

6 THE HOME DEPOT ANNOUNCES SECOND QUARTER FISCAL 2024 RESULTS; UPDATES FISCAL 2024 GUIDANCE, August 13, 2024, https://ir.homedepot.com

7 Walmart Reports Second Quarter Results, August 15, 2024, https://s201.q4cdn.com

8 Walmart Reports Second Quarter Results, August 15, 2024, https://s201.q4cdn.com

9 Walmart (WMT) Q2 2025 Earnings Call Transcript, Motley Fool Transcribing, August 15, 2024, https://www.fool.com

10 Walmart (WMT) Q2 2025 Earnings Call Transcript, Motley Fool Transcribing, August 15, 2024, https://www.fool.com/

11 Walmart beats estimates, raises outlook as it sees stable consumer health, Melissa Repko, CNBC, August 15, 2024, https://www.cnbc.com

12 Majority of Back-to-Class Shoppers Have Already Begun Purchasing School Items, National Retail Federation, July 11, 2024, https://nrf.com

13 FactSet Earnings Insight, FactSet, John Butters, August 16, 2024, https://advantage.factset.com

14 FactSet Earnings Insight, FactSet, John Butters, August 16, 2024, https://advantage.factset.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.