The following research was written by Christine Short, VP of Research at Wall Street Horizon.

Executive Summary:

– Second quarter earnings season is on deck — inflation and ESG are top concerns among executives on recent conference calls.

– Two ESG investor conferences are scheduled this week in IT and Health Care sectors.

– Three small caps that issued preliminary earnings reports will provide quarterly results.

– A pair of US stocks resumed paying dividends, continuing a theme we highlighted earlier this month.

Earnings On The Way

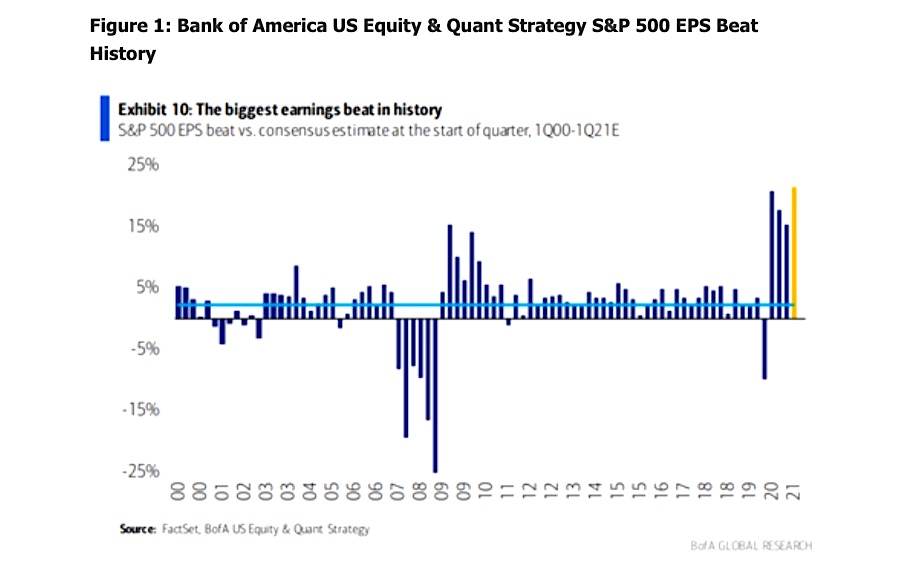

Traders are gearing up for another earnings season. S&P 500 companies have handily beaten analyst expectations in each of the last four reporting periods, so expectations are likely growing loftier. Market analysts and economists have been raising earnings outlooks for the balance of 2021. Just last week, the Federal Reserve raised their 2021 GDP growth¹ outlook—the FOMC now expects 7.0% growth of the US economy this year which would be the highest since 1984’s +7.2%.²

Inflation Amid Economic Growth

Corporate America and the economy are running on all cylinders right now while Europe is also finding its footing. Inflation is often a byproduct when growth runs above the long-term average of 2-3% per year. Companies voiced that issue on conference calls during the previous earnings season. FactSet reported that the first quarter 2021 earnings season featured the highest percentage of S&P 500 companies citing “inflation” on earnings calls in over 10 years.³ Expect more of the same with particular emphasis on supply chain constraints and order backlogs across many cyclical and consumer sectors.

Sectors Most Concerned

The top sectors mentioning “inflation” were Consumer Staples, Materials, Industrials, and Consumer Discretionary, according to FactSet. This week, the following global firms will hold shareholder meetings according to Wall Street Horizon data: Kroger (KR) and Coca-Cola HBC AG (CCH.CH) from the Consumer Staples sector, MasterCard (MA) from Industrials, and JD.com (JD) and Guess (GES) from the Discretionary sector. While shareholder meetings usually do not feature groundbreaking industry news, there can be unexpected voting outcomes.

ESG Is Bigger Than Ever

Also happening next week are two conferences on the hot topic of ESG. Environmental, Social, and Governance are top of mind (along with inflation) in the C-Suite. On Tuesday this week, Cisco and Goldman Sachs will host an ESG Conference Call, and on Wednesday morning and Johnson & Johnson will host an ESG Investor Update Webcast.

With a record number of S&P 500 discussing ESG during the Q1 earnings season, expect more such conferences as the year progresses, particularly as events move to traditional in-person settings. Wall Street Horizon gathers investor conference dates and source links for our clients to keep traders ahead of important news often detailed at these key events.

CSCO & JNJ ESG Conferences

At the Cisco & Goldman webcast, Cisco’s SVP of Corporate Affairs will provide an overview of the firm’s Corporate Social Responsibility (CSR) strategy and how it will help overall shareholder value creation. As companies become cash-rich during these booming economic times, the importance of how to deploy that capital becomes increasingly significant. Earlier this month, we detailed that firms have recently begun to increase dividends. Dividend changes are just one of the corporate data points we track from the 9,000+ global firms Wall Street Horizon covers.

J&J’s ESG Investor Update on Wednesday is slated to outline the company’s ESG management approach around its corporate priorities. The S&P 500’s biggest Health Care company by market cap will share progress it has made to drive long-term value creation for shareholders and how it is addressing concerns of all stakeholders. It was an eventful past 52-weeks for J&J, so this webcast should be particularly useful to investors.

Preliminary Earnings

On the earnings front, three small stocks issued preliminary earnings reports over the last two months and are scheduled to report quarterly results this week.

Key Tronic Corp (KTCC), Giga-tronics Inc. (GIGA), and Friedman Industries Inc (FRD) have earnings reports on Tuesday the 22nd, Thursday the 24th, and Monday the 28th, respectively.

Traders and investors in these names should be on guard for unusual news to be included with the quarterly results data. Companies often pre-announce earnings to incorporate key information beyond financials—such as M&A activity or regulatory issues. You can read more about the importance of preliminary earnings announcements and why they are critical for portfolio managers to monitor in our white paper.

Dividend Resumptions

We wrap up this week’s Event Data Outlook with positive news. Two US firms recently resumed paying dividends.

Signet Jewelers Ltd. (SIG) and REV Group, Inc. (REVG) announced dividend resumptions earlier this month. While there are just two data points, it continues a broader theme of companies emerging with confidence from a difficult period last year.

Conclusion

The optimistic narrative from a few months ago of pent-up consumer demand has given way to the pessimistic narrative of supply shortages and inflationary fears. The Federal Reserve was forced to change its projection of future interest rate hikes to account for higher consumer prices.

It will be particularly interesting to monitor the top risks cited by global firms during the upcoming earnings season. Fundamental economic shifts are tough to navigate while ESG concerns grow ever-present. It will be a busy time for investors following the U.S. holiday weekend, and traders must stay on top of the latest news and corporate events.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Sources:

2 Statista

3 FactSet

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.