The Q1 2017 13F filings have been released showing hedge fund positions. Using Whale Wisdom’s excellent suite of tools I am able to customize a list of my 50 favorite hedge funds and then look for common buy/sell activity throughout the quarter.

These are funds with fairly high concentration, lower turnover, strong track records, and out of the box thinking with quality investments. A method to find some of the smartest funds is simple back-testing, looking at some of the top performing growth stocks and then finding funds that were early holders of the names and continue to hold.

For this research post, I found a few less popular stocks seeing buying activity across five or more of my top 50 funds from the Q1 2017 13F filings.

Here are 5 stocks that stood out:

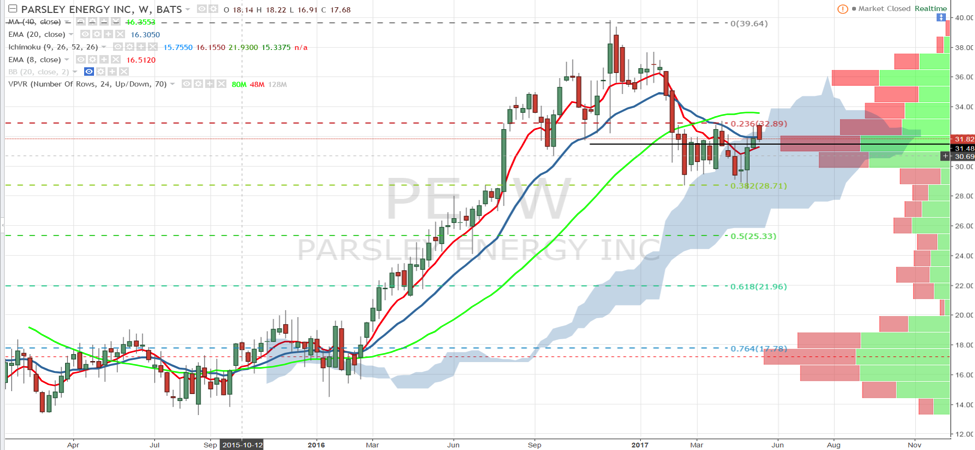

Parsley Energy (NYSE:PE) saw a 36.8% jump in institutional ownership in Q1 with notable buys from Carlson Capital, Pointstate Capital, Passport Capital, Third Point, Alyeska, Point 72 and Discovery Capital. Parsley Energy is an $8.75B energy company focused on the Permian Basin trading 23.55X Earnings, 1.7X Book, 6.75X FY18 EBITDA and 4.57X Cash. PE recently raised its production guidance after a strong first quarter with 88% Y/Y growth. It has a leading LOE (Lease Operating Expense) versus peers and is increasing oil volume as a percentage of total production. Call options spiked in PE on 5/12 with some sizable buys in September and December $32.50 calls. In a struggling sector Parsley Energy offers attractive valuation, strong production growth, above-average cash flow, high quality assets, and a strong balance sheet. On the chart shares have outperformed peers since 2016 and recently based above its 38.2% Fibonacci support at $28.70, now looking to emerge out of its base.

Conduent (NYSE: CNDT) saw notable buys in Q1 from Carl Icahn, Highline Capital, Greenlight Capital, OZ Mgmt., Pennant Capital, Anchorage Capital, Point-72 and others. CNDT is a $3.5B provider of business process services for healthcare, public sector and commercial industries that was spun-off from Xerox (XRX). Conduent’s revenues is mostly driven by long-term annuity contracts with 86% renewal rates giving it stable earnings, and the BPO market opportunity is estimated at $260B with 6% annual growth. Commercial Industries accounts for 44%, Public Sector 26%, and Healthcare 26%. Conduent (CNDT) is seen as a margin expansion opportunity as well with a stronger portfolio focus, improved productivity and cost transformation. The company plans to ramp M&A in 2018 and is working on a $700M cost saving opportunity through 2018. It is working in a group with some very large players like IBM, Accenture, Automatic Data, and Cognizant Tech, so it could become a M&A target itself. At 7.6X EBITDA it trades at a steep discount to the 11X average, and can be expected to close that gap if it can show better margin expansion and ROIC. On the chart shares have traded in an uptrend since bottoming early in the year and in the options market notable call buys in June $17.50 for 6,500 contracts, October $20 for 4,000 contracts and 2,000 July $17.5 calls.

Mulesoft (NYSE:MULE), a recent IPO, saw some notable firms buy in Q1 filings, including OZ Mgmt., Gilder Gagnon & Howe, Adage Capital, Cisco and Millennium Mgmt. The $3.14B Tech Company provides connectivity solutions with its Anypoint Platform enabling companies to build application networks. MULE is forecasting 45% revenue growth in 2017, 35% in 2018, and 31% in 2019 with profitability likely in 2020. MULE has traded in a choppy $21/$25 zone its opening months. It recently delivered Q1 results above expectations and is seen as a transformative company that can make enterprises more nimble at IT environments become more heterogeneous. In Q1 billings came in at +51% Y/Y and subscription revenues at +62%. MULE will be releasing “Crowd” in June 2017, its next version of the Anypoint Platform. With a path to eventually hitting $1B in revenues, MULE is in the early stages of its growth and looks to have nice upside over the longer term. As a disruptor in the software integration market, estimates at $20B market, it has a long runway for growth and though richly valued near-term the focus will be on it delivering on growth which it started off with a bang in Q1.

Elf Beauty (NYSE:ELF) saw notable buys from Oak Ridge, Time-Square Capital, Cortina, Tiger Global, Adage Capital, Highbridge, Elk Creek, Laurion, and Carlson Capital. ELF is a $1.18B cosmetics company trading 46.3X Earnings, 4.96X Sales and 7.43X Book. ELF is targeting 27% revenue growth this year, 20.6% next year and 17% in 2019 with EPS rates similar. ELF is the fastest growing brand in cosmetics with its ability to offer high quality products at low costs and is also targeting the 18-34 year old demographic. Cosmetics is one of the more sustainable growth categories and ELF is already showing margin expansion and growing faster than its much bigger peers. ELF has posted strong beats its first two quarters and though there are overhangs with share offerings and high expectations in the early going, the long term upside looks quite attractive. My main concern with ELF is that the channels it sells its products through like Target and other retailers are seeing less and less traffic so it needs to step up its e-commerce business.

Ardagh Group (NYSE:ARD) showed up as a name with notable buyers including Canyon Capital, Brahman Capital, Lakewood, Ratan, ARD is a $5.09B leader in metal and glass packaging solutions for the food & beverage industry. On 4-27 it reported Q1 results well above Street estimates with 51% revenue growth due to the Beverage Can acquisition. ARD is considered a “roll-up” story with its acquisition approach, and at 8X EBITDA is cheap to a peer Ball (BLL) which trades 11X with weaker EBITDA margins and ROIC. At this point ARD is a play on the Beverage Can deal playing out with further synergies, and the hedge fund gurus eat up M&A synergy names. ARD delivered solid numbers in its debut quarter with healthy volume/mix and at these levels looks attractive on valuation with 30% upside.

You can get more of my research and options trading ideas over at OptionsHawk. Thanks for reading and have a great week!

READ MORE: AxoGen (AXGN): An Exciting Med-Tech Growth Stock

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.