PulteGroup reported Q4 2019 earnings on January 27, helping to lift its stock price (ticker PHM) this week.

The company reported adjusted EPS of $1.14, which beat consensus estimates of $1.08.

Revenues came in at $3.02B, which also beat consensus estimates of $2.97B. PHM reported a 33% increase in net new orders.

The company’s CEO, Ryan Marshall, attributes the increase in net new orders in part due to low unemployment, low mortgages rates and a balanced inventory of homes.

Let’s see what the charts tell us.

PulteGroup (PHM) Weekly Chart

At askSlim.com we use technical analysis to evaluate price charts of stocks, futures, and ETF’s. We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

askSlim Technical Briefing

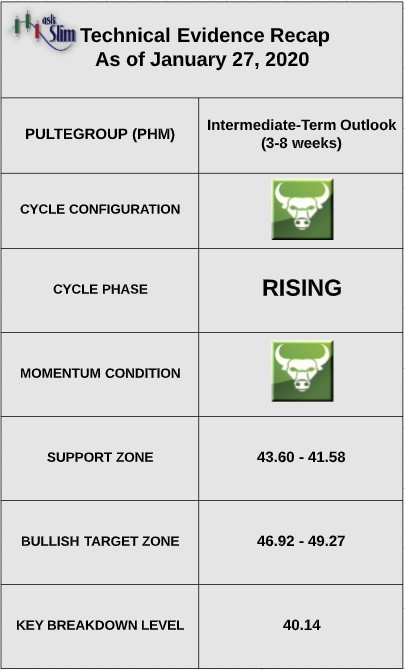

Pulte Homes stock (PHM) has a very bullish intermediate-term cycle configuration and positive weekly momentum. These conditions will likely to limit any downside in the stock to the rising intermediate-term Fibonacci supports between 43.60 – 41.58.

On the upside, there is an intermediate-term Fibonacci projection/target zone from 46.92 – 49.27. On the downside, there are rising intermediate-term Fibonacci support zones from 43.60 – 41.58. Our analysis suggests that for the bears to regain control of the intermediate-term, we would likely need to see a weekly close below 40.14.

askSlim Sum of the Evidence

PHM has a very positive weekly cycle configuration that suggests that declines will be limited to the intermediate-term Fibonacci supports beginning at 43.60. The next projected intermediate-term low is due in May. Once the next intermediate-term low forms, there is a likelihood of the stock reaching 49 by July.

Interested in askSlim?

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.