The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Potential Stormy Reporting Season Ahead with Bearish Pre-announcement Trends

- There has been a slight uptick in preliminary earnings announcements on Wall Street

- Management teams are attempting to lower the bar ahead of individual profit reports

- Traders can use trends in pre-announcements to trade around key earnings dates

Back in September, markets had begun to find their footing after a bruising reaction to a hawkish speech by Fed Chair Powell at Jackson Hole and an unsettling August CPI report. FedEx (FDX) delivered a harsh reality check with its earnings pre-announcement on Sept. 15, however. Following the major Industrials sector company’s preliminary first-quarter outlook that was much less optimistic than what forecasters had been expecting, shares faltered. The broad market arguably took its cue from FedEx, too. The S&P 500 went on to drop more than 10% to its October low.

Bear Market Anxiety into the Q3 Reporting Period

While many other forces were at play to drive broad market volatility, there’s no doubt that earnings season trepidation is front and center. There has been a slew of bearish preliminary earnings announcements from companies big and small amid a quickly shifting economic backdrop.

For background, along with actual guidance numbers, traders look to preliminaries for a sense of how an earnings season might verify. You can think of it like breadcrumbs leading you down the path of corporate profit trends. Both equity and options traders can benefit by knowing what firms are pre-announcing and when. Corporate executives are always trying to position their company just right ahead of major announcements – like students sitting at the front of the class, making the right impression on the teacher (Wall Street) is critical. Guidance updates are part of that signaling.

Tracking Preliminary Earnings Trends

Wall Street Horizon keeps a close eye on earnings season trends. The increase in pre-announcements comes at a time of heightened global macroeconomic uncertainty. FedEx, for example, cited adverse impacts from exceptional weakness in Asia and challenges in Europe. By late in the third quarter, more weakness was seen in the U.S., according to Raj Subramaniam, FedEx president and chief executive officer.

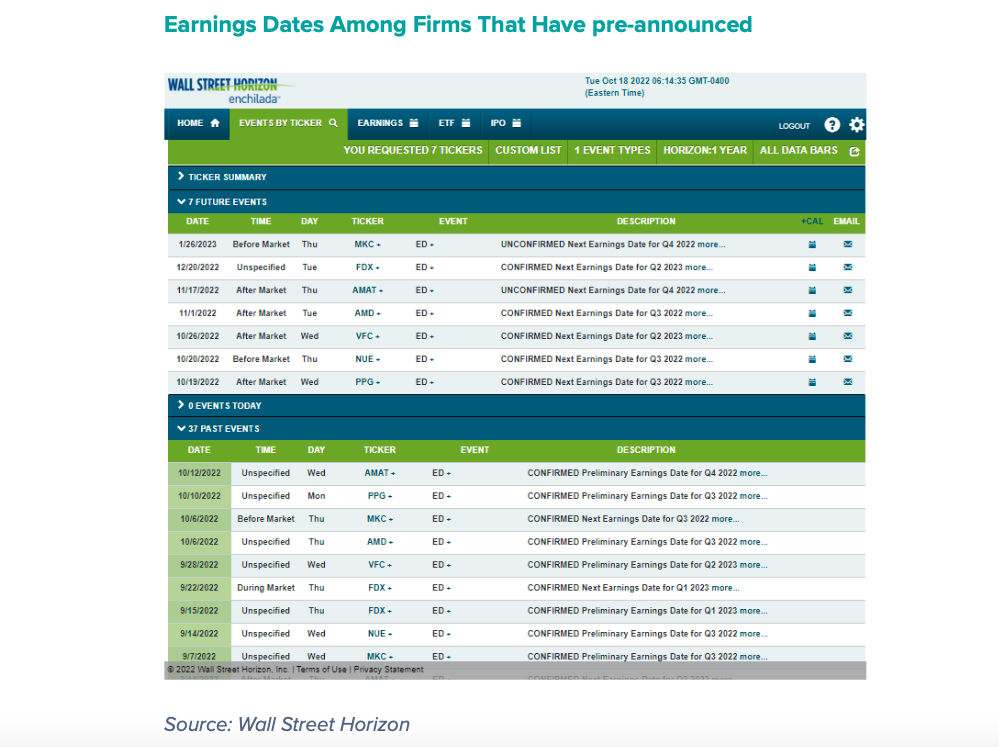

Negative Pre-Announcements Span the Sector Spectrum

Other high-profile firms pre-announcing earnings include Applied Materials (AMAT), PPG Industries (PPG), Advanced Micro Devices (AMD), VF Corporation (VFC), Nucor (NUE), and McCormick & Co (MKC). For investors and traders, you will notice that the preliminary earnings updates go across a range of industries and sectors. While not all preliminary earnings updates are negative, most of the firms listed above did not have upbeat news to report. Traders have few places to hide. Even safe sectors like Utilities and Real Estate have recently come under attack. Look out for more volatility around key earnings dates among these preliminary earnings stocks.

Traders should pay close attention to AMD in particular. We noticed that along with issuing a bearish negative profit warning earlier this month, the company also has a late earnings date – pushed back a week versus normal. A later-than-usual Q3 report, now confirmed for Tuesday, November 1 AMC, might portend more troubling news. FedEx, meanwhile, does not issue results until December 20.

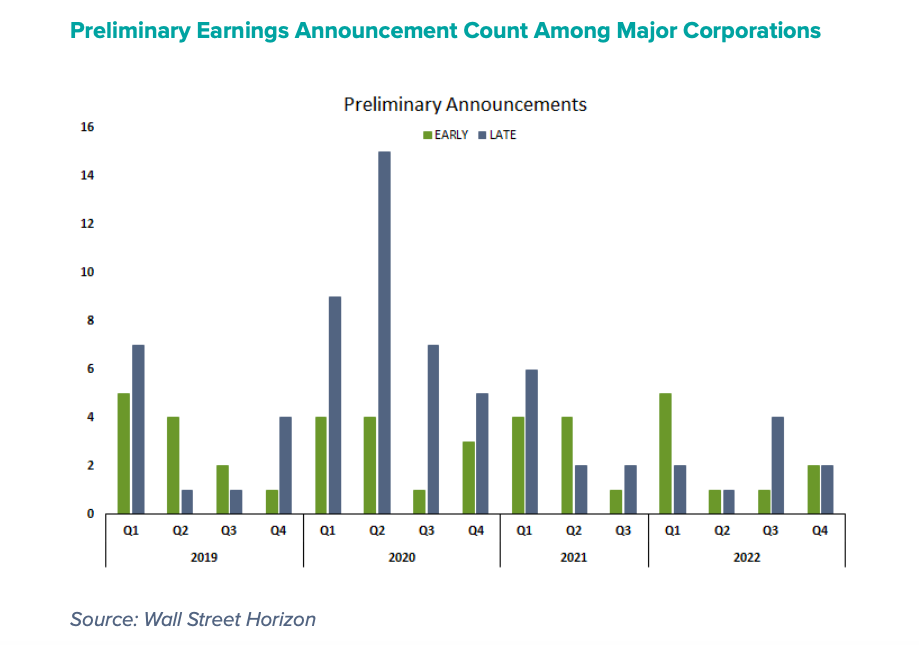

In total since July 1 among stocks trading on major indexes, we found that there has indeed been a slight uptick in the number of preliminary earnings announcements. It’s important to recognize the fourth quarter has just begun. The chart below illustrates that there was a massive jump around the height of the Covid pandemic, understandably so. Outside of that and perhaps some minor seasonal spikes during first quarters, times, in general, have begun to normalize. That could change now that volatility continues to run high across global markets and fears of a recession permeate the corporate psyche.

So far, while early, Wall Street’s cautious tone is playing out in bottom-line actuals versus estimates. Bank of America Global points out that just 42% of companies have beaten on both sales and EPS, the weakest percentage since Q1 2020. Moreover, according to FactSet, the S&P 500’s third-quarter EPS growth rate is expected to be just 1.6%, the lowest since Q3 of 2020. Moreover, excluding the Energy sector’s massive 119.4% forecast per-share profit surge from a year ago, earnings growth would be down by 4.9%. This comes at a time when inflation is, of course, running very hot, so “real” earnings growth is sharply in the red.

The Bottom Line

While preliminary earnings announcements are not as common as they were many years ago, they remain an important way the corporate world communicates with investors. This go-around, we have seen several major global players from a variety of sectors aim to temper earnings season expectations through bearish profit pre-announcements and guidance cuts. Traders can use upcoming earnings dates to play volatility trends in these high-profile names.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.