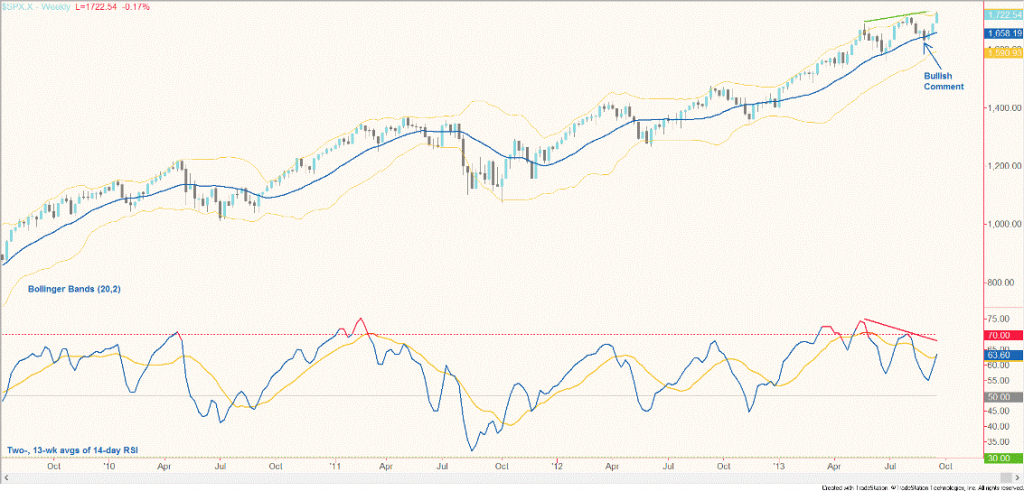

Greetings, investors. I’m following up on a piece I wrote for See It Market on August 29th about buying the DIP in the S&P 500 (SPX) to its weekly mean at the 20-week simple moving average. That turned out to be a sound call for position traders. But price is now trading at the upper Bollinger Band (two standard deviations above the mean), signaling an extended condition and thus an elevated risk of some backing and filling soon. As well, price is hesitating after edging to a new high. SPX is notorious for reversing not long after reaching new highs (professional traders bid up stocks and then let retail traders buy into the new highs; after that retail demand starts to slow, they take profits at higher prices and the market comes back in).

Greetings, investors. I’m following up on a piece I wrote for See It Market on August 29th about buying the DIP in the S&P 500 (SPX) to its weekly mean at the 20-week simple moving average. That turned out to be a sound call for position traders. But price is now trading at the upper Bollinger Band (two standard deviations above the mean), signaling an extended condition and thus an elevated risk of some backing and filling soon. As well, price is hesitating after edging to a new high. SPX is notorious for reversing not long after reaching new highs (professional traders bid up stocks and then let retail traders buy into the new highs; after that retail demand starts to slow, they take profits at higher prices and the market comes back in).

With these factors in mind, it’s an attractive time for traders to reduce long holdings. Since there isn’t any evidence of the primary trend in stocks since 2009 being over, it’s worth keeping some capital in the market in case gains extend from here or a dip attracts buying. I don’t believe it’s an opportune time to put any new capital at risk in stocks.

Keep in mind the pace of the advance has been slowing ever since overbought readings in May warned a point of buyer exhaustion was on the horizon. You can see this in the decline in weekly RSI averages. Also be aware that, while the reaction to the FOMC statement was indubitably bullish, it follows a pretty good run that suggests much of the gains associated with the announcement were achieved before it came out.

At miAnalysis, I’m advising clients to look to ETF opportunities in other asset classes following the Fed statement. While more tapering is being taken as bullish for equities, other markets show better reward-to-risk scenarios for swing and position traders right now (if anything, I’ll be watching for the right time to recommend a contrarian short trade in stock-related ETFs, many of which are pretty extended on daily charts). Good trading, everyone.

Twitter: @ChrisBurbaCMT

Chart Source: TradeStation

No position in any of the securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.