Philip Morris (PM) rose 5 percent on Wednesday, after it announced that merger talks with Altria (MO) had ended.

However, our view is that the stock will fail, as the current market cycle matures.

Philip Morris announced that its talks with Altria had ended, as the two firms could not come to an agreement on how to merge into one company. Interestingly, Altria spun-off Philip Morris a decade ago with the understanding that the latter would focus on international markets.

However, the latest innovation in the cigarette industry is vaping and Altria has a stake in the most important provider, Juul. The companies had hoped that PM could add value through an improved international focus.

Philip Morris Stock (ticker: MO) – Cycles Point Lower

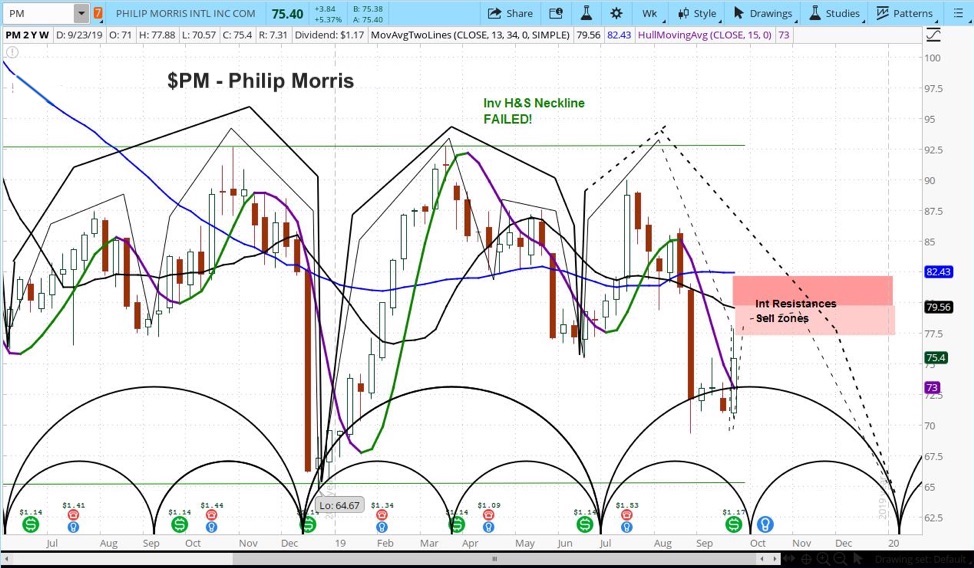

Our approach to stock analysis uses market cycles to project price action.

Our analysis shows a negative pattern, with PM having previously broken its cycle low.

It is now trading just below our resistance zone between $77-80. Yet as the current cycle matures, we expect sharp selling through year end.

Philip Morris (PM) Stock Weekly Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.