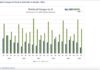

Commodities prices have risen rather sharply over the past 12-18 months, adding to worries of pricing pressure and inflation.

As you can see in the chart above, businesses are taking note. The word “inflation” is being mentioned at a record rate by S&P 500 companies on earnings calls.

Although there are several inputs that effect consumer prices and inflation, perhaps one major indicator is worth watching right now: Crude Oil.

How crude oil trades directly effects energy prices… and those prices are major inputs for both consumers and businesses. And right now crude oil is trading at an incredibly important “long-term” resistance level.

Since peaking in 2008, crude oil has been trading within a declining price channel (marked by lower highs on the “monthly” chart above). But the past several months have seen crude oil (along with other commodities) surge in price. And this now has oil trading at dual price resistance, marked by its prior two highs as well as the falling downtrend line. While a move lower may keep inflation in check, a breakout move higher would embolden inflationistas and bring worries of higher prices to the fore.

Humbly speaking, I think what crude oil does at (1) will determine if inflation is going to become an issue in the months ahead. Stay tuned!

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.