When traders and investors hear the term diversification, they tend to think of the construction of their portfolio. Starting with asset allocation: the classic 60/40 equity to bond split comes immediately to mind. Or perhaps it implies a broad basket of individual equities across different sectors and geographies in an attempt to reduce single stock risks.

When traders and investors hear the term diversification, they tend to think of the construction of their portfolio. Starting with asset allocation: the classic 60/40 equity to bond split comes immediately to mind. Or perhaps it implies a broad basket of individual equities across different sectors and geographies in an attempt to reduce single stock risks.

But other methods of diversification are frequently overlooked by traders. Perhaps the most overlooked is the benefits of diversification across different trading strategies. As many market experts have noted, no strategy is profitable in all market conditions. Nowhere has this been more evident than in the managed futures/trend following space.

Systematic trend following’s resurrection in the second half 2014 followed several years of declarations that trend following was dead and that the momentum market anomaly had been “arbed away”. These pronouncements proved premature. A year-end CNBC article subtly entitled “Hedge Fund Robots Crushed Human Rivals” summed up their outperformance.

“So-called managed futures funds—which trade the futures contracts of stocks, bonds, currencies and commodities—gained an average of 15.2 percent last year, according to Societe Generale unit Newedge. That beat virtually every other hedge fund strategy, including stock pickers, beat-up bond vultures and macroeconomic prognosticators. The average hedge fund gained in the low-to-mid single digits for 2014.”

“”Systematic trading started 2014 as the least-loved asset class and has ended it as the best performing in part as a result of having positions opposite to the consensus,” said Ewan Kirk, Cantab’s chief investment officer.”

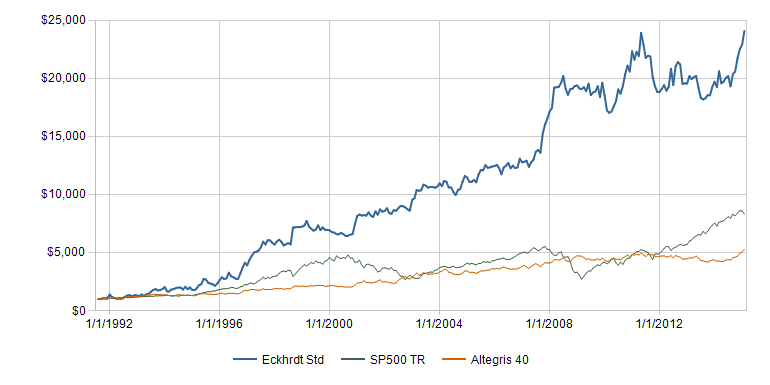

Here’s a performance chart from renowned CTA Trend Follower, Eckhardt Trading. Note the significant spike in 2014 after a range-bound spell. Chart courtesy of managedfutures.com.

While directional trend following delivered profits in 2014, neutral trading strategies such as selling option premium performed well in most of 2011 and 2012 while trend following languished. Even the celebrated trend following CTAs of 2014 regularly employ counter-trend strategies into their overall programs to smooth their equity curves and reduce drawdowns.

Diversification of trading strategies also allows you to walk away from a strategy that has shown to be no longer effective. Formerly profitable strategies such as trading commodity ETFs ahead of the futures contracts’ rolls or front-running end of month window dressing have been shown to be less profitable over the past several years. If you relied solely on these two trading strategies to capture alpha, your P+L would have suffered and you may have found it emotionally difficult to pull the plug.

As you examine your portfolio of trading strategies, look for ways to broaden your approach to markets to allow yourself to realize gains in a variety of market conditions, even when you are not quite sure where the market is headed.

In a future article we will look at another overlooked diversification tool – using multiple timeframes.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.